Medicare Advantage Plans Face More Budget Pressure

What You Need to Know

Medicare Advantage plans assign each enrollee a health score.

A federal deficit-fighting group was saying before that the risk scoring has been too aggressive and is driving up costs.

Now, the group says, new studies show the enrollees are healthier than other Medicare enrollees.

A debate about how sick or healthy typical Medicare Advantage plan enrollees really are could affect how much funding pressure issuers face in Congress for the rest of the year.

The Committee for a Responsible Federal Budget — a group that tries to narrow the gap between how much revenue the government raises and how much it spends — said in a new analysis that two recent studies show that the Medicare Advantage program enjoys favorable selection of better risks, and that typical Medicare Advantage enrollees are much healthier than typical enrollees who stick with “Original Medicare,” with or without Medicare supplement insurance.

The gap is so wide that, under current rules, the government and enrollees could pay the plans about $810 billion to $1.56 trillion too much from now through 2033, compared with earlier committee overpayment estimates of $230 billion to $412 billion. The earlier estimates were based solely on information about the enrollees’ typical health “risk scores,” or health problem “coding intensity.”

The committee predicted that eliminating all overpayments based both on enrollee health coding intensity and favorable selection could save the Medicare Part A hospitalization plan trust fund $400 billion to $770 billion over 10 years.

What It Means

Medicare Advantage plan issuers, their trade groups and their happy plan enrollees may have to work hard to defend the plans against members of Congress hunting for easy ways to reduce the federal budget deficit or ways to offset the cost of new federal programs.

The Federal Deficit

The U.S. federal government lost $1.4 trillion in 2022 on $4.6 trillion in revenue. It expects to add $14 trillion in debt over the next decade.

Medicare Economics

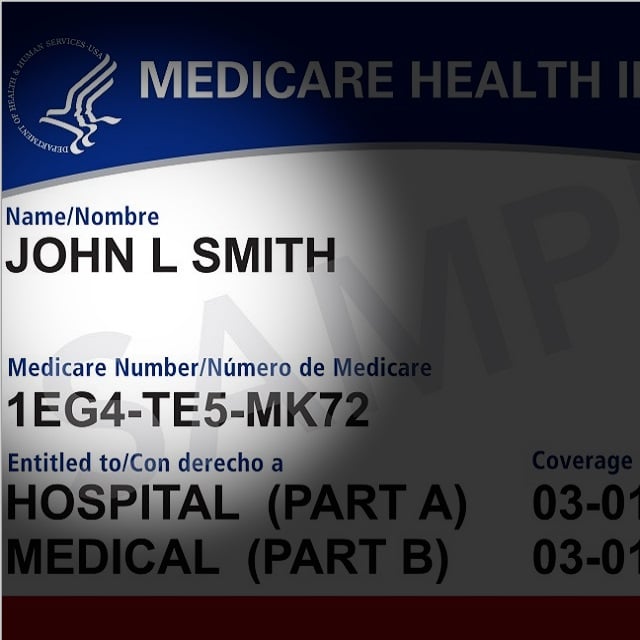

Medicare is a program that provides health coverage for 65 million people.

About 35 million people get their coverage from the Medicare Part A hospitalization plan and the Medicare Part B outpatient and physician services plan, which are administered by nonprofit and for-profit health plan administrators.

Another 30 million enrollees get their coverage directly from private plan issuers. The issuers get a combination of cash from Medicare and premiums from enrollees.

In 2022, the government collected $353 billion in payroll taxes and $4.6 billion in enrollees premiums for the Medicare Part A program and $468 billion in premium revenue for the Part B program. It paid $403 billion to Medicare Advantage plan issuers.