Material hurricane Milton losses could change 2025 property reinsurance price trajectory: KBW

If now major hurricane Milton results in “material” losses for reinsurance capital providers, analysts at KBW have said that this could change the expected trajectory of property catastrophe reinsurance pricing at renewals in 2025.

After the recent Monte Carlo Rendez-Vous industry event, the expectation was set that property catatsrophe reinsurance rates would likely decline in the mid-single digits.

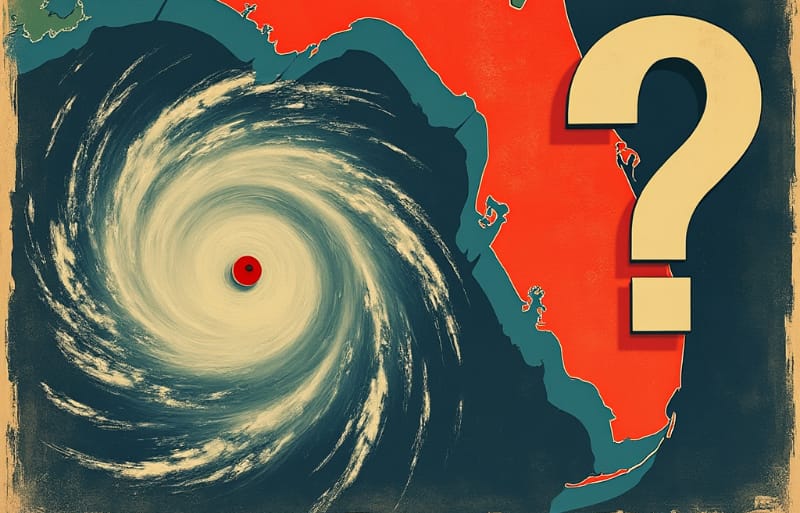

But hurricane Milton is already driving some discussion of whether this could change and with the storm now intensifying rapidly and heading for the Florida Gulf Coast, the KBW analyst team say that reinsured losses from Milton could change the market’s outlook on the end of year renewals.

It’s important to note that there is still significant uncertainty over where insurance industry losses from hurricane Milton would fall.

The NHC’s latest forecast cone continues to show a spread of the west coast of the Florida Peninsula from as far south as Naples, up to Cedar Key.

But the centre of the forecast cone continues to be focused around the Tampa Bay area and most hurricane models are still spread for a landfall from there south to Cape Coral and Fort Myers.

As we reported, the initial storm surge height indications from the NHC are for between 8 and 12 feet in Tampa Bay.

As a result, the market is readying itself for a potentially impactful hurricane landfall, that has the potential to be the most costly since 2022’s hurricane Ian.

KBW’s analyst team, in their first update on hurricane Milton said, “Depending on Milton’s ultimate path – we emphasize that there is still a LOT of uncertainty – we see three significant potential implications to the P&C industry.”

Going on to explain that these are, “1. Unlike most of YTD adverse weather, a landfall impacting densely-populated regions of Florida (like Tampa) could cause insured losses well above $10 billion.

“2. The fact that many Florida-focused property reinsurers buy relatively low attachment points suggests that reinsurers could collectively bear a higher percentage of Milton losses than of previous 2024 weather events.

“3. Material reinsured Milton losses could change the trajectory of 2025 property reinsurance pricing. Our – obviously pre- Milton – Monte Carlo discussions anticipated mid-single-digit decreases, although the frequency of 2024 hurricane formation is already starting to convince us that mid-single-digit decreases are a worst-case scenario.”

The KBW equity analyst team also said, “Significant primary insured losses could also highlight the weaknesses of Florida’s current reliance on numerous relatively small insurers plus Citizens, the state’s (ostensible) insurer of last resort. We see this situation – in which many of the nation’s largest property insurers maintain disproportionately low exposure to Florida – as ultimately unsustainable.

“If and when the state-focused insurers’ solvency is sufficiently pressured (most likely from a combination of retained net storm losses and expensive reinsurance), we expect Florida’s regulators to (eventually) allow the larger carriers to charge what the latter group deems adequate rates.

“Significant insured losses could also provide an acid test of the state’s December 2022 litigation reforms’ ultimate effectiveness, which remain a concern for at least some reinsurers, most notably RNR.”

The analysts are careful to reiterate that there remains “considerable uncertainty” and at this stage it is unwise to consider any particular level of industry losses baked-in. Greater clarity should emerge as the storm approaches Florida over the next two days.

Hurricane Milton is now estimated to be a Category 4 storm with 150 mph sustained winds, intensifications is particularly rapid.

The latest forecast advisory data from the NHC expects intensification to continue up to near Category 5, but then a gradual weakening as hurricane Milton interacts with a trough to the north, while at the same time the storm expands its wind field. Landfall is still anticipated in the region of Category 3 wind speeds and how much weakening will occur is another area of uncertainty, while the larger wind field will mean more significant impacts even from a slightly weaker storm at landfall.

Also read:

– Cat bond & ILS managers explore options to free cash, as hurricane Milton approaches.

– Hurricane Milton: First Tampa Bay storm surge indications 8 to 12 feet.

– Hurricane Milton is biggest potential ILS market threat since Ian in 2022: Steiger, Icosa.

– Hurricane Milton forecast for costly Florida landfall. Cat bond & ILS market on watch.