Markets Go on Wild Ride in Week Marked by Forced Selling

What You Need to Know

With many asset groups not yet screaming economic angst, one bullish mantra is starting to emerge from the noise: Buy the dip.

Panicked moves were the theme of the week, particularly Monday.

Still, almost as quickly as it blew up, volatility eased, and the S&P 500 staged its biggest rally since 2022.

It started, innocently enough, in markets, when high-flying tech stocks started giving back gains that nearly all of Wall Street was convinced had gone too far.

Roughly a month into a trauma that expanded this week to encompass everything from emerging-country currencies to Japanese shares — before defusing almost as fast — a lot of people worried about the economy are hoping markets are where it will stay.

A signature fact of the worst turbulence of 2024 remains how much of it is confined to excesses wrought by traders. Speculators exploiting an ever-weakening yen got chased out of cross-border wagers. Quants who’d been ringing up gains for months suffered a comeuppance. Popular options bets premised on calm briefly blew up.

In short, while economic fears lit the match that fueled the selloff’s loudest bursts, a daisy chain of leverage drove a slew of market reversals that muddy the potential recessionary message from slumping stocks — to everyone from retail day traders to Jerome Powell, who looks poised to lower rates in September.

With a slew of asset classes and sectors not yet screaming economic angst, one bullish mantra is beginning to emerge from the noise: Buy the dip.

“It is a healthy correction for now. Crowded positions and panic resulted in accelerated selloff,” said Vineer Bhansali, founder of the Newport Beach, California-based asset manager Longtail Alpha. “The momentum trade made everyone very long a concentrated set of positions, and exit liquidity is dismal.

For investors resisting the urge to sell, it may be the strongest plank in the bull case. And while anyone saying it’s all an overreaction must answer to the steep drop in bond yields — as close to an unambiguous sign that the economy is in trouble as markets ever send — those who stuck it out were rewarded as volatility receded at week’s end.

“When you get these violent moves, the market always overshoots, and that’s exactly what happened,” said Michael de Pass, global head of rates trading at Citadel Securities. “It was an overshoot driven by a bond market that had a lot of room to rally given where current fed funds levels are.”

One thing’s for sure: despite reversing just as fast this week — equities and bonds both — the great August swoon of 2024 has become front-page news, providing ammo in the U.S. presidential race and ramming into the popular consciousness fears of a U.S. recession or monetary-policy error.

Should it resume, the potential exists for serious global tumult, sweeping up carry traders in Tokyo, emerging-market investors in Mexico and volatility professionals in New York.

Panicked moves were the theme of the week, particularly Monday, when Japan’s Topix tanked 12%, the Cboe Volatility Index surged 42 points in the space of a few hours and losses in the S&P 500 at one point surpassed 4%.

All at once, global traders who’d been riding risky assets to gains for months lost their nerve. Weakening U.S. labor data convinced many the Fed had waited too long to cut rates, leading them to dump stocks after US Treasury yields staged the biggest one-week slide since 2008 last week.

Especially harsh for professional investors was disruption of a popular strategy where money borrowed in the Japanese currency is used to fund purchases of higher-yielding assets elsewhere — the so-called carry trade — which shuddered as the yen appreciated for five straight weeks.

The amount of money involved is disputed — estimates range from tens of billions of dollars into the trillions — but its unwinding was particularly pronounced in Asia, where an MSCI index tracking the region swooned 6% to start the week.

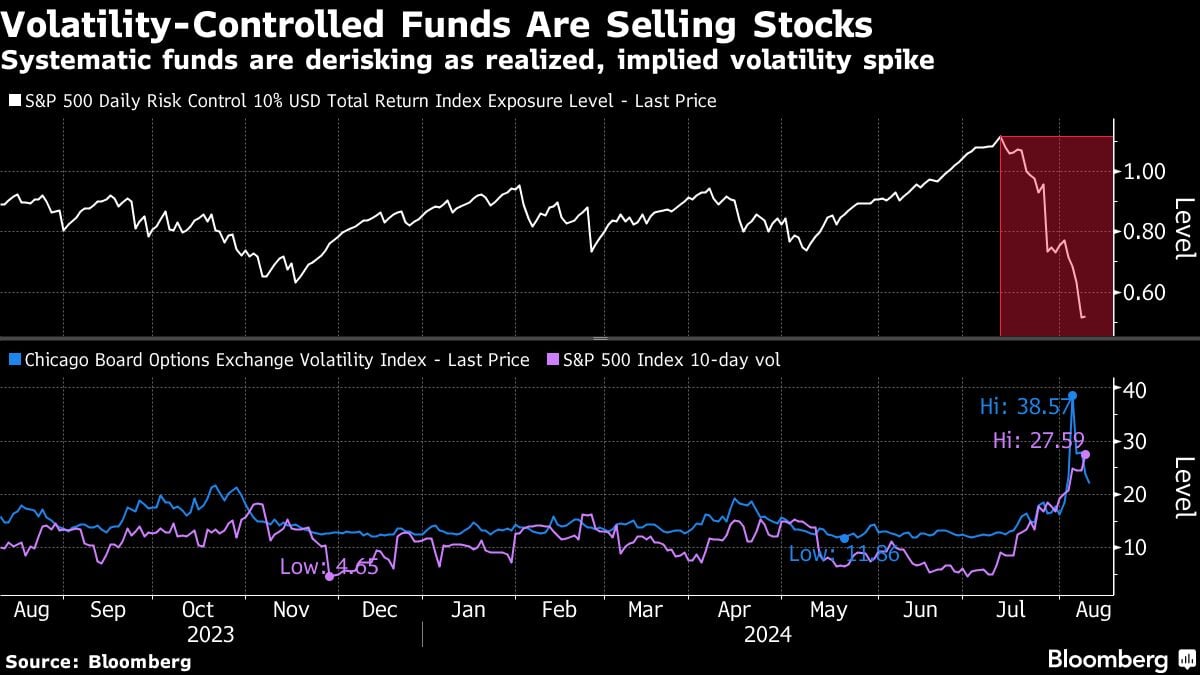

Elsewhere among the pro class, systematic funds that use volatility as a signal to buy or sell assets rushed to exit equities and load up on bonds and cash. So tranquil had markets been in the runup to July that one category of volatility-controlled funds had pushed its allocation to equities to 110%.