MAPFRE unveils major management revamp alongside Q3 results

MAPFRE unveils major management revamp alongside Q3 results | Insurance Business America

Insurance News

MAPFRE unveils major management revamp alongside Q3 results

More than 15 execs moved in leadership shuffle

Insurance News

By

Kenneth Araullo

After undertaking a comprehensive review of its organisational structure and management teams, multinational insurer MAPFRE has announced that it is ushering in changes to better adapt to the evolving and intricate business landscape amid a mix of economic, social, and geostrategic uncertainties.

Despite a business model that has proven effective quarter by quarter, the company said that it seeks to preserve its leadership positions across diverse markets. To navigate the current global situation, characterised by greater instability and unpredictability, the company is moving towards simpler and more flexible structures that prioritise its core operations, enhancing client relations and maintaining service excellence.

The reorganisation of the management team involves a strategic blend of experience and emerging talent, aiming to harness the full spectrum of management capabilities and seize numerous opportunities on the horizon.

Exec moves for MAPFRE

The corporate appointments include José Manuel Inchausti succeeding Ignacio Baeza as the first vice chairman, and Fernando Mata taking on the role of third vice chairman while continuing as the group’s CFO. Furthermore, Raúl Costilla has been appointed as the group’s chief business officer, responsible for directing the group’s sales and technical strategy globally.

In an effort to simplify the corporate structure, People, Strategy, and Sustainability have been integrated into a single area led by Alfredo Castelo. The Corporate Internal Audit Area will see José Luis Gurtubay taking over from March 31, 2024.

Key appointments in Iberia include Elena Sanz Isla as CEO of MAPFRE Iberia and Jesús Martínez Castellanos as deputy CEO and CEO of MAPFRE Vida.

The business units undergo changes as well, with geographical areas like LATAM and EMEA integrated into a new unit called International Insurance, led by Eduardo Pérez de Lema. Miguel Ángel Rosa has been appointed CEO of MAPFRE RE, while Mónica García Cristóbal becomes CEO of Verti Germany.

The reorganisation extends to several group countries, with new CEOs appointed in Mexico, Brazil, the Dominican Republic, Chile, and Panama and Central America.

Alberto Berges, MAPFRE Mexico CEO

Óscar Celada, MAPFRE Seguros business CEO

Nelson Alves, MAPFRE Seguros deputy CEO of finance and business support

Andrés Mejía, MAPFRE Dominican Republic CEO

Eva Tamayo, MAPFRE Chile CEO

Óscar Ortega, MAPFRE Panama and Central America CEO

These changes will take effect on Jan. 1, 2024, except for the internal audit appointment.

“We are laying the foundations of the company for the next 10 years,” said Antonio Huertas, chairman and CEO of MAPFRE. “Everything we have achieved so far, especially financial strength, service excellence and proximity to the client, the focus on people and the reinforcement of our ethical commitment and values, will be maintained as essential and differentiating elements of MAPFRE. But the environment has changed, and we are going to move forward with a new, simpler road map that gives us the flexibility and ability we need to continue holding leadership positions in the group’s main markets.”

MAPFRE Q3 2023 results

Besides the major management shakeup, the company also revealed its financials for the third quarter of the year. MAPFRE touted robust financial performance for the first nine months of 2023 – a trend continuing from its last financial report – showcasing significant growth in both revenue and results.

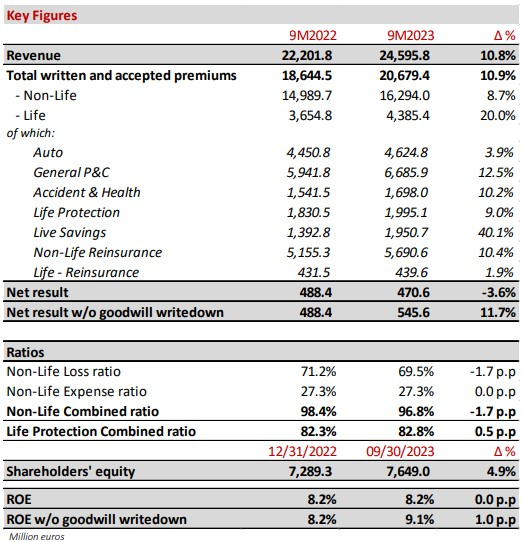

The 10.8% surge in revenue underscores the continuation of positive trends witnessed in recent quarters, driven by a substantial increase in business volume and enhanced financial performance. Notably, premiums registered a 10.9% upswing, with minimal impact from exchange rate fluctuations (at constant rates, premiums increased by 12%).

This growth mirrors a broad improvement in business, with non-life premiums increasing by 8.7% and life premiums soaring by 20%. Key contributing factors to this growth include the regions of IBERIA and LATAM, as well as the positive performance of the Reinsurance business.

Within the non-Life segment, premiums experienced a rise of over €1.3 billion during the first nine months of the year. This growth was particularly pronounced in general property & casualty (P&C) with a growth rate of 12.5%, while accident & health premiums increased by 10.2%, and auto insurance saw a 3.9% rise.

Despite the economic scenario’s volatility and dispersion observed in previous quarters, the combined ratio for non-life improved to 96.8%, marking a reduction of 1.7 percentage points. General P&C exhibited a commendable combined ratio of 87.1%, which was 2.8% better than the previous period. This helped compensate for ongoing challenges in the auto insurance segment, which had a combined ratio of 105.9%, a slight improvement of 0.3% compared to June.

In the life business, premiums surged by more than €730 million, mainly driven by life savings in Spain. The positive performance in this line can be attributed to strong technical proficiency and robust financial income, particularly in Latin America. The life protection combined ratio remained excellent at 82.8%. Consequently, the life technical-financial result witnessed a 7% improvement.

Significant events impacting financial results included the earthquake in Turkey in the first quarter, with a €105 million impact on the net result. This event primarily affected MAPFRE RE (€100 million) and had a minor impact on the local insurer (€5 million). In 2022, the most relevant catastrophic event was the drought in Brazil, which had a net impact of €106 million on the Group. In 2023, a favourable reinsurance market environment and a milder hurricane season contributed to MAPFRE RE achieving a result of €190 million, doubling the previous year’s performance.

The third quarter also saw two noteworthy economic events: a positive net impact of €46.5 million resulting from arbitration regarding the conclusion of the alliance with Bankia and a prudent €75 million provisional impact for a goodwill write-down for the company’s insurance operations in the United States. This write-down, accounting for 11% of its book value, was made in response to rising interest rates and challenging conditions in the auto insurance sector due to inflation. The estimate for this goodwill write-down will be updated at year-end based on interest rates and business plans.

Regarding the investment portfolio, there were no significant changes in the asset class structure during the third quarter. Realised gains net of impairments had a €22.3 million impact on the net result for the period, compared to €70.8 million in the same period in 2022.

“Our business continues to show robustness, both in revenue and premium growth as well as in the result, based on a high level of diversification and ability to adapt to the context. MAPFRE is overcoming the difficulties presented by inflation, thanks to continuous improvement based on our technical management,” Huertas said.

What are your thoughts on this story? Please feel free to share your comments below.

Keep up with the latest news and events

Join our mailing list, it’s free!