Managing professional risks as sweeping changes impact the healthcare staffing market

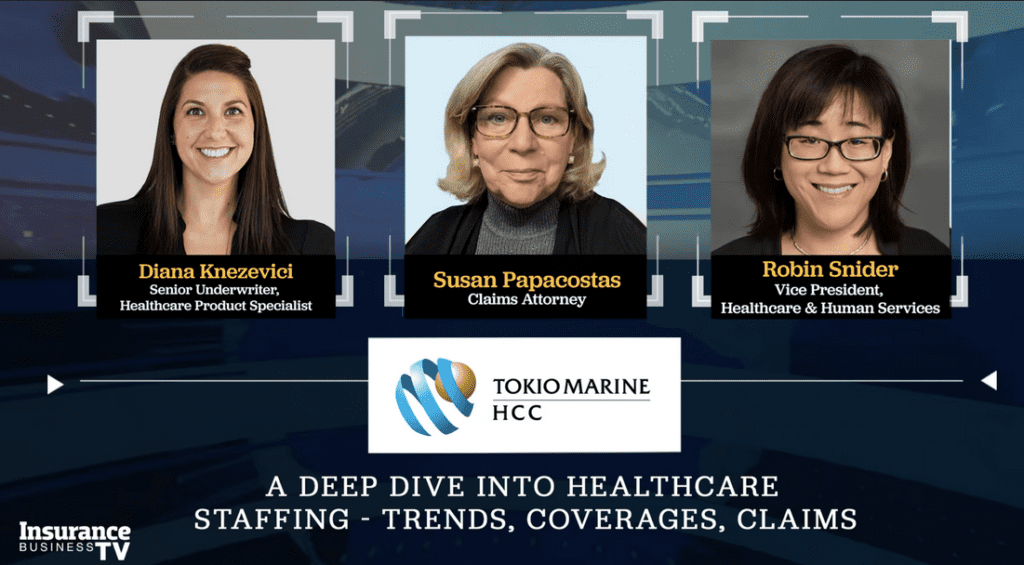

Bethan: [00:00:29] Hi everyone, and welcome to IB TV. I’m Bethan Moorcraft, senior editor at Insurance Business. And in this episode, we are taking a deep dive into the health care staffing market and how it’s being impacted by changes in the health care industry. I’m joined by a panel of experts who are going to share their insights on health care, staffing trends, insurance coverages and claims, among other things. With that, it’s my pleasure to welcome Diana Knezevici, senior underwriter and health care product specialist at Tokio Marine, HCC’s Cyber and Professional Lines Group. We have Susan Papacostas, claims attorney at Tokio Marine, HCC’s Cyber and Professional Lines Group. And we have Robyn Snider, vice president of Health Care and Human Services at Arlington Roe. Well, it’s great to have you all on the show. Let’s start with some scene setting. Robyn, I’ll come to you first. What is the current state of the health care staffing market?

Robyn: [00:01:26] So I read somewhere that the US health care staffing market is expected to be around 35 billion by 2030 post-pandemic. There’s been a massive shift in the marketplace and staffing organizations have experienced double digit revenue gains because of drastic increases in demand due to geriatric population, boomer retirements, early retirements from burnout and stress, and a general lack of skilled professionals from physicians to providers across the country. And we’ve seen staffing models become more attractive to these health care professionals because of high pay travel opportunities and short term assignments. Furthermore, in response to increasing operating expenses, hospitals are forced to reduce their staff and often favor these services to ensure staff is available when the workloads increase. And finding the right solutions for the unique liability concerns created by this high turnover. Short term nature of this industry is constantly evolving with the marketplace. Would you agree, Diana?

Diana: [00:02:33] Yes, absolutely. So as Robyn mentioned, we’re also seeing the uptick in health care staffing risks. And from an underwriting perspective, we’ve been able to accommodate and adapt to the various requirements of the insured. We’ve maintained our comprehensive review of accounts and have addressed the nuances that have come up, such as being flexible in covering telemedicine and virtual mental health counseling placements. We can consider new venture risks, which have been a large number of the submissions that we’re hitting on, especially during the past couple of years with the pandemic. We need the need to fill more of the gaps and provide the care has been one of the reasons people have been entering the staffing market and we’ve been able to accommodate those requirements.

Bethan: [00:03:18] That’s great. Thanks, Diana. Sticking with you for the next question, how is the policy intended to provide cover?

Diana: [00:03:25] So we have a very broad definition of insured, which includes and not limited to employees, volunteers, interns or residents, medical directors and independent contractors. We want to stress the importance of reading the policy and understand who has coverage as a question we get asked frequently when it comes to staffing risks. Is the insured has hired, for example, a new registered nurse and they’re requesting for a confirmation of coverage in our end would have coverage if they fit in the definition of insured. Providers such as nurse practitioners, physician assistants and physicians are not covered in less endorsed. We may have the option to schedule on these providers and depending on territory and venue where they are being placed. Specific to health care staffing, we have the option to cover both professional and general liability as a package, which can also include some additional coverage enhancements, which I’ll touch on a little bit later. What’s unique about our GL coverage is that it follows the insured and is not designated to a premise unless specified. It’s beneficial for the staffing risks as they’re generally being placed in clinics, hospitals, private homes and knowing the details of the insuring agreement will ensure that the client has the appropriate coverage. Susan, do you have anything to add to that?

Susan: [00:04:43] One of the things that Tokio Marine does is vet very carefully and choose our panel counsel to be available to our insureds in every venue, and they are experts in that venue. And therefore any specific state interpretations of the terms of our policy are well covered. Again, I want to emphasize that Diana went into detail about the definition of an insured, and an insured generally does not cover a list of specific providers such as surgeons and doctors, dentists, physician assistants. However, as Diana mentioned, we are able to provide coverage at the request of the insured and add them via a scheduled endorsement. It’s important to realize, though, that you need that endorsement so that you can get coverage for these specific individuals as the claims professionals to determine whether or not coverage is triggered under the policy. But one thing I also want to mention is that it’s important to submit anything that could end up turning into a claim so that you you maintain the continuity of coverage. And that issue would be covered if it expanded into something further later on in a future date. And again, I just want to touch on the GL portion of the policy which Diana mentioned and how important it is and how beneficial it is to our staffing agency clients that the coverage in that section follows the insured wherever they’re placed. And I don’t know, Robyn, if you want to jump in there.

Robyn: [00:06:22] Yeah, I agree. Understanding who is an insured in the policy form is going to be key because these accounts are so varied. You can have a physician to a nurse, to a skilled allied professional, to a non medical aid and just making sure that the forms and endorsements that verifying with your underwriter that those are there for you. And the coverage is intended to cover the services that they have committed to provide with their contracts is going to be key because if you don’t, it’s like you said, if you don’t endorse a physician on it, there’s no coverage. And if you’re assuming that that’s that’s a worst possible scenario you can think of when you’re talking to an insured at Oh, I didn’t verify that that was on there. So it is essential that the broker understands the policy terms.

Bethan: [00:07:16] Thanks, everyone. Now, in this sector, why is it so important to verify training and credentialing protocols of staff? Robyn, I’ll come to you first.

Robyn: [00:07:26] Well, kind of. As I’ve mentioned before, it is so difficult to place these health care savvy risks because they’re not a one size fits. As a broker, I encounter differences from state and carrier requirements when it comes to licensing. For some of these staffing organizations. Staffing to in New York is going to be very different than staffing to a nursing home or staffing home health. And the differences in the types of professionals from physicians to home health aides. And so understanding that the staffing company and the or the organization that they are contracting with provides appropriate training and that the staff professionals are licensed properly for the positions they’re filling and that the staffing organization has proper vetting to determine that the professional is actually qualified to be placed in the position. Is all the difference between placing an account with an underwriter or not? Wouldn’t you agree, Diana?

Diana: [00:08:19] For sure. And just to piggyback what Robyn was just saying is that as an underwriting company, we evaluate these risks and when we have a clear picture of their operations, the type of staffing and what training and credentialing protocols the insured actually has in place, it aids us in determining the eligibility of that exposure. So when an insured provides a complete and accurate application for a submission, we as underwriters can confirm that they have a well run operation and they have the procedures to qualify those placements, the more complete the application, the faster we’re able to review and turn around terms, eliminating some of that back and forth additional information requests. So with well defined hiring protocols, background and abuse registry checks, risk management practices, it depicts characteristics of a good insured and we’re able to apply credits which offer premium savings to that insured. When applications are received incomplete, it delays the process for all the parties involved. So yeah, as Robyn had mentioned, understanding the training that is being provided by the insured and if they’re being placed in a facility that has their own protocols being up front and clear with that staff on those requirements supports the expectation of that contract. And it also validates that that they have a well versed and organized business and it’s actually a favorable risk to us. Susan, is there anything that you want to add from a claims perspective?

Susan: [00:09:47] I just want to just actually a couple of things on credentialing. And you touched on this, that the individual contracts with our insured and the ultimate placement of the of the professionals will often or can potentially have its own credentialing requirements. So in addition to all of the credentialing requirements that you’re looking for, that the insured has in place to assess and complete all of their internal procedures for credentialing, they want to be aware of any potential pitfalls if a contract that they’ve entered into has requirements that they meet all of those as well, because that can cause issues down the road. And I also want to mention here that there are particular credentialing requirements in some of the many and varied endorsements that we provide to to give additional coverage to the insured. And they need to be aware of those credentialing requirements as well, and that they’re that they’re following up on those. Just as a quick example, one of the endorsements we can provide, which is relevant in in the staffing agency arena is the hire non auto coverage, and that requires very specific credentialing for each insured that’s going to be covered under that endorsement. And if those conditions aren’t met, it can potentially hamper our ability to provide the coverage that they’re anticipating receiving.

Bethan: [00:11:17] Thank you. That’s an interesting example. Now, why does the type of facility where staff are being placed matter, Diana, I’ll come to you first?

Diana: [00:11:27] So it is a area that we review as an underwriting requirement. And similar to our broad definition of insured, we have a wide range of facilities where staffing services can offer relief that being in hospitals, clinics, private duty, nursing homes, just to name a few. And one area that we’re currently not considering is placement into correctional facilities, and that’s due to the high historical frequency and severity of claims. Once we identify the type of facility, we review the type of staff being placed, whether that’s medical or non medical, and that the staff that is being provided into those facilities. For example, with hospital placements, we request the percentage of exposure in emergency rooms, intensive care units and obstetrics as those are departments that are a higher risk. We also verify the venue and territory where the facility is located, as there are some regions that are less favorable to us. We either debit the account or we may pass on it altogether, depending on where that venue, that facility is actually located. And I touched upon new ventures earlier on and. The experience of the insured is very important to our underwriting decision. We assess the owner’s knowledge on staffing, their familiarity with the type of facilities and the length of time that they’ve been in the industry. Should the owner lack that experience? We would look to see if they’ve hired an operations manager with that missing expertise. Robyn, what is it that you’re seeing in the marketplace?

Robyn: [00:12:55] Yeah, I see that a lot. And honestly, I see a lot of startup organizations. And what I’m seeing is tech companies that have decided to start staffing health care professionals. And while a tech company is going to understand places someone in an office environment, they might not truly understand what it means to place a professional in a hospital or a nursing home or even in a home health type of an environment. And what that creates for us is a broker is that we end up with in terms that don’t always understand that underwriting rigor. And why do you need to know all of this information? I’m a professional staffing organization. I do it all the time and there is a difference. And being able to understand that and explain that to an insured is key. So it’s very helpful for you to give that insight. Diana, thank you.

Bethan: [00:13:54] That’s great. Thank you, everybody. And finally, to close, I’d like to ask, how does Tokio Marine HCC offer a competitive advantage for health care staffing? Diana, I’ll come to you first.

Diana: [00:14:08] Thanks, Bethan. So we are a specialized underwriting and claims team with bench strength. Our underwriting approach offers bespoke solutions to our broker partners and our prospective insureds, and we’ve maintained our approach for the past seven years. We’ve had this core approach and consider ourselves a market leader, which has helped us build credibility. I mentioned our broad appetite for health care staffing and with limited restrictions on the type of facilities and only a few territories that we won’t entertain. In addition, our policy form, which has broad definition of insured and the flexibility to schedule providers, are all what sets us apart for this class. So lastly, I’m so excited to share that we have an expansive ability to add some coverage enhancements. We can offer sexual misconduct, hired and non owned auto. We have a med defense product, cyber and the ability to include separation of insured language, which are key to creating a customizable product that meets the needs of the insured and more importantly, their contractual requirements. We also work so closely with our claims teams when when incidents do arise. Susan, would you please share a little bit more about our fabulous claims team?

Susan: [00:15:17] Thank you, Diana. Yes. You know, you mentioned early on that the Team HCC has a deep bench of support for our insureds. And part of that is the in-house dedicated claims counsel attorneys. And we are completely client focused and we are tasked with providing direct, meaningful and informative support and communication with our insureds. And the other thing we pride ourselves on is having a really strong sort of symbiotic relationship with our underwriters. So communication, nothing is ever lost between them and us and our brokers as well. I think that’s something that really sets Team HCC apart from this area.

Bethan: [00:16:01] Thanks, Susan. And finally, Robyn, what would you add on this one?

Robyn: [00:16:05] Well, as a broker, to me, it’s a service that makes all the difference. And exactly what these ladies were saying is that when the claim occurs, the insured has somebody to talk to. That’s huge. And from a broker standpoint, when I’m placing business, being able to talk to an underwriter, discuss an account, discuss the exposures and discuss possible solutions is really it just makes it makes it much easier to place an account. And in addition, Tokio Marine provides really easy to understand quotes. And when you’re dealing with a staffing organization, they want to know the basics and they’re very well laid out and easy for an insured to understand. But they also have hyperlinks to the actual forms, which is brilliant to be able to dig in when they have very specific questions. So personally, I like the service and I feel like it makes a difference when you can get a hold of a person to talk to them.

Bethan: [00:17:15] That’s really great to hear. Well, Diana, Susan, Robyn, thank you all so much for a fascinating conversation today. Health care staffing is obviously a critical market and it’s clearly going through a lot of changes at the moment which require the attention of insurance partners like our expert panel today. Thank you all for coming on the show. Thank you.

Susan: [00:17:38] Thank you, Bethan.

Diana: [00:17:39] Thanks, Bethann.

Bethan: [00:17:41] Thanks also to our viewers for tuning in. I’m Bethan Moorcraft, senior editor at Insurance Business, and this was IB TV. Until next time, everyone.