Majority expect over $15bn of property cat bond issuance in 2023

After a very busy first-half for the catastrophe bond market saw issuance of property cat bonds reach a new high of $9.7 billion, the Artemis community is forecasting the market will remain busy through the rest of 2023.

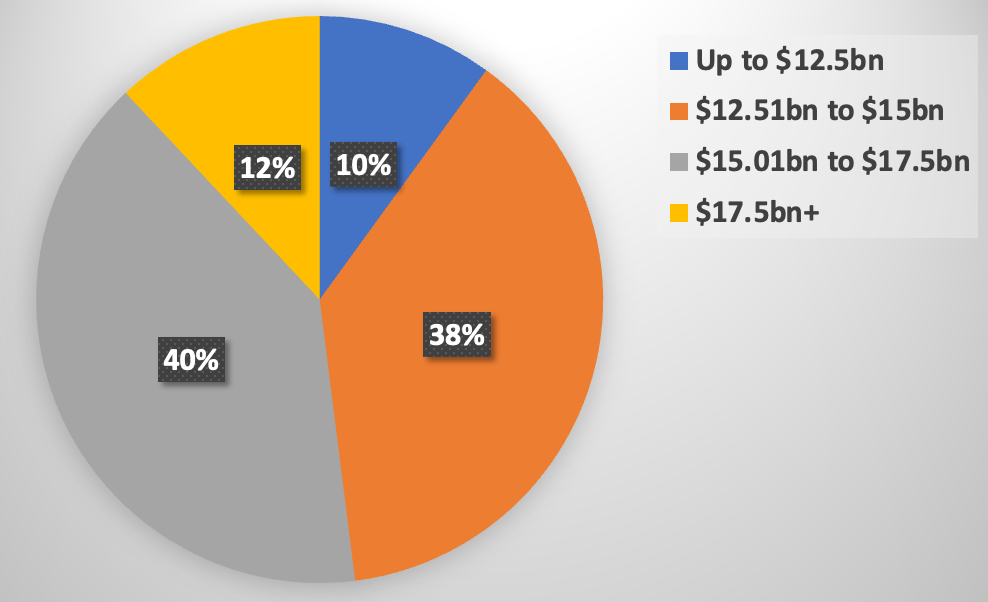

We polled some of our audience to ask them how high they expect issuance of property cat bonds could reach in 2023.

52% of respondents opted for property cat bond issuance to exceed $15 billion, with 40% expecting $15 billion to $17.5 billion of issuance, and 12% opting for an ambitious $17.5 billion or more.

10% of our respondents were much less ambitious, believing property cat bond issuance will only manage up to an additional $2.8 billion in the entire second-half of the year, as they said they expect property cat bond issuance to remain below $12.5 billion by year-end.

As a reminder, the record for full-year property cat bond issuance is only $12.51 billion, so that level would still be a strong year.

38% of respondents opted for issuance of between $12.51 billion and $15 billion, so this would be a new annual record for property cat bonds to be set in 2023.

It’s hard to envisage that we fail to see a new record this year, given the very strong start we’ve seen.

It would take a major catastrophe loss, or significant capital market upheaval, to derail the issuance flow and pipeline for the catastrophe bond market, we believe.

How high issuance reaches will also depend on reinsurance market competition as well, of course.

But, with broker-dealer sources now largely calling for a record issuance year, while saying the pipeline remains buoyant and it looks like a busy second-half ahead, right now it is hard to envisage anything other than a new record setting year.

All of our catastrophe bond market charts and visualisations are up-to-date, so include this latest quarter of issuance data.

For copies of all our catastrophe bond market reports, visit our archive page and download them all.