Look after what you love!

The cards are in the shops, the balloons and teddies are everywhere. The more romantic may start thinking about what to do for Valentine’s Day, while some may reflect more on who they have in their lives, whether partners, family, friends or even pets. But after Valentine’s Day has long gone, it’s important to look after who you love in the future too.

A recent survey illustrated that up to 50% of households with a mortgage have life insurance, leaving the remaining 50% at risk should one of the household earners pass away.

The thought of having to sell up, move or find finances to pay for debts or a funeral, could add significant stress to an already-traumatic experience, and it could be easily avoided.

The primary function of life insurance is to support our loved ones, after all, we don’t get to benefit from it ourselves. Instead, it gives us that peace of mind that, if something unfortunate were to happen to us, that things would be financially manageable for those we leave behind, making life just that little bit easier.

Even if you don’t have dependents, there are ways to secure your financial future should you become unwell, it’s important to love yourself too, and we will go into that a little later.

What is a life insurance policy?

Quite simply, a life insurance policy is an insurance designed to pay out a tax-free cash lump sum to the loved ones of your choosing should you pass away. The money can be used to pay off a mortgage or any other debt, support children or grandchildren, and help with household bills and expenses.

Although nobody likes to think about it, it really can make all the difference in situations where your loved ones may need to move, or could remain in their home, after you’ve gone. As home is where the heart is, it’s certainly worth considering this if you have a family.

Are there different types of life insurance policies?

There are three policy types available with several insurers to choose from. It’s always best to seek advice when thinking about life insurance, as everyone’s circumstances, from age to mortgage amount, will be slightly different.

Level term insurance

This policy will last for a fixed term (for example, 10 or 25 years) and the policy will only pay out if the insured dies during the term of the policy. The amount of cover, as well as the premium, will remain the same throughout the length of the policy. You can choose the amount you would like to be covered for.

Decreasing term insurance

This policy will run for a fixed term and pay out if the insured dies during the term of the policy. A decreasing term policy is usually used to cover a repayment mortgage because the pay-out reduces alongside the mortgage. This means that your mortgage, at whatever stage it is at, is effectively covered, so your family doesn’t have to worry about mortgage repayments in your absence.

Whole of life insurance

This policy is guaranteed to pay out when you die, so long as you have consistently maintained your premium payments. You can choose the amount you would like to be covered for. The amount of cover, as well as the premium will stay the same throughout the policy.

If you do have cover, but you aren’t sure how long you are covered for, or what type of cover you have, you can find out by contacting your provider directly.

Who should have life insurance?

Life insurance is suitable for the majority of people and is something that should be considered by anyone who owns a home (with or without a mortgage), anyone with dependents (children, elderly, disabled, non-working spouses), and anyone with outstanding debt. This then protects the things you love and gives you peace of mind safe in the knowledge your loved ones won’t be left to struggle financially.

…and who doesn’t necessarily need life insurance?

There are some people a life insurance policy may not be suitable for. This could include students, and anyone without dependents. Anyone without dependents but still with commitments should consider alternative options, such as an income protection policy. This would cover loss of income through accident, sickness or unemployment and provide peace of mind should a life change occur – it’s important to love yourself too!

Looking after what you love doesn’t have to be expensive!

If you have a clear medical history, life insurance can often cost less that your Amazon Prime subscription – or a round of drinks in your local pub.

The cost of life insurance will depend on several factors;

Age is a large factor; a life policy is always best when purchased at a younger age.Smokers are deemed a higher risk than non-smokers.The higher the cover, the higher the premiums.The longer the policy term, the greater risk to the insurer.The insurer will ask questions about your medical history, your family’s medical history and questions around drinking and smoking.

A life insurance policy is best purchased with advice so a qualified advisor can look at all the options for you and make recommendations based on your personal circumstances. The best way to find out your individual cost is to obtain a quote.

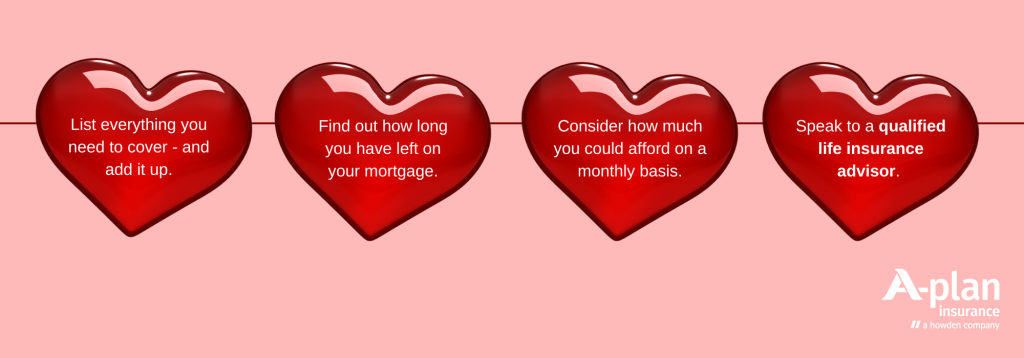

How to protect what you love?

We are always happy to answer any questions you may have. You can contact our friendly life insurance team on 0800 172 172 or fill in this quick form and we will call you back.