Long term care insurance in Canada: Benefits & drawbacks

But how does this type of insurance policy work? What benefits can policyholders get out of it and is it worth taking out? Insurance Business answers these questions and more in this article. For the insurance professionals who frequently visit our site, this would be a good article to pass along to any of your clients, or potential clients who have questions about long-term care insurance in Canada.

In its guidebook, the Canadian Life and Health Insurance Association (CLHIA) defines long-term care insurance as a type of policy designed to provide financial protection if you are unable to care for yourself due to the following:

Chronic illness

Disability

Cognitive impairment such as dementia

Other age-related impairments

Depending on the level of coverage, long-term care insurance pays out a portion or all of the expenses incurred in accessing care, which often includes stays in nursing homes and chronic care facilities or the services of a caregiver in your own home.

In general, long-term care insurance in Canada follows either of these two models:

Reimbursement-style long-term care insurance: As the name suggests, this reimburses you for eligible care expenses that are outlined in the policy within a capped amount.

Income-style long-term care insurance: This pays out a pre-determined benefit each month for a set period, usually two years. The funds can be spent on anything needed to support your care.

Most long-term care insurance plans also have a waiting period. This is a set time – usually between 30 and 90 days – that must pass before coverage comes into effect. Another important thing to remember is that long-term care insurance benefits are tax-free in Canada.

Long-term care insurance can be complex and involves a lot of buzzwords. If you want to know the meaning behind common industry jargon, you can check out our glossary of insurance terms.

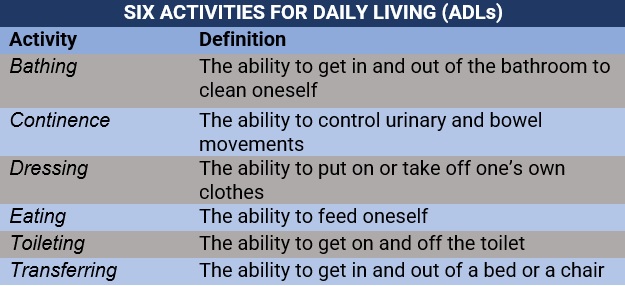

To qualify for long-term care benefits, you will often need to secure certification from a reputable healthcare provider that you can no longer perform at least two of the six “activities for daily living”, or ADLs, in the table below without “substantial assistance.”

You may also be eligible for benefits if you have a debilitating condition, including:

Alzheimer’s disease

Dementia

Schizophrenia

If you file a claim against your policy, your insurer will perform an assessment to confirm your ability to perform these activities. Following confirmation, you can start receiving payments and reimbursements once the waiting period lapses.

Another thing to note is that if you already have a critical illness or disability insurance policy, you may be able to add a long-term care insurance extension without purchasing a separate plan.

Long-term care insurance in Canada covers the cost of care in the following:

In your own home

At an adult daycare program

In an assisted living facility

Comprehensive long-term insurance policies may also pay out for occupational therapy, rehabilitation expenses, and assistance with personal care tasks, consisting of the six ADLs.

The Financial Consumer Agency of Canada (FCAC) pointed out, however, that long-term care insurance is not only for senior citizens. This type of coverage also protects Canadians, regardless of their age, if an accident or serious condition forces them to require assistance for managing daily activities and prevents them from working for more than 90 days.

This means that instead of supplemental healthcare or therapy draining your savings, long-term care insurance provides you with tax-free benefits to cover the costs.

Canadians who require around-the-clock care have two main options:

A specialized residential care facility that can provide full-time care such as a nursing home

Being cared for in your own home, either through professional services or by a family member

Both choices can put a huge dent in your savings. The tables below from CLHIA’s guidebook sum up how much care costs in a long-term care facility and in your own residence in different provinces across Canada.

Long-term care facility

Depending on the room type and government funding, accommodation in long-term care facilities can start at $900 and exceed $5,000 monthly. The table below shows the monthly average cost for retirement homes without government subsidy.

ACCOMMODATION COSTS, RETIREMENT HOMES/RESIDENCES BY PROVINCE

Jurisdiction

Average cost per month

Private

One-bedroom suite

Alberta

$953 to $4,285

$2,658 to $4,400

British Columbia

$995 to $3,500

$1,595 to $5,400

Manitoba

$1,359 to $2,475

$1,690 to $3,300

New Brunswick

$800 to $2,533

$1,943 to $3,500

Newfoundland and Labrador*

$1,500 to $1,800

$1,065 to $4,200

Nova Scotia

$1,705 to $3,100

$1,900 to $3,490

Ontario

$1,236 to $6,000

$1,849 to 8,000

Prince Edward Island*

$1,825 to $2,880

$1,950 to $3,750

Québec

$850 to $6,700

$750 to $2,500

Saskatchewan

$1,380 to $3,700

$1,200 to $4,300

*Described as semi-private and private

Private home care

Private home care services – including homemaking, and personal and nursing care – can cost between $12 and $90 per hour. The table below details the hourly cost of basic services in the different provinces.

HOME CARE SERVICES COSTS BY PROVINCE

Province

Cost per hour

In-home meal preparation

Personal care (bathing/dressing)

Skilled nursing

Alberta

$19.90 to $30

$19.90 to $32

$27 to $80

British Columbia

$16.50 to $36.95

$15 to $36.95

$35 to $75

Manitoba

$16.50 to $25

$19 to $25

$40 to $75

New Brunswick

$15.25 to $20

$15.25 to $20

$36 to $71.25

Newfoundland & Labrador

$15 to $20

$15 to $20

$33 to $70

Nova Scotia

$10 to $23.50

$14 to $23.75

$25 to $80

Ontario

$13 to $30

$13 to $30

$22.85 to $70

Prince Edward Island

$17.25 to $17.65

$18.50 to $20.25

$25 to $47

Québec

$3 to $25.25

$12.50 to $25.25

$15 to $85

Saskatchewan

$18 to $28

$22 to $27

Not available

To illustrate how expensive long-term care costs in Canada can be, based on the figures above, if you require either of the following:

Private care facility accommodation at $4,000 per month, or

Home care services for five days a week for four hours a day at $40 per hour

The final cost can add up to $48,000 and $41,600 per year, respectively.

Based on the personal finance and insurer websites that Insurance Business has researched, long-term insurance premiums in Canada can cost a 45-year-old policyholder, regardless of gender, around $50 to $90 monthly. Rates for those aged 55 years start at about $100, while premiums for the 65-year-old and above bracket are at least $200 each month.

Premiums for long-term care insurance in Canada are dictated by a range of factors. These include:

Your age: The younger you take out a policy, the lower your premiums, although you will also have to pay the policy longer.

Health status: If you put off getting long-term care insurance until health issues arise, you may have to deal with higher premiums, or worse, having coverage denied.

Gender: Because women tend to have longer lifespans than men, increasing their likelihood of making a claim, they also often pay more expensive premiums.

Level of coverage: Higher daily and lifetime limits, as well as purchasing additional benefits – including inflation protection and shorter waiting periods – can drive up premiums.

Insurance provider: Long-term care insurance premiums vary between insurers.

If you want to know how premiums work, not just in long-term care insurance, but also in other types of policies, you can visit our complete guide to insurance premiums.

One common misconception preventing many from taking out long-term care insurance in Canada is that full-time care in a nursing facility will be fully covered under government healthcare programs. But the truth is the country’s public healthcare system does not cover long-term care.

At best, the government may pay a small portion of the expenses incurred during stays in a nursing home or other specialized residential facilities. This means you will have to cover a large part of the costs associated with long-term care on your own.

Just like all types of policies, long-term care insurance is designed to cater to a certain demographic. You should consider taking out long-term care coverage if you want to:

Protect part of your assets and income

Personally pay for any care that you may need

Stay independent from the support of others

Have peace of mind

Some questions you may also ask yourself before purchasing long-term care insurance in Canada include:

What is my current health status?

Does my family history indicate possible future health concerns?

What kind of support – for example, spouse, children, relatives – do I have at present?

Can I expect them to care for me in the future?

What are the trade-offs when considering the limits placed on my disposable income by hefty premiums?

Am I willing to sacrifice other expenditures?

On the flip side, it would not be wise to take out long-term care insurance if you:

Have limited assets

Cannot afford to pay premiums

Rely on government programs as a source of income

Often have trouble paying for utilities, food, medicine, and other essential needs

If you want to know if long-term care insurance fits your lifestyle, an experienced insurance agent or broker can help answer your most pressing questions about this type of coverage.

Before taking out this type of coverage, it may be important to ask yourself, “Is long-term healthcare insurance worth it in Canada?” It may also help if you will consider the advantages and disadvantages of purchasing long-term care insurance. The table below sums up some of these pros and cons.

Additionally, these are the factors you need to consider before purchasing long-term care insurance in Canada:

Benefit amount: This involves assessing the type of care you expect to receive and how much it costs on a daily basis.

Payment term length: Some insurers will give you the option to choose how long you want to pay for the policy, usually from two years to a lifetime.

Age: Most industry experts recommend taking out a policy between your mid-50s and early 60s, although buying a long-term care insurance policy at a younger age can help lower premiums.

Waiting period: The longer the waiting period, the lower the premiums, but you also have to cover the cost of long-term care longer.

Inflation protection: Insurers often offer riders to protect against inflation, which result in yearly increases in the daily benefit.

Insurer reputation: With many providers exiting the market in recent years, it is important for you to practice due diligence and pick an insurer that is both financially stable and committed to offering policyholders the best care possible.

If you or a loved one are living in the US and you want to know how this type of coverage works south of the border, our comprehensive guide on long-term care insurance in the US can provide you with helpful information.

Do you think long-term care insurance in Canada is a smart investment? Do the benefits outweigh the drawbacks? We’d love to see your answers in the comment box below.