Life Insurance. Worth It Or Not?

We All Know Someone, Right?

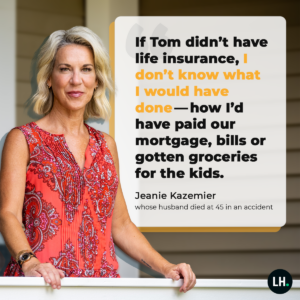

If you haven’t experienced the premature death of a friend or family member, it’s coming. How about a friend of a friend or someone you hear or read about on social media? Do you ever stick with the story long enough to know how those who were left behind pick up the pieces of their shattered life? That’s right, shattered!

I’ve been beating this drum for the last 25 years, but really drop yourself in this scenario and think about what shattered looks like. You’re married and have children. If both of you work, you probably need both incomes. Hey, today there are a lot of two income families that are barely keeping their boat floating. If one of you works, there’s no question your family needs that income. So think. If something happens to you what is shattered going to look like? Take some time with that question and, please, get real. Don’t even consider GoFundMe as the answer. This is real life and this is about your real spouse and your real children carrying on without you.

Is Life Insurance A Viable Answer?

The most common reason for families not having life insurance is that it isn’t free. If someone could protect your family with $500,000 of life insurance, a tax free gift to those left behind, for free, wouldn’t you sign up? The problem is that it isn’t free. When it comes with a price tag of $30 or $40 a month, then it’s competing with other expenses, like internet service, satellite TV, eating out, beer, groceries, gym memberships, morning latte, well, then it’s messing with your life, your plan. The most common reason families don’t have life insurance protection for their family is that it messes with their plan.

Bottom Line!

Who am I to ask you to analyze your plan and find the room to protect your family from a potentially shattered future? I’m a guy who has helped put $millions in the hands of families. I can’t replace their loss, or yours, but I can help create hope of a financially secure future. It’s your decision if it’s worth it or not. My name is Ed Hinerman. Let’s talk.