Life Insurance with Overactive Thyroid

Complete this questionnaire, and I’ll send you a quote taking your thyroid issue into account.

Getting Mortgage Protection with Hyperthyroidism

See here for life insurance with an underactive thyroid

Suffering from an overactive thyroid?

You’re not alone; it’s one of the more common health conditions in people applying for life or mortgage protection.

If you suffer from Hyperthyroidism, your thyroid gland is overactive and makes excessive amounts of the thyroid hormone.

The most common causes are Grave’s disease (auto‑immune disorder) and thyroid goitre (an enlargement of the thyroid gland). Treatment is with medication, radioactive iodine or surgery.

Hypothyroidism symptoms include dry skin, brittle hair, weight gain, tiredness, cold intolerance, a hoarse voice, constipation, lower libido, muscle weakness, heavier periods, a puffy face and bags under the eyes, slow speech, movements and thoughts, depression, memory problems, difficulty concentrating, a slow heartbeat, slightly raised blood pressure and raised cholesterol.

The thyroid gland releases hormones that control the metabolism and govern how the body uses energy, including how fast you burn calories and heartbeats.

How Does Hyperthyroidism Affect Life Insurance or Mortgage Protection?

The good news is that an overactive thyroid (hyperthyroidism) shouldn’t affect the price of your life insurance provided:

it’s well-controlled and under regular supervision with no complications.

you don’t have any outstanding test results, follow-ups or investigations.

you apply to the right life insurance company (some are to be avoided)

there are no other health issues

And, you’ll be relieved that an overactive thyroid should not affect your application for specified illness cover or income protection.

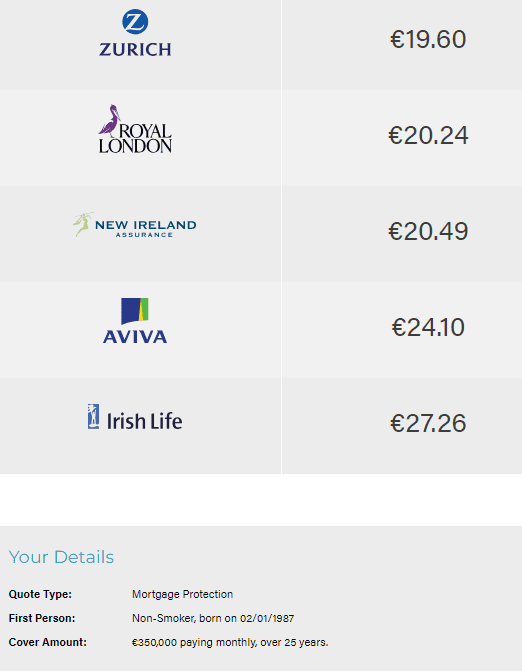

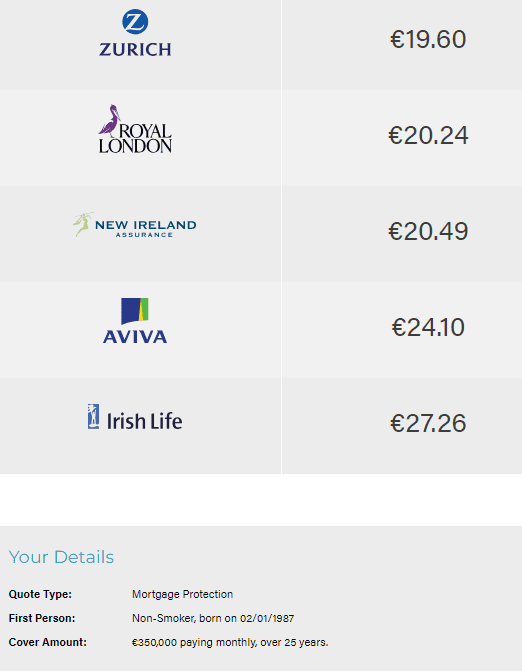

How Much is Mortgage Protection with an Overactive Thyroid

You should pay the same price as everyone else, the standard price.

Here’s an indicative quote for a 37-year-old who is getting a mortgage of €350,000 over 25 years:

What Information Will The Insurer Look For?

The life insurance company will ask questions such as:

When were you diagnosed?

What are the type, frequency and dates of your symptoms

Are you under regular supervision?

When did you last see your doctor?

What are the results of your most recent thyroid function tests (TFTs)?

What’s your current treatment? (type and dosage of any medication)

Have you ever had or are you waiting for an operation?

Have you ever been off work with this condition? (dates & duration)

If the insurer needs more information, they will write to your GP for a medical report, but generally, a well-completed questionnaire will be enough to decide.

Life Insurance with Overactive Thyroid

Choosing the most suitable insurer and packaging your application correctly is a very important first step.

We know the insurers who are more lenient when assessing life insurance for people with an overactive thyroid.

If you decide to apply through us, we’ll help you through the application process and advise you on the best course of action to obtain your life insurance policy at the lowest possible price with the least hassle.

Loads of our clients have thyroid issues, so we know what we’re doing.

I don’t like going to the doctors so I was really stressed about getting cover for my mortgage as I had read horror stories online. I thought it would make everything more complicated or too expensive. But the team at lion.ie was so brilliant. They walked me through everything and helped me find a policy quickly without a medical.

Over to you…

Would you like the best price when applying for life insurance with an overactive thyroid?

Complete the thyroid questionnaire below, and I will discuss your case with my underwriters (on a confidential basis) to get you the best cover at the lowest price.

If you’d prefer a quick chat, you can schedule a callback here

Thanks for reading

Nick

Editor’s note: We published this blog in 2017 and have regularly updated it.