Life Insurance When Pregnant

Sometimes pregnancy is

and sometimes it’s more

Either way, congratulations!

The fun starts here.

You’re going to make new friends, learn new things and come out the other side a better person.

But don’t let this journey pass you by.

Try to remember every single magical step you take right up to the big day when your life insurance policy finally issues 😉

Does Pregnancy Affect Life Insurance or Mortgage Protection?

Usually, being pregnant won’t affect your life insurance premiums.

The insurers are ok with certain readings and measurements being higher than normal like

BMI,

blood pressure

and cholesterol.

But if the readings are above even the normal range seen in pregnancy then you may have an issue.

The insurer could postpone offering life insurance until your readings are back in an acceptable range.

The main reason we see the insurers increase life insurance premiums in pregnancy is due to gestational diabetes.

Gestational diabetes is when high blood sugar/glucose develops during pregnancy.

Don’t worry, it usually disappears after giving birth.

If you get gestational diabetes during pregnancy you will pay a more for your life insurance. This is called a loading.

Once your sugars are back to normal, the insurer will remove the loading.

Should You Wait Until After You Have a Baby to get Life Insurance?

It’s a good idea to plan for the future by buying life insurance coverage when you’re pregnant or even before you become pregnant!

Sooner rather than later and all that jazz.

All the other stuff baby related stuff like the buggy, the car seats, the multitude of “What to Expect When You’re Expecting” books – whether you buy them today or in three months time, the price won’t change.

However, with life insurance, the cost of your policy can go from “standard rates/the normal price” to multiple times that amount if you develop any complications (as I mentioned above) during pregnancy.

So if you’re reading this article while family planning, you should consider life insurance now.

Can Post Natal Depression Affect Your Life Insurance?

It’s normal for your mood to flip-flop right after your baby is born.

If you’re feeling sad, anxious or teary within the first two weeks after giving birth, this is known as the “baby blues” but some mums feel down for much longer, and those feelings may develop into postnatal depression.

Signs of postnatal depression include loss of joy or absence of pleasure, feeling sad, hopeless, worthless, and/or useless, little or no energy, or feeling you just can’t cope.

As with other types of depression, there’s no simple reason why some women are affected.

If you are experiencing these feelings, please speak to someone.

From a life insurance perspective, you should be able to get life insurance at the ordinary price if you have suffered from postpartum depression.

However, if it is linked to another mental health condition, the insurer may increase your premium.

For BMI, do you use Current or Normal Weight?

This is the most common question we are asked 😅

The insurers realise that your weight during pregnancy won’t be a fair reflection of your usual weight, so when completing the application form, put down the weight you were immediately before your pregnancy

Is a Medical Exam Required?

Assuming you have no health conditions, you won’t have to undergo any sort of medical exam or screening.

And even if you have some health issues, the insurer will write to your GP for a report to get your medical history.

What Type of Life Insurance Should you buy in Pregnancy?

The most affordable type of cover is term life insurance.

You take out a policy on your life for a specific amount (say €500,000) for a specific time (until your child is 25 and financially independent).

If you pass away before your child’s 25th birthday, the insurer will pay out half a million euros to your estate/partner.

Other types of life insurance are available (serious illness cover, income protection, whole of life assurance) and we discuss the various life insurance types in more detail here if you’re interested.

How Much Life Insurance Should you Buy?

Term life insurance will payout a tax free lump sum on your death so you need to put enough in place to make sure your child is financially secure.

Have a read of this blog: how much life insurance do I need

Or if you couldn’t be arsed – stick your details in here and it’ll give you a quick estimate.

CALCULATE

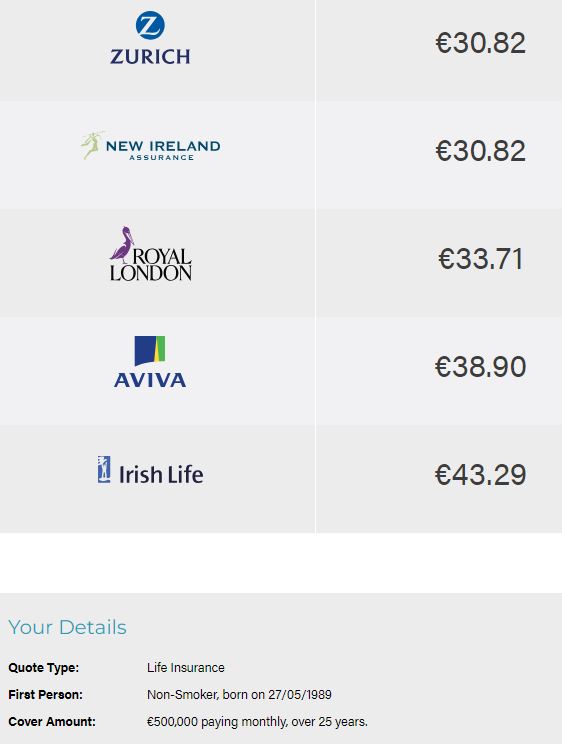

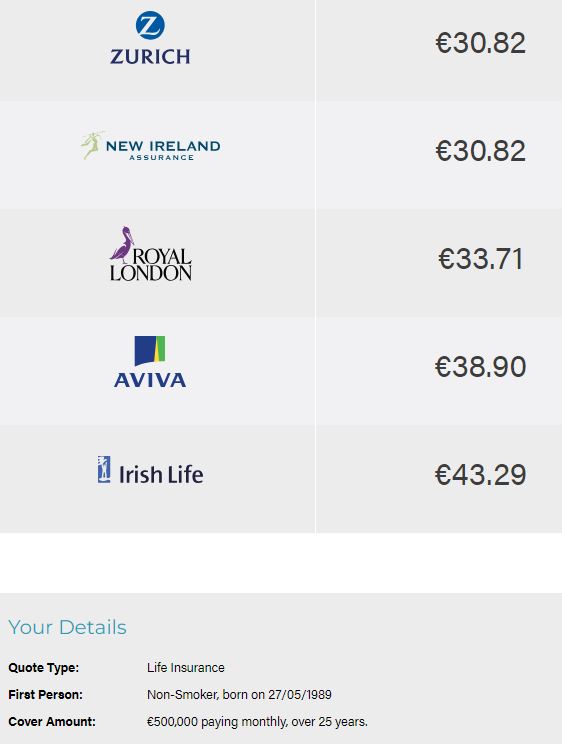

You can then go and get an indicative life insurance quote to see how much this life insurance stuff costs.

A healthy, non-smoking 35-year-old female could buy half a million cover for €1 per day.

Yep, a lot cheaper than you thought!

If you’d like me to figure out how much cover would suit you, please complete this financial questionnaire and I’ll be back over email with a no-obligation recommendation.

Do you Need Cover if You’re a Stay at Home Parent?

100% you do!

Royal London considered the duties of a stay-at-home parent and researched the cost of replacing the jobs they do for the family and in the home.

They included some of the ‘top jobs’ parents carry out on a weekly basis such as cooking, cleaning, driving children to their various activities and so on, and the average work-place costs associated with these duties.

Royal London’s calculations reveal that the cost to employ someone to do the household jobs normally done by a stay-at-home parent would be an estimated €54,590

So go right ahead and punch €54,590 into our calculator above to get an estimate of the cover you should buy.

Can you Buy Life Insurance for a Child?

You can’t insure a minor but the insurers add children’s life insurance to their parents term life insurance policy as follows:

From What Age is A Child Covered?

Be careful here.

Irish Life is the only insurer that covers a child from birth.

All of the other insurers have a “survival cruel” which is pretty cruel if you ask me.

This means to make a death claim, the child must have lived for a certain period, usually three months.

We have campaigned for children to be covered from birth but as of today, Irish Life is the only insurer that does so.

Which Insurer is Best for Life Insurance When Pregnant?

Irish Life, no question.

This payment is totally independent of your main life cover benefit which means that you can make a claim for one of these conditions, without affecting your life cover amount.

1. Disseminated Intravascular Coagulation (DIC)

2. Ectopic Pregnancy

3. Hydatidiform Mole

4. Placental Abruption

5. Eclampsia (Under this condition, the following is not covered: Pre-eclampsia.)

Can you Buy Income Protection During Pregnancy?

Yes, you can but income protection when you’re pregnant but not if you are already on maternity leave.

We’re often asked if income protection covers pregnancy?

Pregnancy is not defined as a “medical condition” so you can’t make a claim on your income protection policy.

However, if you develop complications during pregnancy or childbirth e.g back or mental health issues that stop you returning to your job, you can claim on your income protection policy and it will pay you a replacement income until you get back to your job.

How does income protection work?

How do you get Life Insurance as a new parent?

Oh hi, those 9 months flew, you’re a new parent now I see?

I cover the topic of life insurance for new parents in detail here which should help you settle into life with your gorgeous bundle of joy 👶

Do you have a Financial Checklist for parents-to-be?

Of course, we do:

The Having a Baby Financial Checklist

Over to you

Right, that’s enough for me, we’ve covered a fair bit there.

Here’s the link to our questionnaire if you’d like my advice.

![]()

![]()

All that’s left for me to say is to make sure you take it easy and get lots of rest before the baby comes.

And to all the Dads reading

You’re so gonna need it

Thanks for reading

Nick

Editor’s Note | We first published this blog in 2020 and have updated it since.