Life Insurance for Young Families in 2024

Having a baby is great.

Not that I’d know much about it.

Us menfolk have to deal with the horrors of man-flu.

How unfair would the lord above have been to lumber us with pregnancy too?

I jest, of course!

But I do remember those days after our kiddos arrived – they sucked – all that projectile puking, pooing and peeing, lack of sleep, making bottles (for one was hard, when the twins came along, jeeessh!).

Changing nappies, mouli-ing vegetables and, worst of all, minding them if you had the sheer audacity/stupidity to have a few shandies the night before.

Kill me now!

Some people lie say it’s the best time of their lives – those people need help.

They’re the same nutjobs who say your school days are the best time of your life – not unless you enjoyed spots, social incompetence and being skint all the time.

But I digress.

No matter how much we dislike our kids’ wailing, stench, and constant neediness, we love them all dearly, don’t we?

DON’T WE??

So we have to make sure they’re ok if we pop our clogs unexpectedly.

Remember, to a baby; we’re not really people.

We’re just providers of nice stuff that keeps them warm and alive.

If we’re not there to provide for them, who will?

So yeah, basically, we’re all just walking, talking paycheques to little Timmy and Tabitha.

And how do you replace a paycheque?

With a big ole life insurance cheque, of course, and that’s where I come in.

What Types of Insurance do Young Families Need?

If you want to protect your family with life insurance, you need three types of cover.

By the way, I’m going to assume you have zilch coverage at the moment, either personally or through work.

Do all families need Income Protection?

If you’ve just had a baby, you’re probably povvo, especially if it’s your first and you’ve just spunked loads of dosh on a top-of-the-range buggy—don’t worry—we’ve all done it!

Our firstborn’s buggy came with its own chauffeur, James, and butler, Gieves.

By the time the twins came along, we had much more sense, so they were wheeled about in a Tesco trolley propped up with a couple of pillows.

OK, Nick, you know the craic, I’m skint so “how can I afford income protection, it’s probably crazy money”

You’d be surprised how affordable it is. On average, you’ll pay 1% of your net monthly income to protect 75% of that income.

1% for 75% coverage – sounds pretty fair to me.

Let’s look at an example to clear things up.

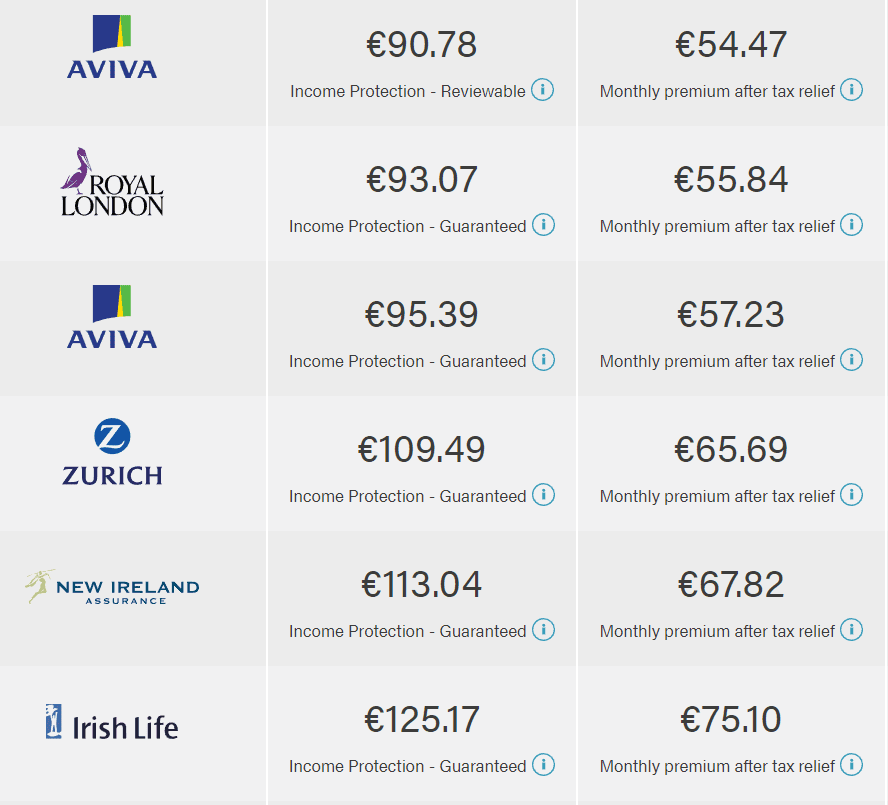

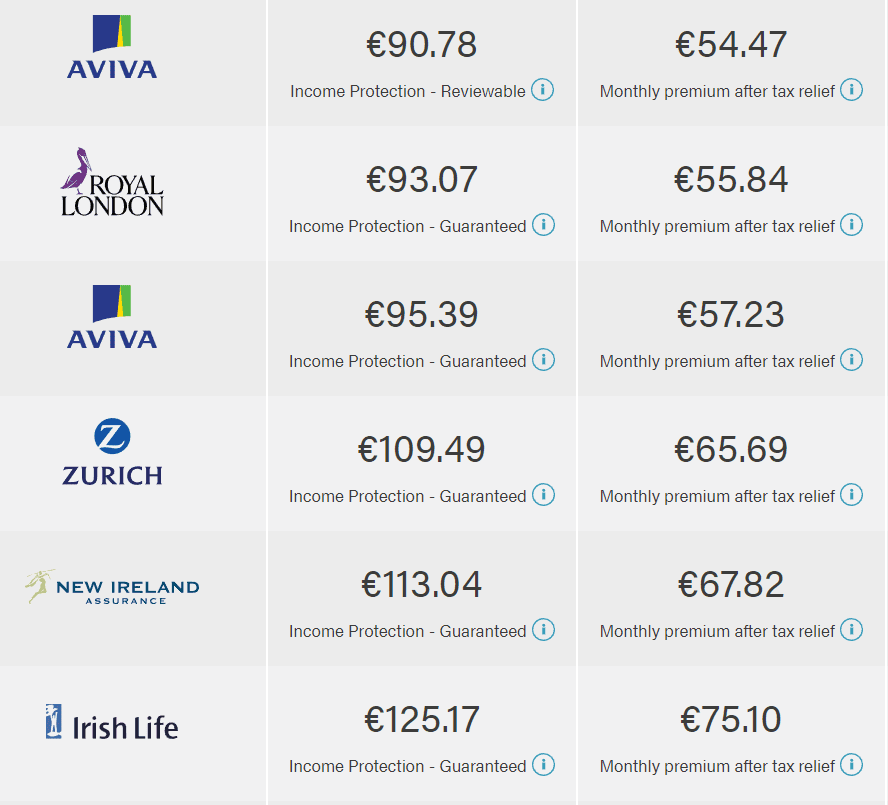

Quote Type: Income Protection

First Person: Non-Smoker, born on 24/07/1979

Cover Amount: €32,936 per year until age 65.

Occupation Class: Software Consultant (Class 1)

Deferred Period: 26 weeks

Assuming you pay 40% tax and using the lowest guaranteed/fixed quote below of €93.07

This means the net cost of your income protection is just €55.84

Your monthly net income is €3665 per month.

So, you would only have to use 1.5% of this to protect your income.

It’s an absolute no-brainer, even for someone with a baby brain.

Money Machine

I’ve beaten this analogy to death, but it’s the best I can come up with – if you had a money machine spewing out thousands of euros per month, would you put aside a few quid per month to maintain it?

Darn tootin you would.

You are that money machine, and income protection is your maintenance contract.

It’ll continue to pay you until you get back to work or reach retirement age.

Income protection gives you financial resilience.

Read more about income protection.

Family Life Insurance

Although it doesn’t have the “OMG that’s so cute” factor of teeny, tiny babies, basic life insurance is essential if you have kids.

A life insurance policy is a real-life Superhero for your family.

It gives you affordable protection* that covers you for a specific period of time — like until the rug rats leave and get their own place, yeah, right, as if that’s ever going to happen.

Also, your children get free life insurance when you take out a policy.

*When I say affordable, I mean cheap; if you’re a 35-year-old non-smoker, you can buy half a million cover for around €30 per month – that’s less than a euro a day.

Life Insurance if you’re the Main Breadwinner.

Serious illness cover

Scary fact alert!

According to a global report, Ireland has the third-highest rate of cancer in the world – ranked only behind Australia and New Zealand.

In Ireland, approximately 42,000 people are diagnosed with cancer annually.

This includes both invasive and non-invasive cancers, with about 24,000 being invasive cases each year.

On average, this translates to about 808 new cancer diagnoses each week.

(NCRI) (Irish Cancer Society).

If you get cancer or any of the other 60 illnesses covered by serious illness cover, you’re likely to be faced with immediate, unexpected bills:

medical bills

travel expenses

structural modifications for your home

As a parent, unless you have savings or a wealthy benefactor, a serious illness could cripple you financially.

Serious illness cover provides a tax-free lump sum when you need it most, giving you some breathing space so you can take time off work to get better or spend time with your kids while you focus on recovery without worrying about money.

Read more about serious illness cover.

Private health insurance

We don’t arrange private health insurance, but personally, I’d recommend it.

We have three kids and have used it a lot even though, thankfully, none of the kids have had serious health conditions.

Private health insurance and income protection are the two policies I wouldn’t be without.

Over to you

If you are a new parent, how do you have time to read this article?

Do you have hired help?

Have you just won the EuroMillions?

If you have, well, feck life insurance, you’re sorted.

However, if you’re not an overnight millionaire and you’d like some advice on how best to protect your family, please complete this questionnaire.

I’ll be right back with a recommendation that we can discuss over email, or we can talk whenever you get a spare minute 😒

Nick

Editor’s Note: We published this blog in 2018 and have updated it since.