Life Insurance for Gestational Diabetics in 2022

Last Updated on December 31, 2021

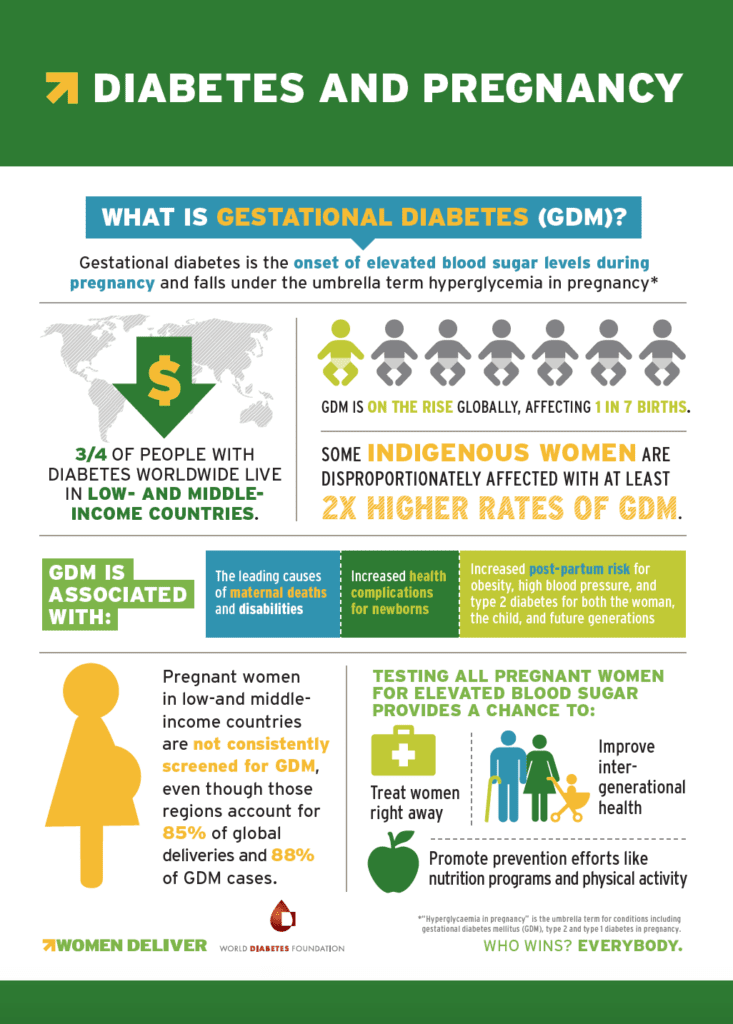

Gestational Diabetes is usually a temporary type of diabetes that occurs during 18 percent of pregnancies, however, studies show that people who develop Gestational Diabetes are more at risk to develop Type 2 Diabetes later on in life.

So what does this meana for you when you are trying to get life insurance, if you have Gestational Diabetes? Here’s a hint, it may not impact best life insurance for gestational diabetes rates at all! Many times life insurance with Gestational Diabetes can be obtain with NO extra premiums, or higher ratings. When working with Diabetes Life Solutions, we’ll make sure to recommend specific life insurance companies that will not rate you the same way as a person with Type 2 Diabetes. Sadly, certain companies view Gestational Diabetes the same way as Type 2 Diabetes.

If you have gestational Diabetes currently, or a history of Gestational Diabetes, you’ll want to work with experts like Diabetes Life Solutions in regards to your best life insurance for gestational diabetics needs. Working with the wrong agent may lead to you paying more for your coverage, than is truly necessary.

What exactly is Gestational Diabetes?

Below is how the American Diabetes Association, defines Gestational Diabetes:

Pregnant women who have never had diabetes before but who have high blood glucose (sugar) levels during pregnancy are said to have gestational diabetes. According to a 2014 analysis by the Centers for Disease Control and Prevention, the prevalence of gestational diabetes is as high as 9.2%.

We don’t know exactly what causes gestational diabetes, but we have some clues. The placenta supports the baby as it grows. Hormones from the placenta help the baby develop. But these hormones also block the action of the mother’s insulin in her body.

This problem is called insulin resistance. Insulin resistance makes it hard for the mother’s body to use insulin. She may need up to three times as much insulin.

Gestational diabetes starts when your body is not able to make and use all the insulin it needs for pregnancy. Without enough insulin, glucose cannot leave the blood and be changed to energy. Glucose builds up in the blood to high levels. This is called hyperglycemia.”

Gestational diabetes is more common than you think. It affects nearly 9% of pregnant women, in the United State alone. If you are obese, have history of high blood pressure, there is a greater chance that you may develop gestational Diabetes. There are also studies showing that ethnic backgrounds such as African-Americans, Hispanics, and Native Americans have a higher percentage chance of being diagnosed with this type of Diabetes.

The condition typically develops after the 20th week of pregnancy, at which point the fetus has already fully developed. The risk of birth defects can increase if you have had undiagnosed diabetes before pregnancy. That’s determined by high blood sugar levels during the first 6 to 8 weeks of your pregnancy.

With gestational diabetes, the child is more likely to develop type II diabetes (though not type I diabetes), and to be overweight throughout life.

Fortunately, the condition usually disappears after delivery. However, women who have experienced gestational diabetes have a 50% chance of developing diabetes within 20 years of delivery.

Gestational Diabetes and Type 2 Diabetes Rick Factor

When getting best life insurance with gestational diabetes, the insurance underwriters know that Type 2 Diabetes is not one that they are born with but that manifests over time with their lifestyle choices. Risk factors are taken into consideration when a life insurance underwriter takes on your case. If you have had Gestational Diabetes you are more likely to get Type 2 Diabetes, however, if you go on to live a healthy lifestyle you are far less likely to develop Type 2 Diabetes.

Life insurance companies obviously prefer to offer life insurance to people in good health, and who have not had treatment for any type of Diabetes. But rest assured if you have had Gestational Diabetes, it is NOT the end of the world. Finding affordable life insurance will probably be easier than you think.

Life Insurance Factors

Please note that there are many factors that go into diabetes and some can be hereditary and not related to living an unhealthy lifestyle. Your history of Gestational Diabetes is just one piece, of the puzzle. Life insurance companies will want a snapshot of your complete health profile.

Here are some sample questions companies offering best life insurance with gestational diabetes will ask you specific to your history of Gestational Diabetes:

Any history of Diabetes complications such as Retinopathy, Neuropathy, or amputation due to Diabetes? What is your most recent A1C and Glucose reading? Are you compliant with your Doctor’s treatment for your Gestational Diabetes?

Another factor to consider when getting best term life insurance for gestational diabetics after being diagnosed with Gestational Diabetes is your family history. Many insurance underwriters consider your family history as a guideline for you. If you have a family history of diabetes in your family tree you are more likely to pay a higher rate. Most life insurance companies will also want details of your treatment for Gestational Diabetes. So be prepared to provide details of your treatment.

Life insurance underwriters look at many other factors if you are suspect to a family bloodline of diabetes or have been previously diagnosed with Gestational Diabetes. Now that you are on their radar for health problems they want to look at your overall health at the current moment.

Questions Underwriters May Ask

• What is your blood pressure like? Is it high? Low?

• Is your cholesterol good or bad?

• What is your height and weight?

• Do you watch your diet?

• Do you exercise regularly?

• What was your last A1C reading?

• Do you use alcohol and tobacco products?

• What medications to you take?

• Do you participate in any high-risk activities?

• Do you have a dangerous occupation?

They might even ask you about your travel history. We have seen people be denied in the past for traveling to certain countries frequently. Our agents are trained to work with you, and to recommend specific gestational diabetes life insurance companies, that will accept your risk profile.

What are the Costs of Life Insurance with Gestational Diabetes?

Now you are probably wondering, “Am I going to have to pay an arm and a leg to get life insurance?” Or, “can I even get life insurance?” Honestly, your history of Gestational Diabetes may have ZERO impact, on your rates and life insurance options.

As you know, Gestational Diabetes can be controlled with a proper diet and exercise. The main concern life insurance companies will have been the potential for a woman with gestational diabetes to develop type II diabetes later in life. With, you’ll want to wait about 6-8 weeks after giving birth, before beginning the application process.

Life Insurance companies will want to make sure the delivery of your child went as smoothly as possible. They will also want to be sure, there were minimal, or NO complications during the delivery process. It’s generally smart to also begin to lose some pregnancy weight, before applying. Gestational diabetes life insurance carriers are aware that you won’t be at pre-pregnancy weight, but your agent can always relay this information to an underwriter.

People with Gestational Diabetes can qualify for the same types of life insurance policies that people without a history of diabetes can obtain. This includes whole life insurance, term life insurance, guaranteed universal life insurance and variable life insurance policies You will also be able to have policies with various life insurance riders, and living benefit riders as well.

In most cases, someone with Gestational Diabetes will receive a Standard to Preferred rating from carriers. Essentially meaning no extra ratings, for having been treated for Gestational Diabetes. Now if your condition was moderate to severe, you may pay ‘extra’ premiums depending on your complete health profile. Worst case scenario is you are declined all together. It’s extremely important to speak with an agency such as Diabetes Life Solutions, before applying for life insurance. We’ll provide you honest advice and will even let you know if you should apply at all, now.

Do I have to do a Medical Exam?

No!!! You do not have to do a medical exam, to be approved for coverage. Generally, there are several options for non-medical exam policies. To find out what your various options are, simply contact us, provide us with your basic health profile, and we can share with you all the options you’d be eligible for. The initial phone call takes 5 minutes or less.

If you qualify for a non-medical exam policy, the application process for gestational diabetes life insurance may take 2-3 days. These types of plans are underwritten in a much quicker time frame, then traditional life insurance policies. However, they may be more expensive, compared to policies who test your blood and urine. Good news is, you can always begin with a policy like this, and in the future, reapply for a policy that may provide a better rate.

Tips for Lower Rates

One metric that underwriters will look at is your height to weight ration and your BMI. Before applying, you may want to try and diet and exercise to lose weight, if you feel like you are not at what is typically considered a healthy weight. This will show that you are leading a healthy lifestyle and may lower your rates.

If you are applying to a company that requires a medical exam, please know what your A1C levels are. To receive a “preferred” rating from an insurance company, ideally your A1C level needs to be 7.1% or lower. To receive a Standard rating, it needs to be 8.5% or lower. Also, since various life insurance companies have different underwriting guidelines, it’ll be important to work with the right carriers.

As an Example, one life insurance carrier may offer you a Standard life insurance rating. This sounds great, as you aren’t paying any extra premiums compared to a person without history Diabetes. But let’s say another life insurance company may offer you a Preferred rating. This may potentially save you “Thousands of Dollars” over the lifetime of your policy. That’s where we come in, to help you navigate the life insurance market place.

Another simple way pay more for life insurance is by smoking. If you smoke, then stop right now.

By simply not smoking you could save thousands of dollars a year on your life insurance plan. Not only will you pay 20% to 30% more in premiums, but most gestational diabetes life insurance companies will charge ONE to TWO extra tables in premiums. If you start with a policy using a Tobacco rating and can stop using Tobacco for 12 months or longer, you can always reapply, and receive rates that reflect your NON-Tobacco status.

Work with Independent Agents

The best way to make sure you’ll receive the best rates is to work with an agent who ONLY WORKS with the Diabetes community. Many agents advertise that they specialize in working with people with Diabetes, but when you look at their website, those agents seem to specialize in HUNDREDS of other types of niches. You need to make sure your agent is knowledgeable on diabetes and gestational diabetic life insurance policies, so you are getting the best possible rates.

That’s what we do. We specialize in only working with people who live with diabetes.

Source: Women Deliver

Calculating Life Insurance Needs

When calculating what life insurance policy, you should get, you should look at a few different things. Our agents are standing by to discuss important issues like this with you.

One item to calculate is your amount of debt. Having enough from your gestational diabetic life insurance payout to help pay off your debt is important to your family. This can include mortgages, credit card debt, student loans, or any other type of significant debt you may have.

Some calculate the costs of funeral expenses, however, burial insurance is a much better way to plan for unexpected funeral costs. Most funerals may cost $10,000 to $20,000 these days, and many people don’t think about how to have these types of expenses paid.

You will also want to add in your annual salary. This is how much you get paid each year because if something were to happen to you, your family is left without your money to help support them. This is critical and needs to be taken into consideration. As an example, Dave Ramsey recommends Ten Times your Annual Salary, at a minimum.

In certain situations, a person with Gestational Diabetes may need life insurance for gestational diabetes to meet a divorce obligation, or for a SBA loan. Our agents will be able to help you find the right policy, to meet these unique needs.

Many people make the mistake of getting a lower amount of life insurance and it leaves behind a mound of debt for the family to pay off which can cause many problems. If you don’t provide your family with the proper amount of life insurance, they may not be able to maintain their desired life style. As with all types of Life Insurance, if you no longer need the coverage, you can cancel the policy at any time.

Being diagnosed with Gestational Diabetes can be overwhelming, especially with everything else that goes into being pregnant. After your pregnancy is over and you are thinking about life insurance for gestational diabetes, then the tips above can be very helpful. Let’s face it. You have a new member of your family, and there’s rarely a better time to start thinking about life insurance.

Finding life insurance with Gestational Diabetes doesn’t have to be difficult. Simply work with an Agency who understands the needs of the Diabetes community, such as Diabetes Life Solutions. You’ll experience first class customer service, and our agents will always be honest with you.

If you have any other questions, please call or email us right away. We love to work with the Diabetes community and are here to serve. Not all life insurance for gestational diabetes companies look at people with Gestational Diabetes the same. Since we are the ONLY agency who ONLY works with people with Diabetes, we know what companies ARE BEST FOR DIABETICS. A 5-minute phone call to 888-629-3064 is all that it takes, to start receiving information based off your health profile, and financial situation.