Life Insurance and Lupus: Buyer’s Guide

Video Transcript

Hey everyone, we’re Jeanna and Natasha from Quotacy, an online life insurance agency where you can get life insurance on your terms.

At Quotacy, our goal is simple: to make it easy for everyone to buy the right amount of life insurance to protect their loved ones.

Today we’re talking about lupus and the impact it has on the life insurance buying process.

The good news is just because you have been diagnosed with lupus doesn’t mean you’ll automatically be declined for life insurance. However, we want to set realistic expectations up front and be transparent about pricing. If you have lupus, your life insurance premiums will be higher than that of the average person. And depending on the severity, you may be declined for traditional life insurance.

Your best chance for approval is to apply through a life insurance broker like Quotacy. Life insurance brokers are not tied to one insurance company.

After you apply online, your Quotacy agent will anonymously shop the details of your case with all the top-rated insurance companies we work with to match you with the company that will give you the best offer.

» Compare: Term life insurance quotes

Life insurance companies use risk classes to determine how much an individual will pay for their life insurance coverage. Life insurance risk classes range from Preferred Plus, which is the best possible offer, to Standard, which is average.

If you have factors that will make you a higher risk on average you’ll be table rated. Lupus often is a medical condition that is considered a higher risk than average in an applicant.

Here at Quotacy we typically see insurance companies offer lupus applicants Standard risk at best. But the majority have been table rated.

Being table rated means that the insurance company has decided that the risk to insure you is essentially outside of their comfort zone and you will need to pay extra in order to be insured. Table ratings range from Table A or Table 1 to Table P or Table 16. Every step down the table you go, the higher your premiums will be.

The sample pricing you see here is for a 30-year-old non-smoking female applying for a 20-year $500,000 term life insurance policy.

Life insurance companies want to be able to provide coverage to anyone who needs it, but they also need to balance the risks they take on to ensure they can honor all their promises to policy owners, such as paying out death claims and dividend payments. If insurance companies offered the best risk classes to those with ideal health and to those with medical issues they would not be in business very long.

To illustrate why working with a broker is beneficial if you have lupus, take a look at this Quotacy client’s case.

Jane Smith applied for a term life insurance policy through Quotacy. Her agent noticed she listed lupus as a medical condition she’s diagnosed with. Her agent then anonymously shopped her case around to the insurance companies we work with.

As you can see, the insurance company’s risk class offers were all over the map.

Had Jane applied directly to Insurance Company C, for example, instead of applying through Quotacy, she would have been declined and likely thought she wasn’t a candidate for life insurance. Her Quotacy agent pushed Jane’s application through to Insurance Company G and she was able to get life insurance coverage to protect her family.

If you’re wondering how much life insurance would cost know that online life insurance quoting tools alone can’t give you 100% accurate information. With a lupus diagnosis, there are just too many variables for a quoting tool to calculate. To find out if you can get approved for life insurance and what it would cost, you’ll need to apply.

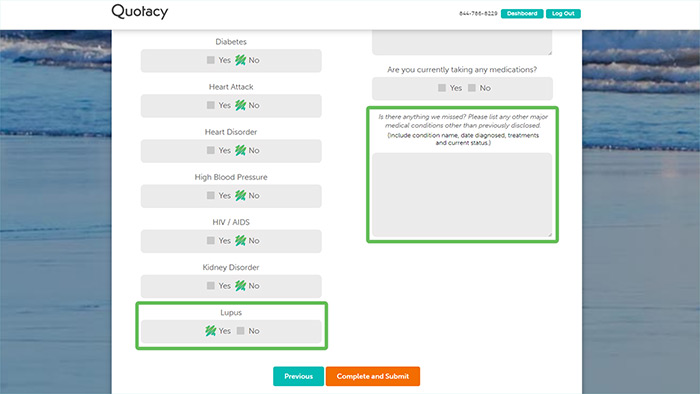

When you apply for life insurance through Quotacy.com and check Yes to Lupus please provide as many details regarding your diagnosis as you can.

By answering these questions honestly and with as much detail as possible your dedicated Quotacy agent will be able to set realistic expectations up front regarding the cost of life insurance.

If there’s a website out there showing you a cheaper price than what your Quotacy agent can find that other website is likely only showing you a best case scenario price and not factoring in your lupus condition properly. There are no coupons or promo codes when it comes to life insurance. It’s all very tightly regulated.

To find out how much life insurance would cost you head on over to Quotacy.com, run a quote and apply right online. It takes less than five minutes and there’s no obligation to buy.

If you aren’t satisfied with the life insurance policy Quotacy finds you you can walk away. There’s no cost to apply for life insurance. No fee to cancel the process and no hard feelings. If you want more in-depth information.

» Calculate: Life insurance needs calculator