Life Insurance After Cancer in Ireland

Cancer is a bastard.

Everyone knows someone who had it – but everything changes if it’s you.

Treatment will make you sick but it’s all worth it when you beat it.

I’m so happy for you that you’re recovering – no doubt it’s been a hellish few months of doctors, treatment and feeling shit.

You can finally move on with your life.

So why does it feel like your bank or insurer is trying to punish you by making it really hard for you to get Life Insurance to protect your family or Mortgage Protection for a home you can call your own?

Having gone through cancer is scary enough without having all that tricky financial stuff to deal with too.

It might feel like another battle, but don’t worry: we’re on your side.

We specialise in helping people like you get insurance.

We work with all five insurers, so we know the pros and cons of each. Some are worth approaching if you have had a history of cancer, others are best avoided. This means we can get you cover at the lowest possible price with the least amount of hassle.

Can you get life insurance after beating cancer?

If you or a loved one has a history of cancer, you’ll be relieved to hear that it is still possible to buy a life insurance policy.

But it will depend on several factors.

Making an application for life insurance after cancer:

The most important information the life insurance company will look for is:

When were you diagnosed with cancer?

What type of cancer was it?

What was the treatment?

How long are you cancer-free (after treatment has ended)

In all cancer cases, the insurer will request a detailed Private Medical Report from your GP along with other hospital reports.

For most cancers, there will be a postponement period of a number of years after treatment has ceased.

This means life insurance will not be available until this postponement period has ended.

Unfortunately, the cover isn’t possible if you are currently undergoing treatment for cancer.

How do the insurers assess severity?

The TNM staging system is the most common way that doctors stage cancer. TNM stands for:

Tumour size

Node describes whether there has been a spread to the lymph nodes.

Metastasis is whether cancer has spread to a different area of the body

Your scans and tests give some information about the stage of your cancer. But your doctor might not be able to tell you the exact stage until you have surgery.

Doctors may also use a number staging system if your specific cancer doesn’t have TNM staging. If you can find out the number staging, that will help me.

How long must you wait after cancer to get life insurance?

This depends on the type of cancer. Each type has a different postpone period – here’s a general guide:

Life insurance after breast cancer

Initial postponement period for one to five years (depending on severity) after treatment has ended.

https://www.cancer.ie/cancer-information-and-support/cancer-types/breast-cancer/staging-and-grading

Life insurance after melanoma/skin cancer

If it hasn’t spread, you must wait three months after treatment ends. For all other cases, there’s generally a six month to two years waiting period depending on staging.

https://www.cancer.ie/cancer-information-and-support/cancer-types/skin-cancer

Life insurance after testicular cancer:

No spread, 6 months waiting period.

For the majority of other testicular cancers, a postponement period of between one and two years will apply.

https://www.cancer.ie/cancer-information-and-support/cancer-types/testicular-cancer

Hodgkin’s and non-Hodgkin lymphoma:

Stages 1 and 2 – generally a postponement period from three to ten years post-treatment will apply.

Stages 3 and 4 – cover will generally be declined.

https://www.cancer.ie/cancer-information-and-support/cancer-types/hodgkin-lymphoma

How much does life insurance after cancer cost?

There’s no getting around the fact that life insurance after cancer is more expensive.

If you can get cover, the insurer will increase your premium significantly compared to someone with no history of health issues.

Normally this increase will be temporary for a period of between one to ten years.

If you’d like me to get you an indicative quote, please complete this questionnaire (as above I’ll need the TNM staging is available)

Why it’s important to choose the right insurer when in remission

Here’s a recent case study:

I want to inquire with you about life assurance. My Fiance and I have been approved for a mortgage with AIB, we are due to sign the contracts on a house next week. We had a call with Irish life last regarding life assurance and they said they will postpone cover for me because I had Non-Hodgkins Lymphoma in 2010. I have been in remission now since November 2010, 8 years thankfully, but it would seem they have a 10 year wait period. I have read through your website and read reviews and you seem to be the man to talk to in such a situation! I have Death in Service cover at work that will cover 3 times my salary and AIB confirmed this morning they will waive cover if I have 2 additional rejections. Obviously we would prefer to get cover in place, but failing that at least the waiver is available.

We managed to get our client covered at the normal price.

She was speechless…and no longer homeless!

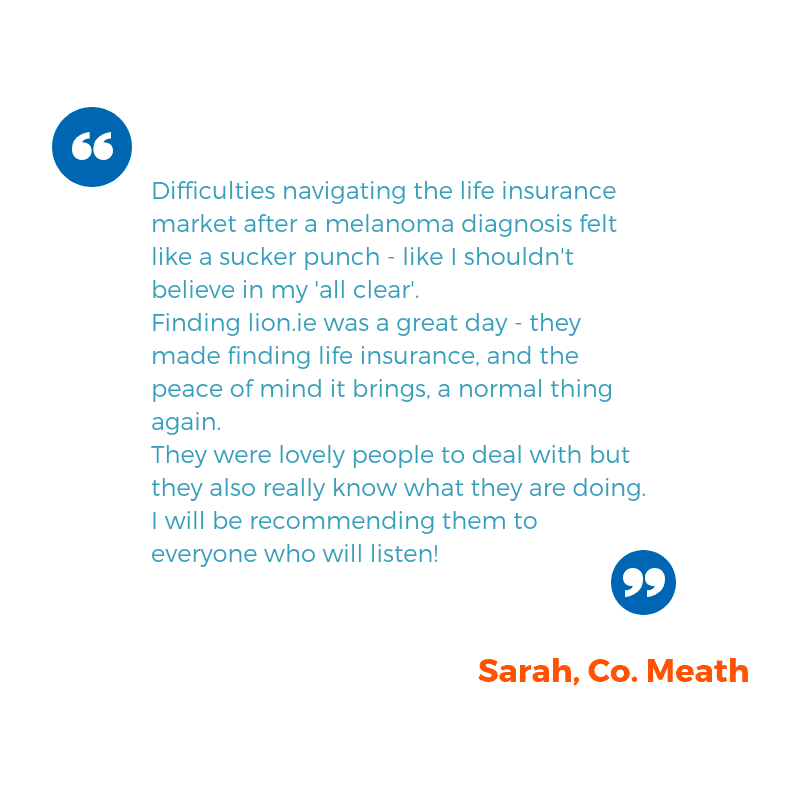

And here’s a recent testimonial:

Over to you…

Don’t give up.

If an insurer has postponed or declined offering you cover after cancer, speak with a specialist life insurance advisor who can approach all the remaining insurers on your behalf. But make sure you pick one who knows what he’s doing, otherwise, you may do more harm than good.

👋

I can sort this out for you quick smart – get in touch by completing this short questionnaire or calling me personally on 05793 20836. In 24 hours I’ll be able to confirm whether it’s worth making a formal application to one of my insurers.

Further reading : Irish Independent Article

Nick McGowan

lion.ie | making life insurance easier