Life Insurance after a Brain Tumour 2024

Complete this questionnaire and I’ll send you a quote taking your health history into account.

Can You Get Mortgage Protection if you have had a Brain Tumour?

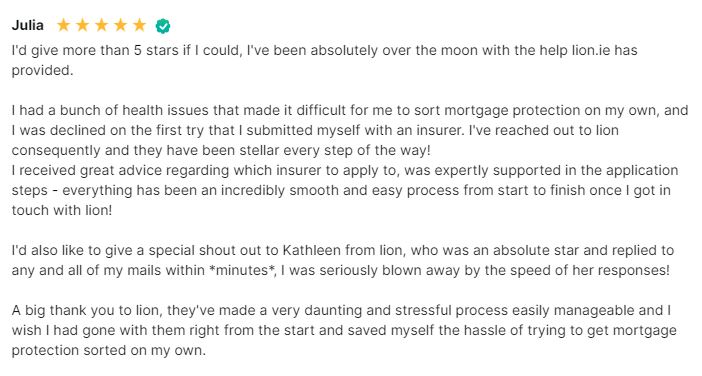

Here at Lion, we have arranged numerous life insurance policies for clients with benign brain tumours.

But I do remember the first time someone came to me looking for cover.

I was so naive; I thought there was no chance of getting cover.

Back then, If someone heard the word “brain tumour”, they’d think the worst, but most benign tumours don’t cause a problem when applying for life insurance.

But it very much depends on how the insurer you choose underwrites the specific tumour you had.

The most common ones are usually fine once fully removed, and a postpone period has passed since surgery.

Tumours like

a pineal gland tumour

acoustic neuroma

meningioma

pituitary tumours.

cavernoma

Brain AVM (arteriovenous malformation)

Others can still be a problem depending on where on the brain they are located.

If they were large or spreading is an issue because of how the pressure affects normal brain tissue.

Benign tumours are usually slow-growing and rarely fatal; however, they can cause problems due to their size.

Space for growth is limited, so there is a danger the growing tumour can press on areas of the brain and affect normal functioning.

It’s sometimes also difficult to confirm complete removal (pituitary tumours don’t always need removal)

What’s the difference between a benign brain tumour and a malignant brain tumour?

Malignant brain tumours invade the surrounding tissues

Benign brain tumours remain in the brain; they don’t spread.

Can you get life insurance after a brain tumour?

If you have had a brain tumour in the past that was being and completely removed, the insurers will accept you at the standard price.

However, there is usually a postponement period of three years post-surgery.

Get your indicative life insurance quote here.

If it were malignant, the insurer would defer cover for a further postponement period (2-5 years depending on the stage of the tumour).

Once this period has passed, you will pay an increased premium for a number of years after treatment has finished.

An example may make it easier:

John diagnosed with a Grade 3 brain tumour in Feb 2024, excised March 2024.

The insurers won’t be able cover John until March 2027.

From March 2027, John will pay a higher premium until March 2030

In March 2031, he will pay the standard premium due to the Cancer Code.

However, if there have been complications such as

recurrence

incomplete removal

post-surgery symptoms

or neurological deficit

then it will be more difficult to get cover.

What medical information do you need when applying for life insurance after a brain tumour?

To discuss your case with my panel of underwriters, I’ll need to know

the exact diagnosis,

date of diagnosis

if there has been a full excision/removal

what symptoms you have suffered.

With that information, I can speak with my underwriters to check whether it is worthwhile to apply.

If the underwriters agree to consider an application, the insurer will write to your GP for a detailed medical history once you apply.

Is serious illness cover possible after a brain tumour?

Yes, where there has been a full recovery.

As serious illness cover policies pay out for benign brain tumours, there will be an exclusion here, meaning you cannot claim in the future if the tumour returns.

Can you get income protection after a brain tumour?

It’s impossible to say without knowing the specifics of the tumour.

Over to you

Have you had a brain tumour and need life insurance?

Please contact me before making an application.

Some insurance companies are very strict when it comes to underwriting life insurance after a brain tumour.

Make sure you approach the correct insurer for your health condition.

If you complete this questionnaire, I can advise you.

Alternatively, if you’d like to talk it over first, you can schedule a call here.

Thanks for reading

Nick

Editor’s note | We published this blog in 2016 and have updated it regularly since