Life as an insurance agent: habits that will set you up for success

Life as an insurance agent: habits that will set you up for success | Insurance Business America

Guides

Life as an insurance agent: habits that will set you up for success

Life as an insurance agent comes with benefits and drawbacks. Find out if this career is for you as we give you a snapshot of what a typical workday looks like

Life as an insurance agent can be financially and professionally rewarding, but there are challenges that you first need to overcome. To be successful, you must put in the hard work and have the right mindset.

If you’re wondering how a typical day of an insurance sales professional goes, you’ve come to the right place. In this article, Insurance Business gives you an overview of the day in the life of an insurance agent. We will give you a walkthrough of the usual daily schedule and the skills you need to meet your goals.

If you feel like a career selling insurance is a great fit but want to learn more about what the job entails, this guide can help. Here’s what you need to know about life as an insurance agent.

An insurance agent’s role is that of an intermediary. They act as a go-between for insurers and potential clients who may be interested in getting coverage. Insurance agents may represent one or several insurance companies. They provide customers with information about these insurers and their products.

Agents have contracts with insurance companies detailing the policies they can sell and how much they can earn from each successful sale.

If you want to pursue a career as an insurance agent, you have two options:

1. As a captive insurance agent

If you choose to become a captive insurance agent, you commit to selling policies exclusively for an insurer. You can also opt to work either full-time for an insurance agency or as an independent contractor.

Captive agents enjoy operational backing from their partner insurers. This includes access to an office location, equipment, and administrative staff. They also often get referrals on potential clients from these carriers.

Because of the nature of their partnerships with insurance companies, captive agents don’t have the flexibility to sell whatever policies they want. They also can’t shop around on behalf of their clients to see if there’s a better deal.

2. As an independent insurance agent

Independent agents hold partnerships with several insurers. They can offer insurance buyers a wider range of policies because they’re not tied down to a single carrier.

Independent insurance agents generally earn higher commissions compared to their captive counterparts. These earnings, however, are offset by their business and operating expenses, which they pay for on their own.

Independent agents may also be unable to access products from some of the biggest insurance brands as they often prefer to work with captive agents.

Regardless of whether captive or independent, insurance agents are given the power to bind coverage. This means that they have the authority to confirm coverage even if the policy isn’t finalized yet.

Although often confused with each other, insurance agents and brokers perform distinct roles.

Just like insurance agents, brokers act as an intermediary between the insurers and insurance buyers. But unlike agents who are obligated to sell products from their partner insurers, brokers can access policies from a wider network of providers.

Another key difference is who they represent. While agents represent insurance companies, brokers represent families and businesses. These insurance sales professionals help buyers find the policies that match their unique needs.

Because insurance brokers aren’t bound to a particular insurer, they have more freedom to place policies with different providers depending on market conditions. This allows them to offer the best possible coverage for their clients.

Insurance agents tackle different tasks each day. From finding leads and selling policies to mentoring new agents and earning continuing education credits – to say life as an insurance agent is hectic is often an understatement.

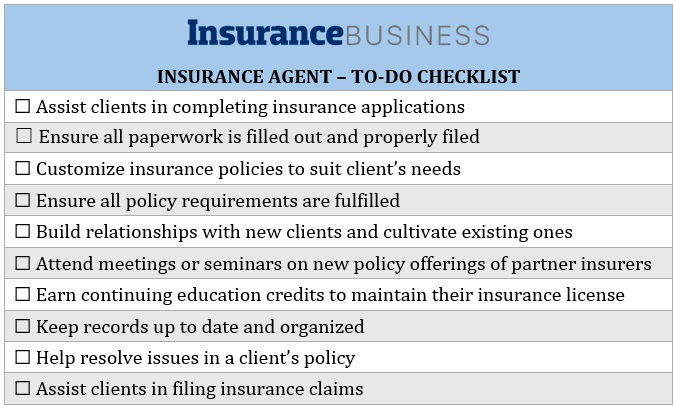

Here’s a checklist of the possible tasks that insurance agents need to accomplish on a typical workday.

This list isn’t exhaustive. As an insurance agent, you need to perform other duties not listed above. Given this, if you don’t have a system in place, it’s easy to get overwhelmed and burnt out.

To prevent this, we gathered tips from industry experts on how insurance agents can manage a hectic day.

Come in prepared

In a YouTube video, David Duford, CEO and owner of Duford Insurance Group, highlights the importance of preparation.

“Many insurance producers get up very early in the morning and they have their day planned,” he shares. “In some circumstances they preset their appointments. Possibly, they called the night before to set their appointments.”

Having a plan allows you to set the direction of your workday. It helps you keep organized and focused. It also increases productivity.

In a separate video, Nicholas Sakha, who owns an insurance agency in Nevada, shares how having a morning routine helps prepare him for the day ahead. His routine includes making coffee, drinking water, walking his dog, getting a cold shower, and meditating.

“What does this have to do with the insurance industry? Absolutely nothing,” he says. “But it has everything to do with my morning state and getting me in the right mood and the right frequency and the right energy to take on my day.”

Connect with people

Finding good leads is the most important aspect of a successful insurance sales career, but it’s also one of the most challenging. If you want to enjoy a long and lucrative career, you need to catch the attention of potential buyers. This is where establishing connections with people comes into play.

“An insurance agent is a salesperson, so this means they are actively visiting prospects or people who may be potentially interested in buying an insurance product on a day-to-day basis,” Duford explains. “This is the most important activity an insurance producer can do. It’s all about seeing the people.

“Agents in the insurance business live and die with how many presentations they hit every week because this determines what their financial outcomes are in the long haul. If they routinely don’t hit those numbers, they routinely fail out of the business. So, seeing the people is the cornerstone of success in the day in the life of an insurance agent.”

Sakha shares that he has incorporated getting out of the office and building relationships with people a part of his work week.

“Every Thursday, I like to get out of the office. I like to go out and just network,” he says. “I like to visit people at their places of business, connect, and add value. And what that does is reignite those friendships and relationships. We figure out ways on how we can benefit each other, how we can add value to each other, and funnel business to one another.”

Put in the hard work

An insurance sales career can be financially rewarding, but you must be willing to put in the effort. Life as an insurance agent also entails having the mental toughness to withstand the stress and pressure that comes with the job.

“It is work,” Duford stresses. “You have to get up. You have to see the people. You have to deal with rejection. You have to deal with success. It is emotionally a rollercoaster sometimes and our biggest competition is us; it’s the person staring back at the mirror.”

Life as an insurance agent comes with its share of pros and cons. To find out if it’s a good fit for you careerwise, weigh these benefits and drawbacks.

Life as an insurance agent – pros

Opportunity to earn a high income

An insurance agent’s income is mostly commission-based, especially if you choose to become an independent agent. Because of this, there can be no ceiling on how much you can earn. If you’re willing to place yourself out there to build relationships with people, more financial opportunities will come your way.

Challenging but rewarding work

Each client has unique needs. That’s why as an insurance agent, you often face challenges that require you to find innovative and creative solutions. This can lead to a sense of fulfillment at the end of the day.

Chance to work with the industry’s biggest names

Pursuing a career as an insurance agent gives you an opportunity to work with some of the industry’s largest players. Many insurance giants partner with captive agents to sell their products. You can check out our list of the largest insurance companies in the US to find out where the biggest names in the industry rank.

Life as an insurance agent – cons

Difficulty in finding leads

Because of stiff competition in the market, finding good leads can be challenging. There’s a strong chance that the prospects you find may have already been contacted by other insurance agents.

High-pressure work environment

Life as an insurance agent often requires long work hours to meet different quotas and targets. This high-pressure work environment can result in stress and burnout, especially for those just learning the ropes.

Rejection and disrespect

It doesn’t matter how good your intentions are. You will eventually meet people who treat insurance agents with disrespect and disdain. You may also experience a lot of rejections before closing a sale. This is why having excellent people skills and an open mind is important if you want to thrive in this career.

Being a successful insurance agent requires having a mix of hard and soft skills that allow you to establish good relationships with people. This, in turn, helps you find the best possible coverage for your clients. Here are some of the most important skills and attributes you should have to become among the best in the field.

People skills: You must be able to build relationships and maintain trust with clients. This is key to finding out what type of coverage they need, so you can provide them with the right policy.

Problem-solving skills: In your daily work, you will face unique challenges each day that will require you to come up with creative and innovative solutions.

Communication skills: Strong written and verbal skills are a must, so you can convey important information to your clients in a simple and jargon-free way.

Attention to detail: You must be able to determine and understand the finer details of a policy that affect your client’s coverage.

Self-motivation: An inner desire to perform to the best of your ability is important, even if this means going the extra mile to close a sale.

Negotiation skills: In times of disagreements, the ability to find mutual ground must come naturally if you want to succeed as an insurance agent.

Time management: You must know how to prioritize tasks and complete projects efficiently.

Organization skills: You must be able to keep your records accurate and organized since you will be working with a lot of clients.

Eagerness to learn: A strong willingness to learn and hone new skills is essential if you want to thrive in your career.

Having a role model is also important if you want to succeed as an insurance agent. If you’re new in the industry and looking for someone to look up to, our Best in Insurance Special Reports page is the place to go.

Recently, we unveiled the five-star winners for our Leading Insurance Professionals in the USA awards. Check out the special report – find out how these professionals rose through the ranks to thrive and flourish in their careers.

Do you think life as an insurance agent suits you? What makes this career worth pursuing? Share your thoughts below.

Keep up with the latest news and events

Join our mailing list, it’s free!