LIC’s New ULIP Plan Index Plus (Plan No. 873)

LIC of India has launched a new ULIP plan named Index Plus, Plan No. 873. LIC’s Index Plus is a Non-Participating, Unit Linked, Regular Premium, Individual Life Insurance plan. LIC’s Index Plan offers insurance cum saving during the term of the policy. This plan is available for sale starting 06/02/2024. The UIN of Index Plus is 512L354V01.

LIC’s Index Plus (Plan No. 873) offers two Unit Fund options. In Index Plus, life assured gets a Guaranteed Addition after a specific year during the policy term as a percentage of the Annual Premium. This plan can be taken online through LIC’s website.

Features of LIC’s Index Plus

The Following are the main features of LIC’s Index Plus.

Insurance with the benefit of Investment in a single planGuaranteed Addition on the 6th, 10th, 15th, 20th and 25th policy year.Two unit funds, namely Flexi Smart Growth Fund and Flexi Growth Fund, are based on the NIFTY 50 and NIFTY 100 indexes.Refund of Mortality charges on MaturityLiquidity through the Facility of Partial withdrawal is available after the 6th policy year.Choose the risk cover from 7 times the Annualised premium or ten times the Annualized premium.Higher Guaranteed Addition on higher premium

Eligibility Conditions of LIC’s Index Plus

In the above table, BSA denotes the Basic Sum Assured.

Date of Commencement of Risk: If the Life Assured is a minor under eight years old, risk will start after two years of taking the policy or the child completing the age of 8, whichever is earlier.

Maturity Benefit in LIC’s Index Plus

Life Assured will get an amount equal to the Unit Fund Value on the maturity date. Along with the Unit Fund value, Life Assured will also get the mortality charges deducted during the policy term. Mortality charges will only be refunded when the premium is paid for the policy’s full term. No refund of Mortality charges in case of surrender of the policy.

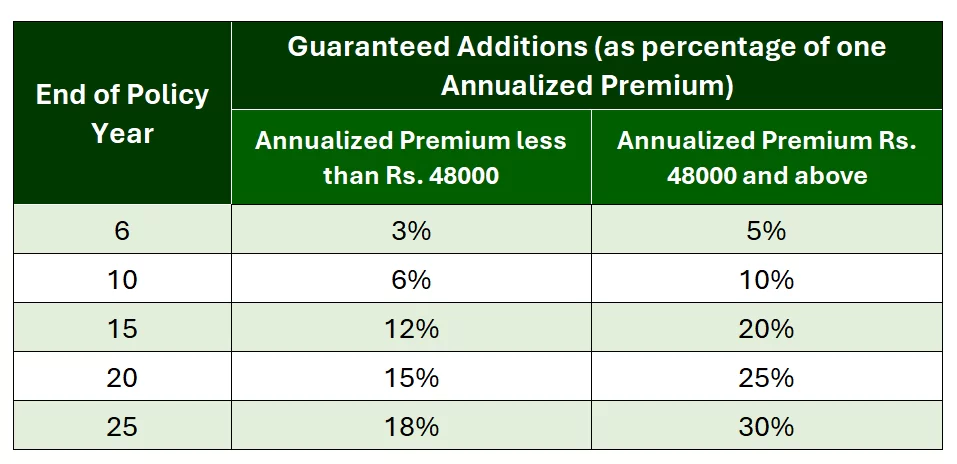

Guaranteed Addition in LIC’s Index Plus

LIC’s Index Fund provides Guaranteed Addition after a specified policy term in the inforce policy (where all the premiums are paid). Guaranteed Addition is payable as a percentage of Annulized Premium and will added to Unit Fund Value. The Guaranteed Addition rates are given below:

Death Benefit in LIC’s Index Plus

Death Benefits will be paid if the policy is in force and the Life Assured dies before the Date of Maturity (including the Grace Period).

On death of the Life Assured before the Date of Commencement of Risk

If the Life Assured dies before the Date of Commencement of Risk, the Unit Fund Value on the date of death will be paid to the proposer.

On death of the Life Assured after the Date of Commencement of Risk

If the Life Assured dies after the Date of Commencement of Risk, the payout will be the highest of the following:

The basic Sum Assured is reduced by any Partial Withdrawals made in the two years preceding death;Unit Fund Value as of the date of intimation of the death of life assured or105% of the total premiums received up to the date of death are reduced by partial withdrawals made in the two years preceding death.

The admissible claim will be booked upon receipt of intimation of death and the death certificate. Mortality Charges, Accident Benefit Charges, Policy Administration charges, and Tax Charges recovered after the date of death will be added back to the Unit Fund.

Any Guaranteed Addition added to the policy after the date of death will be recovered from the Unit Fund.d

Partial Withdrawl in LIC’s Index Fund

Policyholders can make partial withdrawals of their units after the five-year lock-in period, starting from the policy commencement date. However, the following conditions apply:

For minors, partial withdrawals are only allowed once the Life Assured is 18 years or older. Partial withdrawals can be made in the form of a fixed amount or a fixed number of units.The maximum amount that can be withdrawn as a percentage of the fund during each policy year is subject to the following limits: Percentage of Partial withdrawal during various policy years.

Percentage of Partial withdrawal during various policy years.

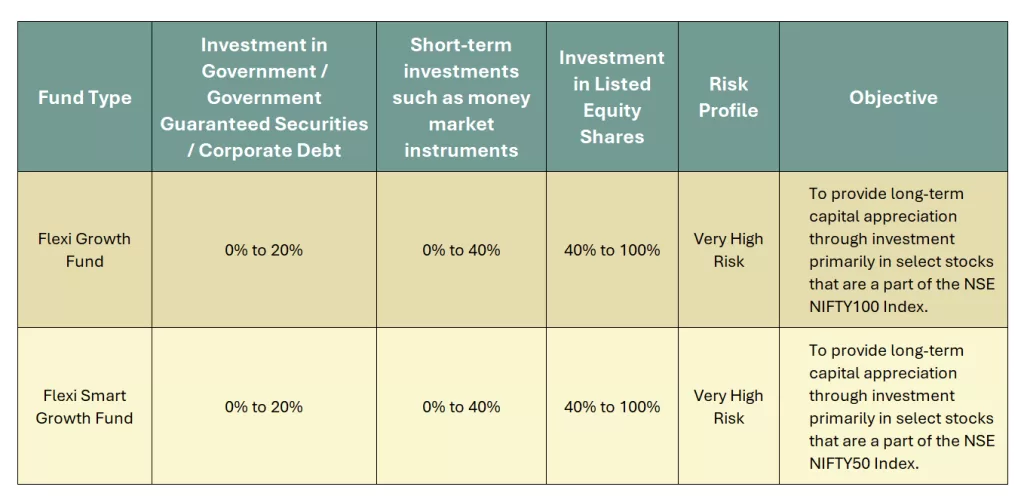

Investment Fund Types in LIC’s Index Plus

While purchasing the policy, the proposer can choose any of the two available funds in Index Plus. These funds are namely Flexi Smart Growth Fund and Flexi Growth Fund. Details of these funds and their broad investment pattern are given below:

Discontinued Policy Fund (SFIN: ULIF001201114LICDPFNLIF512):

This fund is a segregated unit fund consisting of discontinued policy funds from all unit-linked life insurance products. The investment Pattern of the Discontinued policy fund is

Money market instruments: 0% to 40%Government securities: 60% to 100%

Charges and Frequency of Charges

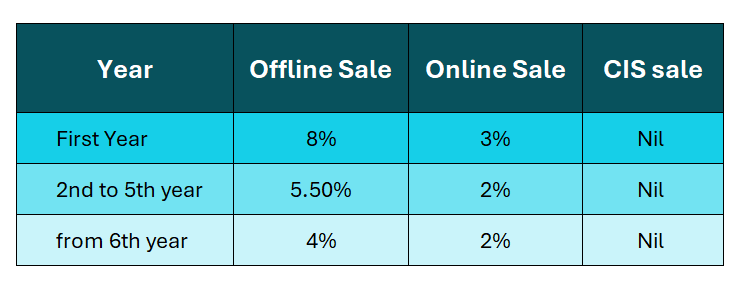

Premium Allocation Charges

A percentage of the premium is deducted toward the charges from the received premium. The premium allocation charges as a percentage of the instalment premium are given below:

Premium Allocation Charges in LIC’s Index Fund

Premium Allocation Charges in LIC’s Index Fund

Mortality Charges

A mortality charge is deducted from the Unit Fund every month to provide the risk cover in the policy. These charges will be deducted only when the Basic Sum Assured is greater than the Unit Fund value in the policy. Mortality Charges will not be deducted if the Unit Fund value exceeds the Basic Sum Assured.

Accident Benefit Charge

This charge is deducted from Unit Fund Value if the customer opts for the LIC’s Linked Accidental Death Benefit Rider. There will be no deduction if customers do not opt for the rider. The rate of the rider is Rs 0.40 per thousand sum assured.

Fund Management Charges

Fund management charges in ULIPs cover the cost of allocating your money into the funds of your choice. This charge is levied at the time of computation of NAV, which will be done daily. The NAV thus declared will be net of FMC. Fund management Charge in Index Plus is

1.35% per annum of Unit Fund in both the funds0.50% per annum in Discontinued Policy Fund.

Policy Administration Charge:

A charge known as the Policy Administration Charge will be applied at the start of every policy month beginning from the sixth policy year until the end of the policy term. This charge will be subject to a maximum of Rs 500 per month (equivalent to Rs 6000 per annum) and deducted from the Unit Fund Value by cancelling units for the corresponding month (i.e. Rs 6000 p.a.) from the Unit Fund Value by cancelling units for the equivalent amount.

Other Important Conditions in the LIC’s Index Plus

Lock-in Period:

There is a five-year lock-in period in the LIC’s Index Plus, similar to all the ULIP plans of LIC of India.

Switching:

switching is allowed in the Index Plus. The Life Assured can change the Fund type as per his risk appetite at any time during the policy term when the policy is in force. Four switches are free during a year, and thereafter, a fee of Rs. 100 will charged per switch of the fund.

Learn more about How to switch funds online in LIC ULIPs.

Surrender:

The policy can be surrendered at any time during the policy term. However, suppose the life assured surrender the policy during the locking period. In that case, the fund will shift to the Discontinued Policy Fund, and the fund value will be paid on the lock-in period’s completion. Discontinue Charges will be recovered from the unit fund.

If the life assured surrenders the policy after the lock-in period, then fund value will be paid to the life assured without any deduction. There are no discontinuation charges after the lock-in period.

Loan:

There is no loan facility in LIC’s Index Plus

Revival:

Policyholders can revive the policy within 3 years from the date of the first unpaid premium by paying all the due premiums. There will be no interest charged. However, all the charges will be recovered from the Unit Fund on revival.

Nomination and Assignment:

Nomination is compulsory as per Section 39 of the Insurance Act of 1938. Policyholders can assign the policy for valuable consideration as per Section 38 of the Insurance Act of 1938.

Back Dating:

Backdating is not allowed like all the ULIP plans of LIC of India.

Suicide Clause:

Suppose the life assured commits suicide within 12 months from the date of commencement of the policy or the date of the revival. In that case, only the Unit Fund value available in the policy will paid to the nominee.

Free Look Period:

If the policyholder is unhappy with the “Terms and Conditions” of their policy, they can return the policy to the LIC of India within 30 days of receiving the electronic or physical copy of the policy document, whichever is earlier. They should also state the reasons for their objection.

Proposal Form:

To download the proposal form of LIC’s Index Plus, Click Here.

If you have any other questions about LIC servicing, mail us at [email protected]. You can also comment below. Share if you liked this valuable information because Sharing is caring!

Disclaimer: This blog post is written based on the information available. In case of any discrepancy or the wrong information, please contact any authorized LIC agent or the nearest LIC office for clarification.