LIC’s New Plan Jeevan Azad (Plan No. 868)

LIC’s Jeevan Azad (Plan No. 868) is the name of the new life insurance plan of Life Insurance Corporation of India. Jeevan Azad is available for sale with effect from 19/01/2023. LIC’s Jeevan Azad is a Non-Linked, Non-Participating, Individual, Savings Life Insurance plan, limited Premium Endowment plan where the premium paying term is 8 years less than the policy term.

This plan is available only to standard lives. There will be no medical up to 300000 of the sum assured only Video Medical on SA above 300000. The Unique Identification Number (UIN) for LIC’s Jeevan Azad is 512N348V01.

Eligibility Conditions of LIC’s Jeevan Azad

Eligibility Conditions of LIC’s Jeevan Azad (Plan No. 868)

Eligibility Conditions of LIC’s Jeevan Azad (Plan No. 868)

Date of Commencement of Risk: In case the Life Assured is minor below the age of 8

years, the risk under this plan will commence either 2 years from the date of commencement of policy or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately from the date of issuance of the policy.

Death Benefit in LIC’s Jeevan Azad

If the Life Assured dies before the maturity date (and after the date of commencement of risk) of the policy, the Death benefit is payable. The death benefit in the policy will be equal to the “Sum Assured on Death”. Here

If the Life Assured dies before the maturity date (and after the date of commencement of risk) of the policy, the Death benefit is payable. The death benefit in the policy will be equal to the “Sum Assured on Death”. Here the “Sum Assured on Death” is defined as higher of Basic Sum Assured or 7 times of Annualized Premium.

Maturity Benefit in LIC’s Jeevan Azad

If the Life Assured survives till the Date of Maturity, “Sum Assured on Maturity” which is equal to “Basic Sum Assured” will be payable.

Optional Riders

Like other LIC endowment plans, Jeevan Azad offers riders along with the base plan on paying an additional premium. These three riders are:

LIC’s Accidental Death and Disability Benefit Rider UIN (512B209V02)

LIC’s New Term Assurance Rider (UIN 512B210V01)

LIC’s Premium Waiver Benefit Rider (UIN: 512B204V03)

Eligibility conditions for these riders are different than the base plan. Please consult your insurance advisor if you are eligible for these riders or not.

Riders are not available if you purchase this plan from Point of Sales Persons-Life Insurance (POSP-LI) or CPSC-SPV

Waiting Period

If the Jeevan Azad Plan is purchased through Point of Sales Persons-Life Insurance (POSP-LI) or CPSC-SPV then, on the death of the Life Assured within the first 90 days from the date of

commencement of risk, LIC will refund only the total premiums paid, provided the

policy is in force and death is not on account of an accident. However, in case of death due

to an accident during the waiting period, Death Benefit as specified under death benefit will be paid. This clause will not be applicable in case the age at entry of the Life Assured is

below 8 years.

Other conditions in LIC’s Jeevan Azad

Surrender: Surrender is allowed if the full 2 years of premiums are paid. On surrender of the policy, LIC will pay a higher of Guaranteed surrender value (GSV) or Special Surrender Value (SSV).

Loan: The loan will be available in Jeevan Azad after the policy acquires paid-up value i.e. after at least two full years of premiums have been paid. The maximum loan as a percentage of surrender value shall be: For in-force policies – up to 90% and For paid-up policies – up to 80%. The rate of interest will be according to the LIC of India declared from time to time.

Freelook period: Policyholder will get 30 days free look period.

Back Dating: Date backing is allowed but not before the date of launch of the product ie 19/01/2023.

Assignment and Nomination: Assignment and Nomination are allowed as per sections 38 and 39 of the Insurance Act 1938.

Suicide Clause: If the Life Assured (whether sane or insane) commits suicide at any time within 12 months from the date of commencement of risk, the nominee or beneficiary of the Life Assured shall be entitled to 80% of the Single Premium paid excluding any taxes, extra premium and rider premiums other than Term Assurance Rider, if any. The nominee or beneficiary of Life Assured shall not be entitled to any other claim under this policy

This plan is also available for online sale through the LIC of India website.

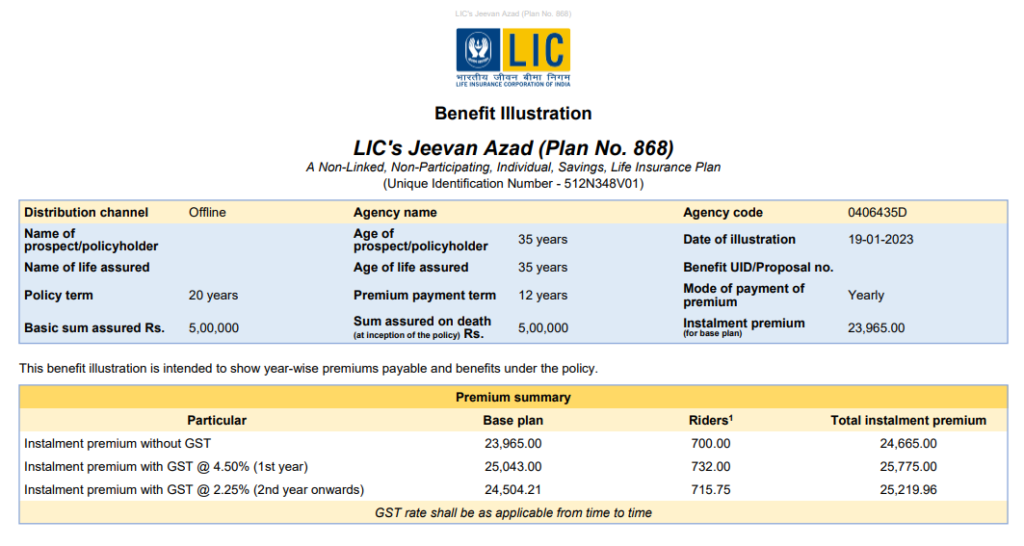

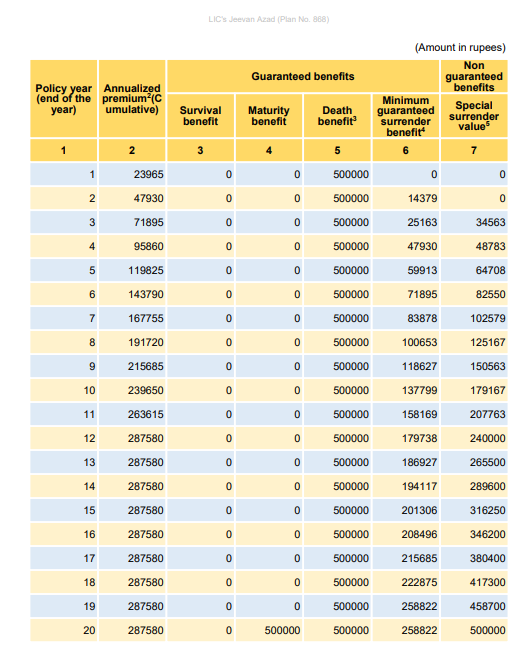

Benefit Illustration of Jeevan Azad

If you have any other questions related to LIC servicing then just mail us at info@sumassured.in. You can also comment below. Share if you liked this information useful because Sharing is caring!