LIC’s New Plan Dhan Varsha (Plan No. 866)

LIC’s Dhan Varsha (Plan No. 866) is the name of the new life insurance plan of Life Insurance Corporation of India. Dhan Varsha is available for sale with effect from 17/10/2022. It is a close-ended plan and will be available for sale up to 31/10/2023.

LIC’s Dhan Varsha is a Non-Linked, Non-Participating, Individual, Savings, Single Premium Life

Insurance plan which offers a combination of protection and savings. This plan provides financial support for the family in case of unfortunate death of the life assured during the policy term. It also provides a guaranteed lump sum amount on the date of maturity. The proposer will have two options to choose “Sum Assured on Death”. UIN for LIC’s Dhan Varsha Plan is 512N349V01.

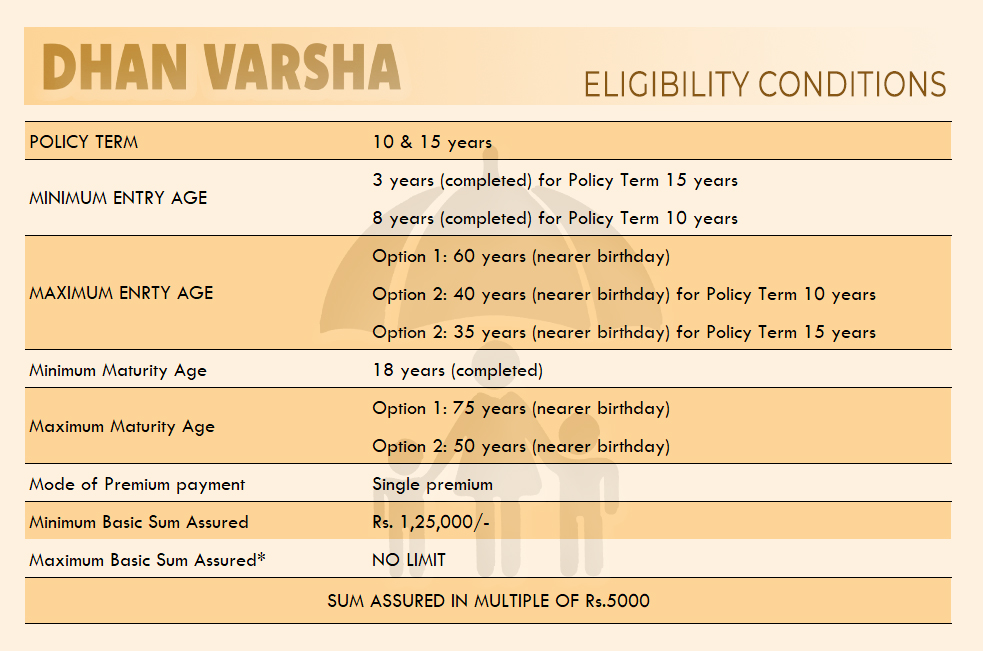

Eligibility Conditions of LIC’s Dhan Varsha

Eligibility Conditions of LIC’s Dhan Varsha (Plan No. 866)

Eligibility Conditions of LIC’s Dhan Varsha (Plan No. 866)

Date of Commencement of Risk: In case the Life Assured is minor below the age of 8

years, the risk under this plan will commence either 2 years from the date of commencement of policy or from the policy anniversary coinciding with or immediately following the attainment of 8 years of age, whichever is earlier. For those aged 8 years or more, risk will commence immediately from the date of issuance of the policy.

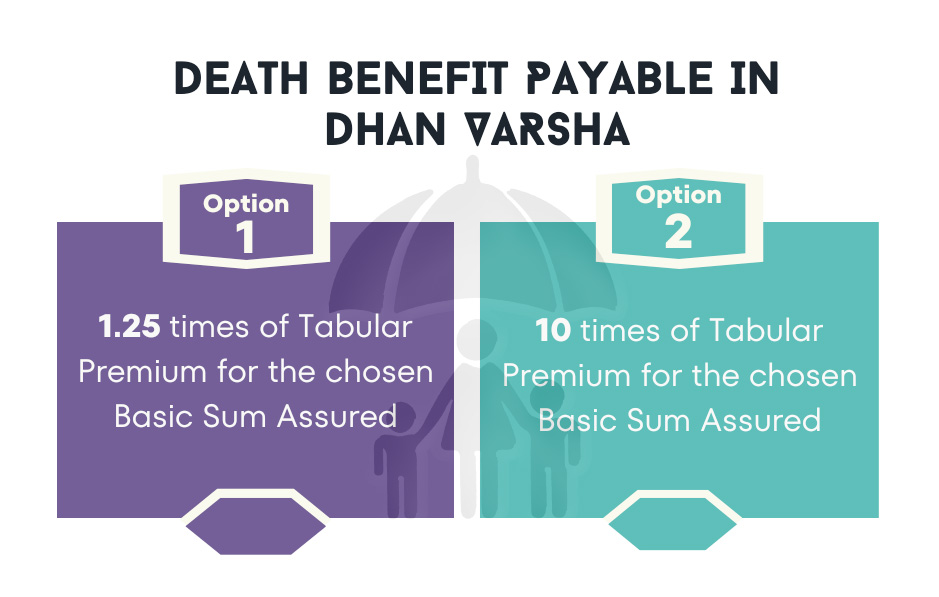

Options in LIC’s Dhan Varsha

The proposer will have two options to choose “Sum Assured on Death” in LIC’s Dhan Varsha. In Option 1, the proposer will have “Sum Assured on Death” equal to 1.25 times of tabular premium. Under Option 2, “Sum Assured on Death” will be equal to 10 times of the tabular premium.

Option 1: 1.25 times of Tabular Premium for the chosen Basic Sum Assured

Option 2: 10 times of Tabular Premium for the chosen Basic Sum Assured

The proposer has to choose one of the above-mentioned options at the proposal stage itself

subject to eligibility conditions. The premium and benefits will change according to the Option chosen and they cannot be changed later.

Death Benefit in LIC’s Dhan Varsha

If the Life Assured dies before the maturity date (and after the date of commencement of risk) in the policy Death benefit is payable. The death benefit in the policy will be equal to the “Sum Assured on Death” along with accrued Guaranteed Additions.

If in any life assured dies before the start of the risk in the policy (in case of a minor), only the premium is refunded excluding any extra premium, rider premium, and taxes.

Maturity Benefit in LIC’s Dhan Varsha

If the Life Assured survives till the Date of Maturity, “Basic Sum Assured” along with

accrued Guaranteed Additions will be payable.