LIC’s Amritbaal (874), a new child plan by LIC

Life Insurance Corporation of India has decided to launch a new children’s plan, Amritbaal (Plan No. 874), starting 17/02/2024. LIC’s Amritbaal is a non-linked, non-participating individual savings and life insurance plan. LIC’s Amritbaal is an Endowment Plan that provides Guaranteed Additions to various needs of children like higher education and others.

LIC’s Amritball has the Option of limited premium payment of 5, 6 or 7 years or, as Lumpsum, a single premium. The unique identification number for LIC’s Amritball is 512N365V01. This plan is also available for sale online through the LIC Website.

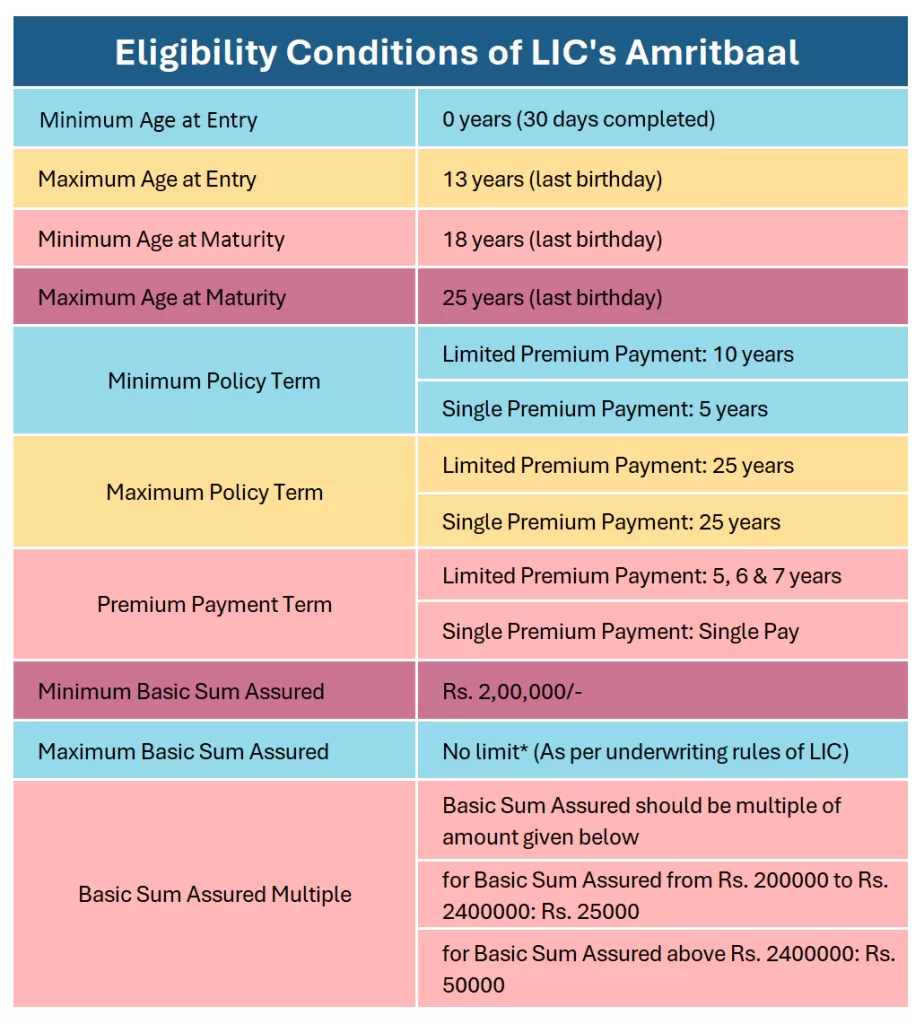

Eligibility Conditions of LIC’s Amritbaal

Mode of Premium Payment: Single, Yearly, Half-Yearly, Quarterly and Monthly (NACH and SSS)

Date of Commencement of Risk: For the life assured age below eight years, risk will commence after two years from the date of commencement of the policy or from the policy anniversary coinciding or just after attaining the age of 8 years. For the life assured aged above eight years, risk will commence immediately.

Date of Vesting of the Policy: The Policy will vest automatically in the name of the life assured from the policy anniversary coinciding or coming immediately after the life assured attains the age of 18.

Maturity Benefit in LIC’s Amritbaal

Policyholders who survive until the maturity date will receive the “Sum Assured on Maturity“, which is equal to the original basic sum assured plus any guaranteed additions earned on the in-force policy. To be eligible, the policy must still be active and not cashed out when the maturity date arrives.

Death Benefit in LIC’s Amritbaal

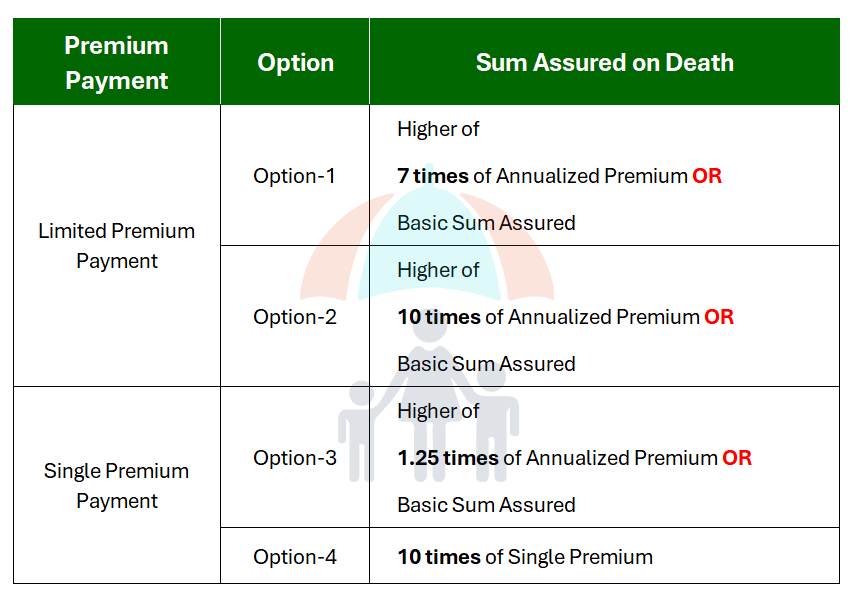

Proposers have the option to choose “Sum Assured on Death” from two options available under both Limited Premium and Single Premium plans. The proposer has to decide during the proposal stage and clearly state it in an addendum. Remember, your choice impacts your premium and payout; it can’t be changed once selected.

Death Benefit payable on the death of the Life Assured, during the policy term after the date of commencement of risk but before the stipulated date of maturity, provided the policy is in force, shall be “Sum Assured on Death” along with accrued Guaranteed Additions for in-force policy. Where “Sum Assured on Death” shall be as per the Option selected as detailed in the Table above.

If the life assured dies before the commencement of the risk in the policy, then the premium paid will be refunded to the proposer, excluding any tax or rider premium.

Guaranteed Addition in LIC’s Amritbaal

LIC’s Amritbaal offers “Guaranteed Additions,” which increase your payout over time. Here’s how they work:

Earning Additions: Every year, your policy automatically adds Rs. 80 per every Rs. 1,000 of your Sum Assured. This happens from the start of your policy until the end of its term. If the life assured dies during the policy term and the policy is inforce, the proposer/nominee will receive the whole year’s Guaranteed Addition, even if it hasn’t fully accrued yet. If you decide to cash out your policy early (surrender), you’ll get a portion of the Guaranteed Addition for the current year based on how long you held the policy that year.

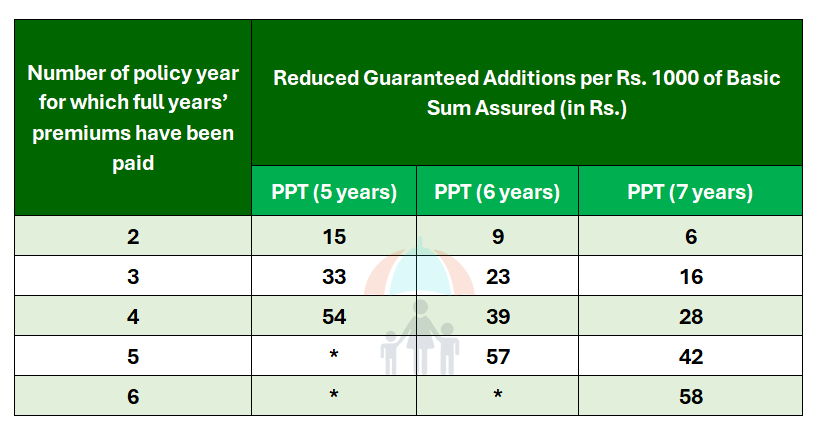

For the reduced paid-up policy, guaranteed addition will accrue with the reduced rate as given below.

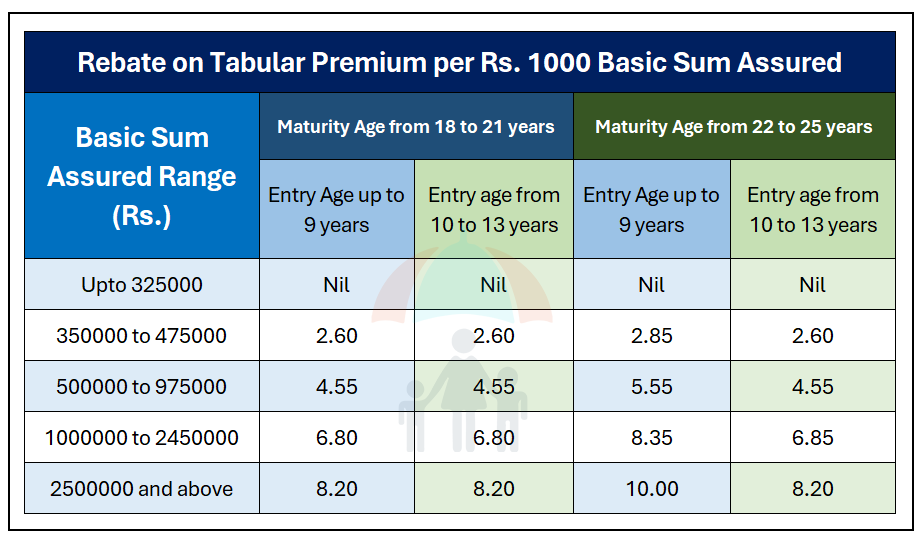

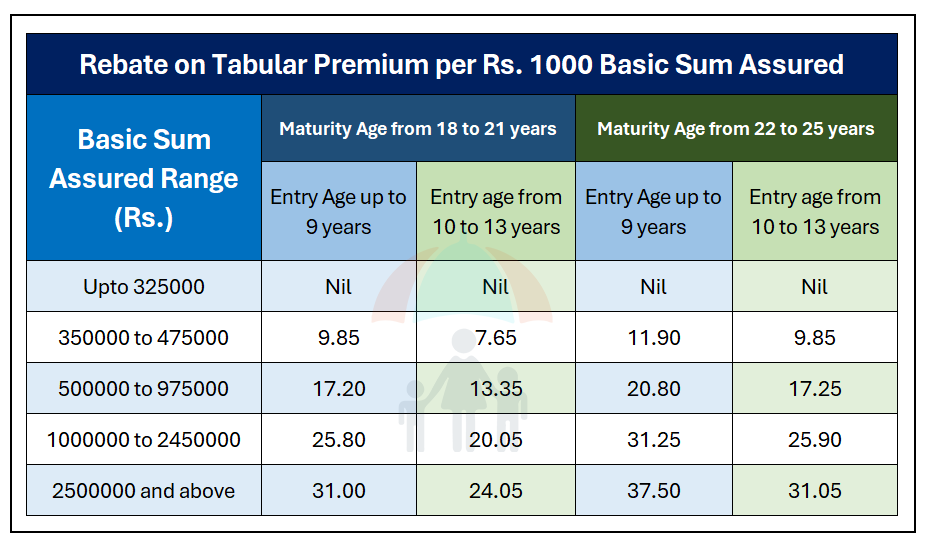

High Sum Assured Rebate in Amritbaal

Proposers who are opting for a higher sum assured will get a reduced premium due to the rebate offered by LIC of India. This rebate is based on age and policy terms of the policy other than the higher sum assured. Rebates shown below are given as a reduction in premium per thousand sum assured.

Rebate under limited premium payment option under options 1 and 2

Rebate under Limited Premium Payment (Under Option I & Option II)

Rebate under Limited Premium Payment (Under Option I & Option II)

Rebate under the Single premium payment option under options 3 and 4

Rebate under the Single premium payment option under options 3 and 4

Rebate under the Single premium payment option under options 3 and 4

Optional Benefit Available in LIC’s Amritbaal

LIC’s Premium Waiver Benefit Rider (UIN: 512B204V03) is available with LIC’s Amritbaal Plan. Proposers can opt for this rider if they are aged between 18 and 55 years (nearer birthday). However, cover of this rider will cease when the proposer attains the age of 70 (nearer birthday). The proposer can take this rider at any time during the premium payment term from the policy anniversary if the remaining premium payment term is five years.

In case of the death of the proposer during the premium paying term in the policy is in force, all the future premiums of the policy will be waived, and the policy will continue as it should be.

Other Important Conditions in the LIC’s Amritbaal

Surrender:

Under Limited Premium Payment (Option I & Option II), the policyholder can surrender the policy at any time during the policy term provided two full years’ premiums have been paid. Under Single Premium Payment (Option III & IV), the policy can be surrendered at any time during the policy term.

If the life assured surrenders the policy after the lock-in period, then fund value will be paid to the life assured without any deduction. There are no discontinuation charges after the lock-in period.

Loan:

Limited Premium Payment (Option I & II): You can take out a loan after paying premiums for at least 2 full years.

Single Premium Payment (Option III & IV): You can borrow any time after 3 months from when your policy is issued OR after the free-look period ends, whichever is later.

Revival:

Policyholders can revive the policy within 5 years of the first unpaid premium by paying all the due premiums.

Grace Period:

A grace period of 30 days is available for quarterly, half-yearly and yearly premium payment modes. A 15-day grace period will be available for the monthly mode option. If the premium is not paid within this period then the policy will lapse after the grace period.

ALTERATIONS:

The following alterations can be allowed in the LIC’s Amritbaal during the policy term on request of the proposer/life assured.

Any change not involving a change in Base premium rates and corresponding benefit structure.Reduction in term of the policy is subject to restrictions as per rules.The inclusion of LIC’s Premium Waiver Benefit Rider. Including a rider is not applicable in the case of a plan sold through POSP-LI/CPSC-SPV. Conditions regarding alterations will follow the instructions issued by LIC of India’s CRM/PS department.

Nomination and Assignment:

Nomination as per Section 39 of the Insurance Act of 1938. Policyholders can assign the policy for valuable consideration as per Section 38 of the Insurance Act of 1938. Nomination can only be done after the policy is vested in the name of the life assured. LIC of India will send an intimation to register the nomination in the policy after its vesting.

Back Dating:

Backdating is allowed within the same financial year, however, not before the plan’s launch date.

Suicide Clause:

Suppose the life assured commits suicide within 12 months from the date of commencement of the policy or the date of the revival. In that case, only the Unit Fund value available in the policy will paid to the nominee.

Free Look Period:

If the policyholder is unhappy with the “Terms and Conditions” of their policy, they can return the policy to the LIC of India within 30 days of receiving the electronic or physical copy of the policy document, whichever is earlier. They should also state the reasons for their objection.

If you have any other questions about LIC servicing, mail us at [email protected]. You can also comment below. Share if you liked this valuable information because Sharing is caring!

Disclaimer: This blog post is written based on the information available. In case of any discrepancy or the wrong information, please contact any authorized LIC agent or the nearest LIC office for clarification.