Liability insurance coverage: Everything you need to know

Liability insurance coverage: Everything you need to know | Insurance Business America

Guides

Liability insurance coverage: Everything you need to know

Liability insurance coverage comes in many forms and the key to getting the right policy is understanding how each one works. This guide can help

No business is entirely immune from lawsuits. Even with all the necessary safety precautions and risk management strategies in place, accidents and mistakes can still happen in your daily operations. And sometimes, even a single mishap can result in huge financial consequences for your company.

That’s why having liability insurance coverage is crucial for any business. This type of policy provides protection against claims of injuries and property damage that your company is legally liable for. But liability insurance comes in different forms and the key to getting the right protection is understanding the level of coverage each one offers.

This is what this client education piece aims to do. Here, Insurance Business explains how the different kinds of liability insurance policies work, so you can decide which types of coverage match your business’ needs. Read on and learn everything you need to know about liability insurance coverage in this guide.

Liability insurance is a broad type of coverage that refers to policies that protect your business against claims of bodily injury, property damage, and reputational harm resulting from your business activities. It covers legal and settlement costs arising from lawsuits, as well as medical payments.

Unlike other types of policies which compensate the policyholder, liability insurance coverage pays out third parties who file the claims.

The Insurance Information Institute (Triple-I) cited three conditions that must be met for a claim to be covered. These are:

1. It must be caused by an occurrence.

The institute defines an occurrence as an “accident, including continuous or repeated exposure to substantially the same harmful conditions.” In layman’s terms, it is an event that causes unintentional injury or property damage to a third party. The keyword here is “unintentional” as liability insurance doesn’t cover intentional harm.

2. It must happen within the coverage territory.

Coverage territory generally refers to the US, including its territories, and Canada. This means the injury or property damage must have occurred in these countries for the claim to be valid. There are certain scenarios, however, that can extend coverage to any part of the world, as long as the lawsuit is brought in the US. These include claims involving:

Products manufactured or sold in the US

Business-related activities of someone from your company while overseas

Personal injury or reputational harm resulting from your business’ online activities

3. It must occur during the policy period.

Liability insurance covers only injuries, property damage, and reputational harm that happen while the policy is active. While uncommon, businesses can also take out a policy called backdated liability insurance coverage. This protects against claims occurring before the plan was purchased.

Liability insurance policies come in two main forms, depending on the level of coverage:

Occurrence policies: Cover businesses against claims that happen while the policy is in force, regardless of when the claim is filed

Claims-made policies: Protect companies against claims that occur while the policy is in force, regardless of when the incident occurred

Another element that businesses need to pay attention to when purchasing liability insurance coverage is the policy limit, which also comes in two types:

Per-occurrence limit: The maximum amount an insurance company will pay out for a single claim

Aggregate limit: The maximum amount an insurer will pay out in a year

Depending on the kind of coverage, per-occurrence limits are typically capped at $1 million, while aggregate limits are usually pegged at $2 million. These figures can be adjusted based on the needs of your business.

There are several types of liability insurance policies that businesses can access, each offering different forms of protection. Here are the most common types of coverage that businesses in the US purchase:

1. General liability insurance

General liability insurance – sometimes called business liability or public liability insurance – covers claims of bodily injury or property damage resulting from your business activities. It may also provide coverage for copyright infringement and incidents that cause reputational harm such as libel and slander.

Some policies include product liability coverage, which protects against claims resulting from a product you manufacture or sell.

General liability insurance is often packaged with commercial property insurance in a business owner’s policy (BOP). This is a type of business policy available only to enterprises with fewer than 100 employees and revenue below $1 million.

This form of coverage isn’t legally required for your business to operate in the country. Some clients, stakeholders, and suppliers, however, may make general liability coverage a condition for doing business with you.

Premiums for this type of policy are determined using a range of variables. If you want to understand the math behind how general liability insurance cost is calculated, feel free to click on the link.

2. Professional liability insurance

Professional liability insurance is not always legally required but it is an essential form of coverage for many businesses, especially those that provide advisory or expert services. Also called errors and omissions (E&O) or malpractice insurance, this type of policy covers legal and settlement costs resulting from service-related mistakes and oversights, including:

Inaccurate advice

Misrepresentation

Negligence

Breach of contract

Unfinished work

Budget overruns

Personal injury such as libel or slander

Professional liability insurance covers all your staff and the business itself.

Businesses in certain industries are required, either by law or industry standards, to purchase this type of coverage. Some clients may also require a professional or a company to carry professional liability coverage before agreeing to do business.

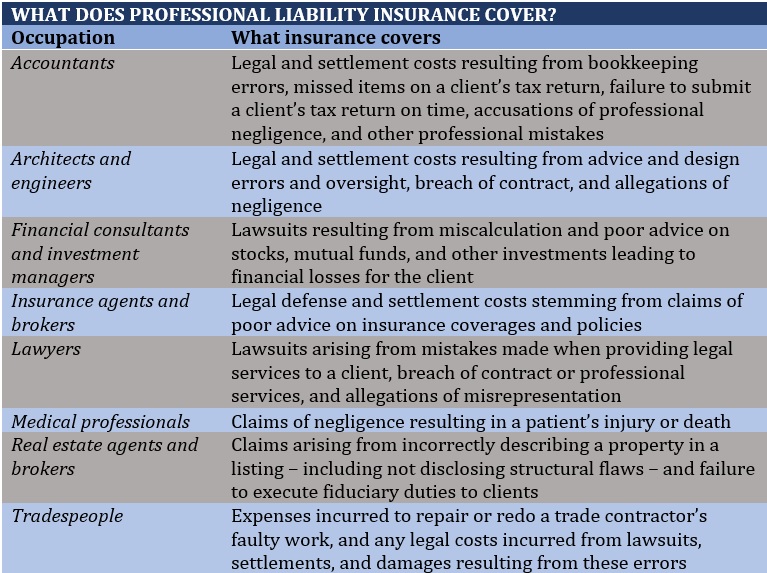

The table below lists down some occupations that need professional liability insurance, as well as the level of coverage it provides.

3. Product liability insurance

If your business sells, manufactures, and designs products, then product liability insurance coverage may be worth considering. This type of policy will protect your company against lawsuits from clients claiming injuries or losses because of your product. It covers legal defense costs and third-party compensation if your business is found to be at-fault.

4. Directors’ and officers’ (D&O) insurance

Mostly designed for large companies, D&O insurance protects the directors and senior management of a business against financial losses resulting from business-related lawsuits. Also known as D&O liability insurance, this type of policy provides coverage for the monetary losses arising from such legal actions, including defense costs, fines, and settlements.

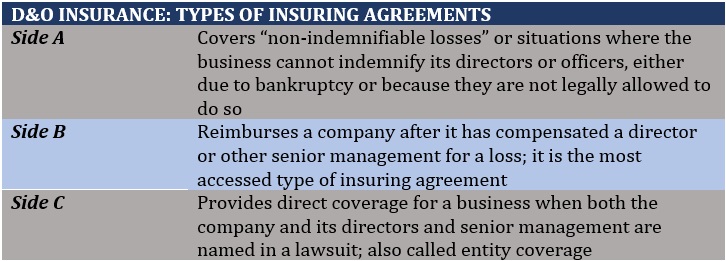

D&O liability insurance coverage comes in three main types, which are also called insuring agreements or sides. Each offers a different level of protection detailed in the table below.

5. Commercial auto insurance

Commercial auto insurance is designed for vehicles driven for business purposes. In terms of protection, it works like private car insurance but covers mainly company vehicles and commercial trucks and vans.

Depending on the state, motorists are often required to take out minimum liability insurance coverage consisting of:

Bodily injury (BI) liability: Covers third-party bodily injury and legal fees if the driver is sued over an at-fault accident

Property damage (PD) liability: Pays out for property damage and legal costs if the motorist is sued over an at-fault accident

6. Cyber liability insurance

Also called third-party coverage, cyber liability insurance protects your business against lawsuits filed by clients, vendors, and even employees for damages caused by a cyberattack. This type of policy covers court and settlement fees, and regulatory fines.

7. Commercial umbrella liability insurance

Also called excess liability insurance coverage, this type of policy provides an extra layer of financial protection by covering losses that exceed your coverage limits. Umbrella liability insurance complements certain types of liability coverage – including general liability and commercial auto insurance – by taking over the cost once the maximum limits are reached.

If your business, for instance, is found to be liable for a customer’s injury and is sued for $1.5 million but your liability insurance coverage is capped at $1 million, then a commercial umbrella policy can cover the $500,000 shortfall.

Because liability insurance policies provide vastly different levels of protection, it is also difficult to come up with a one-size-fits-all estimate of how much coverage costs. The table below provides a breakdown of the different types of liability insurance coverage businesses commonly purchase, along with the average costs based on various price comparison and insurer websites Insurance Business checked out.

Liability insurance coverage cost – breakdown by policy type

HOW MUCH DOES LIABILITY INSURANCE COVERAGE COST?

Type of policy

Average monthly premiums

Average annual premiums

General liability insurance

$40 to $55

$480 to $660

Professional liability insurance

$50 to $60

$600 to $720

Product liability insurance

$30 to $60

$360 to $720

D&O liability insurance

$100 to $140

$1,200 to $1,680

Commercial auto insurance

About $150

About $1,800

Cyber liability insurance

(including first-party coverage)

$140 to $150

$1,680 to $1,800

Commercial umbrella insurance

$40 to $75

$480 to $900

These numbers are just estimates. Your actual premiums can be significantly lower or higher, depending on your business’ unique set of needs.

There is no degree of caution that can make your business entirely unsusceptible to lawsuits. Mistakes and accidents can lead to costly injuries and property damage. Depending on the severity of harm, a single lawsuit can put your company in a dire financial situation.

While many types of liability insurance coverage are not mandatory, it pays to have some level of protection if unforeseen incidents occur. Some policies may cost more than others. However, considering the level of protection they offer, the premiums you pay may spell the difference between sustaining your operations and shutting down.

Liability insurance is among the most common forms of coverage businesses purchase. If you want to know how the different types of business policies can help you navigate challenging situations, you can check out our comprehensive guide to business insurance.

Do you think liability insurance coverage is a worthwhile investment? Can your business survive without one? We’d love to see your comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!