Layering Life Insurance Policies – The White Coat Investor

[Editor’s Note: Yes, the Physician Wellness and Financial Literacy Hybrid Conference (WCICON22) has begun. But it’s definitely not too late for you to join us virtually! When you do, you’ll have lifetime access to the 50-plus hours of presentations, and you can participate in live Q&As, sponsor giveaways, and session chats. You’ll also be eligible for up to 17 hours of CME! Make an investment in yourself and sign up for the virtual version of WCICON22 today.]

By Seth Burstein, Guest Writer

One day, I was thinking about my life and realized enough people were financially dependent on me that getting a life insurance policy was a responsible step to take. I was married with a beautiful baby girl, and I had just bought a house in the suburbs. I decided it would be a good idea to make sure everyone was provided for should something go seriously awry.

I am an actuary, so I know more about this stuff than most people, but I am not a life insurance actuary (I worked on things like homeowners’ insurance and workers’ comp). Anyway, I called an insurance agent and asked her to advise me on the best policy. “Do you have a mortgage?” she asked. I did. Then, the best option was a 30-year policy to cover the mortgage, a little extra for expenses, and to send the kid(s) to college. The policy didn’t seem too expensive and I was a bit sleep-deprived, so, without much thought, I bought it. It was a mistake.

I didn’t think about the policy for years. Then, on the eve of an operation, I was tidying up my finances with my wife and remembered the life insurance policy. How much was the payout? I looked it up—and promptly figured out I hadn’t made the best decision.

Overinsured or Underinsured? Depends on When the Death Benefit is Paid Out

Here’s what I realized: if I died near the end of the 30-year term when all my retirement savings were in place, the mortgage was (nearly) paid off, and my kids were finished with college, then the death benefit would be largely, if not entirely, an unnecessary windfall. But if I died tomorrow, it would not be nearly enough to replace all the income and earnings from investments I would create in the next 25 years. In the first scenario, I was overinsured. In the second, I was underinsured.

Why had I bought this one policy that wasn’t right for now but also wasn’t right for later? This is a mistake many people make, but, as an actuary, I felt I should have known better.

Good news: the operation went fine, but it was time to rethink how I had structured my life insurance coverage. When I thought about it, I came to the conclusion I needed lots of coverage in the short term in case I died and my family had a pressing need to replace my income. Thankfully, still being healthy and relatively young, this coverage was somewhat inexpensive. Then, as the need for coverage diminished, the policies could taper off. In fact, what I really needed was a series of layered or laddered policies.

What do I mean by this? Let’s look at some math and some graphs to illustrate

Note that for the purposes of my illustration, in all scenarios below, you are a healthy 35-year old male who makes $100,00 a year, gets taxed at 25%, gets a 2% raise every year, and plans to retire at 65. Any investment you or your spouse make yields an annual return of 5%.

How to Layer Your Life Insurance Policies

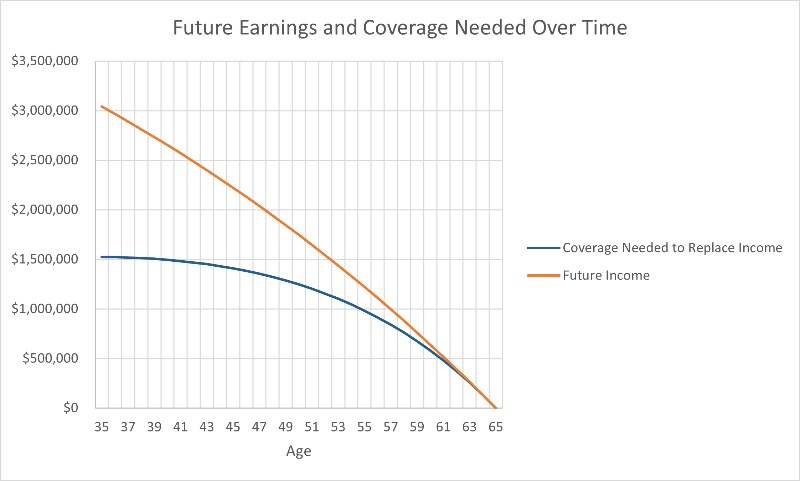

Before we dive in, be aware that, even if your goal is to replace all of your future income, you do not need your life insurance payout to equal the sum of all future earnings. The payout will be less, because, received as a lump sum upfront, it will earn interest over time. In the graph below, the orange line represents the sum of all future earnings. The blue line represents how much would need to be paid in a lump sum to replace the sum of future earnings—a substantially lower number in the early years.

[Editor’s Note: you can click on all the graphs below to get a larger view.]

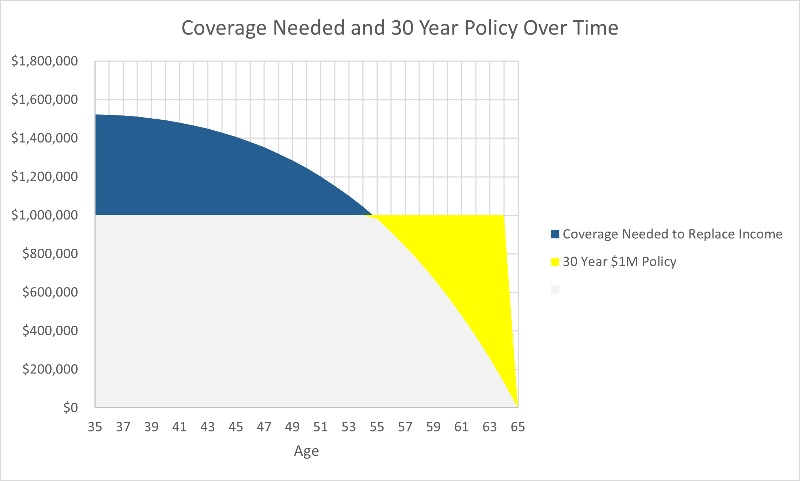

Scenario 1: If You Had to Purchase One 30-Year Life Insurance Policy

Let’s say your agent is trying to align you to your mortgage and strongly suggests a singular 30-year policy, as mine did.

In this scenario, a $1 million policy is the optimal choice. It would cost you about $1,000 a year, with the total cost amounting to about $30,000 over time. On average, you would be $420,894 under or overinsured, with age 54 being the dividing line—that’s huge! In the graph above, the blue area represents the amount by which you are underinsured and the yellow area represents the area by which you are overinsured. This is a pretty typical policy. As you can see, however, it’s also not at all a good fit to replace your income.

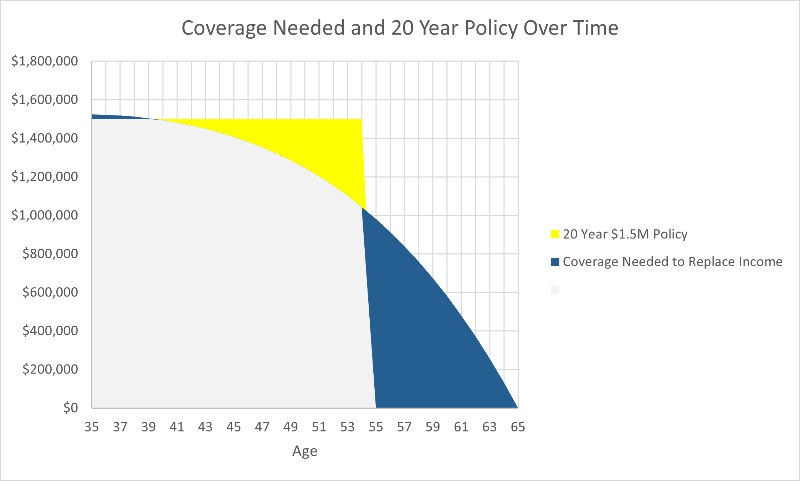

Scenario 2: If You Had to Purchase a Single-Level Benefit Life Insurance Policy

In this scenario, you are also purchasing term life insurance that pays out the same death benefit no matter when you expire, but you get to choose the term. What’s the “best” option?

The optimal choice if you can buy only one—but any term—life insurance is a $1.5 million 20-year policy. This policy would run you about $900 a year, with the total cost coming to $18,000. On average, you would be $300,798 under or overinsured depending on what side of 54 years old you are on. Still not great, but, compared to Scenario 1, this is a 29% “better fit” for your needs, and it costs 40% less.

Now, truth be told, if you passed away right after your policy expired, it wouldn’t be great. But please note that this simplified model doesn’t take into account retirement savings—which obviously would lighten the burden, as you would no longer need those funds.

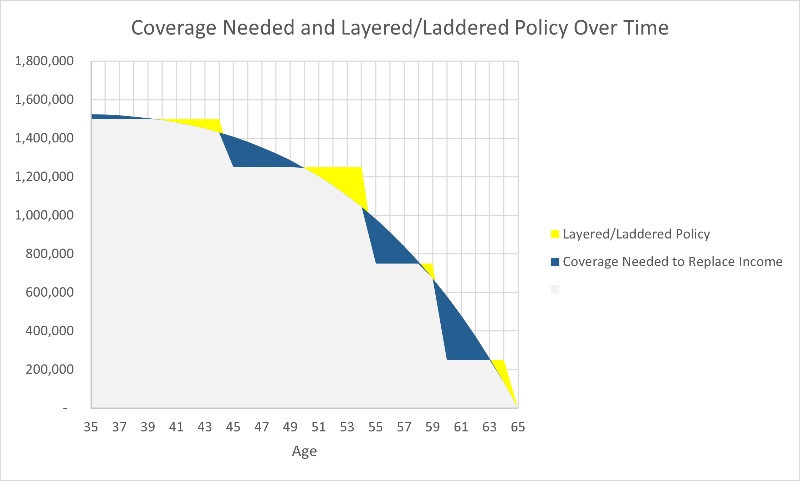

Scenario 3: You Are Able to Ladder Life Insurance Policies to Your Heart’s Content

This is where the math gets fun.

The optimal structure for this scenario is that you purchase four concurrent term life insurance policies: a $250,000 10-year policy, a $500,000 20-year policy, a $500,000 25-year policy, and a $250,000 30-year policy. The coverage resulting from this setup would be: $1.5 million for 10 years, $1.25 million for 20 years, $750,000 for 25 years, and $250,000 for 30 years.

See how layering your life insurance policies can work?

In terms of cost, your first year is going to run you about $1,100, going down to about $270 in the last five years. The total cost for all the laddered policies would come to roughly $26,000. That being said, on average, you would be underinsured or overinsured by only $95,203 throughout the lifetime of the policy. Compared to the first scenario, this is a 77% “better fit” for your needs—not bad! And it will also cost you ~20% less—double bonus!

Can You Have Multiple Life Insurance Policies?

Thankfully, laddering life insurance policies is an option, but it’s a pain for most agents. So you have to ask directly (why would they want to do four times the paperwork for the same amount of commission?). It can also be inconvenient because you have less disposable income when you’re young to throw around on things like life insurance; however, these policies are surprisingly affordable. As we saw in our example, a 10% increase in price could lead to a 50% increase in coverage in the early years of the policy, when your family would need it most should the unlikely become a reality.

So, if you are considering getting life insurance or if you recently fell into the 30-year policy trap like I did, give your insurance agent a call today and ask them about layering or laddering life insurance policies. Your single-term policy is an inefficient use of your resources, but laddering creates a scenario that is both effective and efficient for the best possible outcome.

Have more questions about life insurance and what kind of policies would be the best for you? Hire a WCI-vetted professional to help you sort it out.

Have you thought about layering life insurance policies? If so, what would be your strategy? How many would you get and for how much? Comment below!

[Editor’s Note: Seth Burstein loves numbers, optimization, and personal finance, all of which led him to co-found Fortunately.io—a tool that uses data to provide simple answers to challenging personal finance questions. This article was submitted and approved according to our Guest Post Policy. We have no financial relationship.]