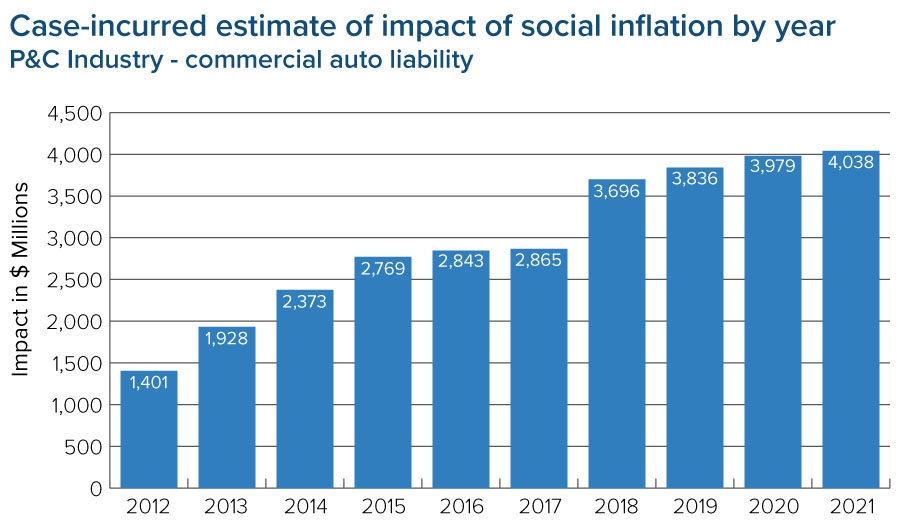

Latest Research on Social Inflation in Commercial Auto Liability Reveals a $30bn Increase in Claims

Social inflation contributed to a $30 billion increase in commercial auto liability claims between 2012 and 2021, according to updated research published by the Insurance Information Institute (Triple-I), in partnership with the Casualty Actuarial Society (CAS). Most of the increase for the total review period is attributable to the newly added years 2020 and 2021 to the data set.

Findings from the research paper, Social Inflation and Loss Development–An Update, suggest that while other factors may be in play, social inflation could be responsible for driving losses over the past 10 years up by as much as 18-20%. Results also indicate that social inflation, as a loss driver, may be outpacing inflation in the overall economy by 2 to 3% per year. The actuarial models in the paper assume that exposure in commercial auto liability grows in the long term at the same rate as the overall economy. The updated research supports the conversation that Triple-I and its industry partners have fostered over recent years to increase awareness about the phenomena and encourage solutions. Both social inflation Triple-I/CAS papers were authored by actuaries James Lynch and David Moore.

Tracing the wake of social inflation in commercial auto liability

Analysts in every industry may rely on economic indicators and established quantitative methodologies to adapt to cost increases caused by general inflation in the economy. According to the definition cited as the basis for the paper, the expansive scope of social inflation can pose a more complex challenge for insurers as it can include “all ways in which insurers’ claims costs rise over and above general economic inflation, including shifts in societal preferences over who is best placed to absorb risk.” The impact of some potential factors, such as increasing lawsuit verdicts and extended litigation, can be dynamic and hard to forecast, making effective risk mitigation tactics difficult.

Still, insurers must aim to offset increasing claim costs, and that effort can include finding a way to outline the footprint of social inflation. Thus, rather than attempting to deconstruct the components of social inflation, this update to the 2022 CAS-Triple I collaboration continues to zero in on tracking evidence of it, ascertaining the potential influence on losses over time, and potentially finding clues that may link back to the culprits. Accordingly, the research stays focused on the claim size and reviews the increase in loss development factors over time.

Research raises questions, highlights a new emerging reality

As with many industries, the COVID-19 pandemic challenges longstanding methodologies and conventional forecasting assumptions. Claim frequency, in relation to the overall economy, decreased sharply in 2020 and remained flat in 2021, even though driving appears to have returned to pre-pandemic levels. However, severity appears to have increased significantly.

Enter loss triangles – a conventional actuarial tool that can enable comparison of loss metrics across years and see how losses develop over time. As in last year’s paper, researchers used this tool to examine the loss development patterns of net paid loss and defense and containment costs (DCC). Analysis suggests that whereas the pandemic may have dramatically impeded the ability to file new litigation for a brief period, it may also have created more enduring repercussions by hampering the timely and, thus, more cost-effective settlement of outstanding claims.

Even as social inflation amplifies losses for commercial auto liability, existing methods to pinpoint where general inflation ends and social inflation begins may become less dependable. In addition to covering the pandemic shocks of the shutdown, the newly added data spanned into the economic recovery and was impacted by much of what came with it – demand booms, stressed supply and labor resources, and, of course, the eventual soaring of the Consumer Price Index (CPI) for all urban consumers. In 2021, the CPI increased by a formidable 4.7 percent, the fastest inflation growth rate this century. These and other changes in the economic environment may have dampened the effectiveness of the testing and modeling framework. In any case, calculations for loss emergence revealed that for the first time in a decade, actual emergence was less than expected emergence in 2020 and 2021, reversing observations made in the previous paper about the reliability of conventional actuarial estimates.

The importance of understanding social inflation

It’s important to remember that although insurers are often called upon to help businesses and communities bounce back from natural disasters or other unexpected events, social inflation is arguably a human-made crisis that already looms large in the marketplace. A 2020 study by the American Transportation Research Institute found that, from 2010 to 2018, the size of jury verdict awards grew 33 percent annually, as overall inflation grew by 1.7 percent each year within this same timeframe and healthcare costs increased by 2.9 percent.

As losses grow much faster than premiums, insurers can resort to any combination of methods to contain costs, including limiting the amount of coverage offered, increasing premiums, or discontinuing certain types of coverage. For policyholders that need to mitigate their commercial auto liability exposure, expensive coverage or lack of coverage can threaten the ability to stay competitive or even remain in operation, particularly for those in tight-margin industries.

Unprecedented times call for new ways of collecting and reviewing claims data. The paper relies on new ways of using old-school methods and discusses how the reliability for some metrics could be improved by utilizing other data sources. A paper by the same researchers included similar observations for the medical malpractice liability sector. Key takeaways from the findings of these papers, along with an emerging body of research on social inflation, can be helpful in exploring actionable strategies, such as curbing lengthy litigation.

For a quick summary of social inflation and other helpful resources about its potential impact on insurers, policyholders, and the economy, check out our knowledge hub, Social inflation: hard to measure, important to understand.