Lahaina, Maui fire insured property loss estimated ~$3.2bn by KCC

Insured property losses from the wildfire that devastated the Maui town of Lahaina in Hawaii have been estimated at around $3.2 billion by catastrophe risk modelling specialist Karen Clark & Company.

Karen Clark & Company had previously said that the insured loss from the fire would likely become the second largest disaster loss in Hawaii history, second only to Hurricane Iniki based on today’s property value.

As we explained yesterday, the 1992 storm Hurricane Iniki was estimated to have caused around $3.1 billion in damages, equivalent to $6 billion as of 2022 values and currency, while it was estimated at the time to have resulted in a $1.6 billion insurance market loss, which we said likely extrapolates out to roughly $3 billion at today’s values.

Now, KCC has issued its initial insurance and reinsurance market loss estimate, pegging the total at around $3.2 billion.

In our report from yesterday, we highlighted two other early loss estimates, Moody’s which said the Lahaina wildfire would drive an insurance industry loss of above $1 billion, and analysts at RBC that said it could be as much as $3 billion.

A day earlier we had reported that the rebuilding cost for the wildfire in Lahaina had been estimated at $5.52 billion, with 2,207 structures reported to have been destroyed.

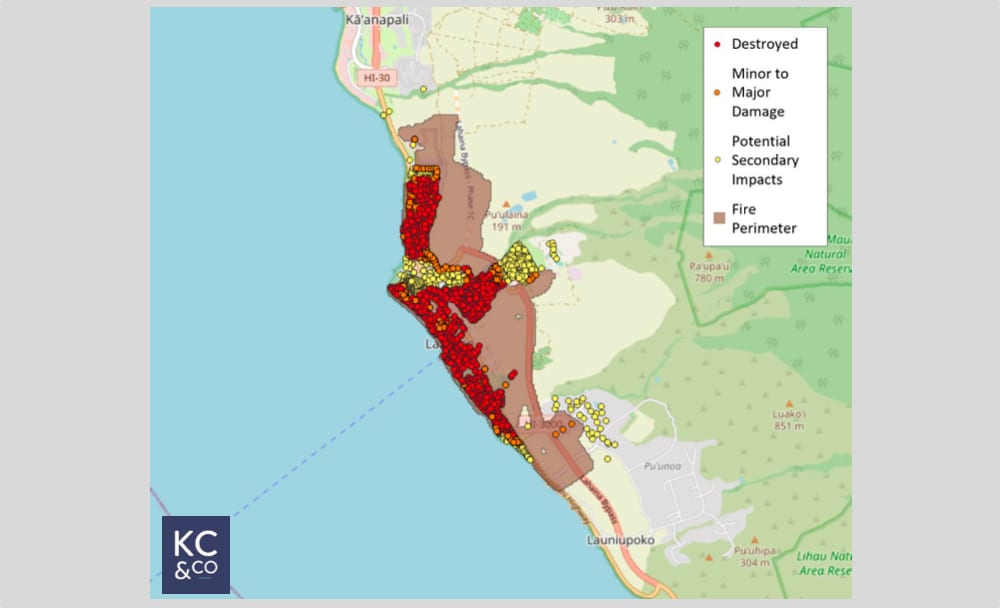

KCC said that an independent geo-spatial analysis of satellite and aerial imagery suggests more than 2,200 structures fell within the Lahaina fire perimeter, while more than 3,000 total structures were likely impacted by the fire, including secondary impacts such as branding and smoke.

“The majority of damaged structures were residential buildings, though many commercial buildings were damaged as well. The high proportion of wood frame and older construction present in the Lahaina building inventory likely contributed to the high damageability rates observed in the fire,” KCC said.

While low humidity and drought had primed the region for wildfires, hurricane Dora’s passage to the south of Hawaii and a high pressure system to the north created a pressure gradient that resulted in high winds that helped fires spread quickly.

KCC also said that, “In Hawaii, the dry season is becoming hotter and drier due to climate change, which leaves the state more vulnerable to brush fires and wildfires.”

As we also reported yesterday, reinsurance layers look set to respond in some cases at least, with Hallmark Financial one company that suggested it expects its reinsurance layers will kick-in, as it said its maximum exposure to the Maui wildfire would be capped by the protection.

At an industry loss of around the $3 billion level, impacts to the insurance-linked securities (ILS) market are expected to be largely constrained to aggregate erosion in the catastrophe bond market, as well as erosion to certain other aggregate protections where ILS funds have participated on a collateralized reinsurance basis.

Direct losses seem likely to be minimal for the ILS market, at this time.