Japan hit by magnitude 7.6 earthquake, structural damage and tsunami reported

Japan has started the new year with a damaging magnitude 7.6 earthquake that hit the Noto peninsula region of Ishikawa prefecture today, with widespread reports of damage, the first major tsunami warning since 2011 and thousands of people evacuated from the coast.

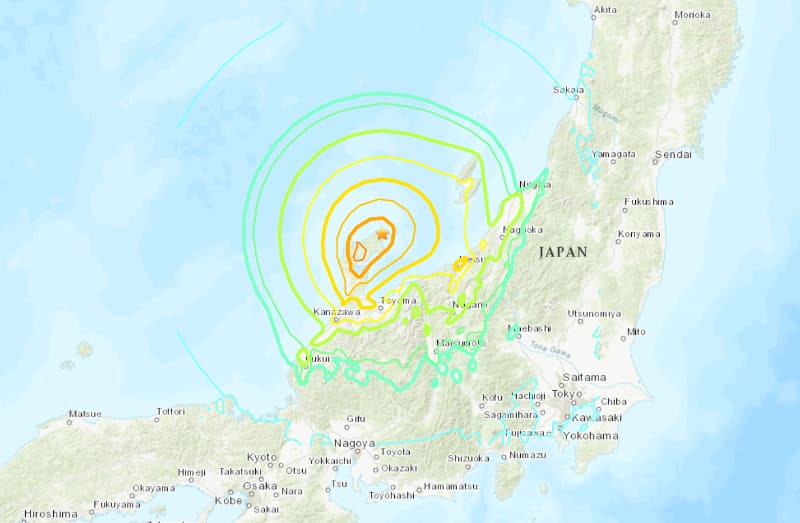

The earthquake struck at a very shallow depth at 16.10 pm local time (07.10 UTC), according to the Japanese Meteorological Agency (JMA) and at magnitude 7.6 is the strongest quake recorded in the Noto peninsula region of Ishikawa since 1885. The USGS currently has the quake measured at M 7.5.

A series of earthquakes stronger than magnitude 4 has now occurred over the last few hours, but the immediate concern was for the potential for a major tsunami event from the M 7.6 event, with warnings suggesting waves of up to 5 metres were possible along areas of the western coastline of Japan.

So far though, the largest tsunami waves reported have been around 1 metre in Ishikawa prefecture, while warnings are still in place for Niigate and Toyama coastal areas we well. The tsunami warning in Japan has now been downgraded, so is no longer cited as “major”.

Further afield, South Korea has reported small tsunami waves of around 1.5 foot, while both North Korea and Russia have also issued tsunami warnings for their coasts.

Property damage has been reported, with a number of people said trapped by falling rubble and images show significant damage to roads that have cracked in the areas worst affected by shaking, which authorities said reached Shindo 7, the strongest rating for a quake on Japan’s official scale.

A large fire has been reported burning in the city of Wajima in Ishikawa, which is in the area of the Noto peninsula worst affected by the quake and home to around 13,000 households.

At least 30 buildings are reported to have collapsed in Ishikawa so far, a local fire department in Wajima city said. That figure is expected to rise.

Monday’s earthquake was felt widely, with buildings swaying in Tokyo and some damage reported in cities further away from the epicentre such as Kaga, home to almost 30,000 households.

Authorities have said there are no irregularities at nuclear power plants in the region, although utility firm Kansai Electric said it was monitoring one of its nuclear plants in the region to assess whether any damage has occurred.

Japanese earthquake risk is a peril in the catastrophe bond market and at this time roughly $1.4 billion of cat bond risk capital outstanding is directly exposed to Japanese quake loss events.

Details of Japan earthquake cat bonds can be found here. Additional Japanese earthquake exposure is found in a number of international and regional multi-peril cat bond deals as well.

At this time it is impossible to speculate on the eventual cost to the insurance and perhaps reinsurance industry, given the recency of this earthquake in Japan.

The imagery coming out of Japan would suggest a reasonable amount of damage, but perhaps not at the level that would trouble any higher-layer reinsurance arrangements such as catastrophe bonds, at this stage.

Losses are assured for primary insurance exposure, with property damage reported and structural damage seen across a relatively wide area of the western region of Japan that has been most affected.

The USGS pager system currently gives a 39% chance economic losses fall between US $100 million and US $1 billion, but a 25% chance they fall above that, up to US $10 billion and a 7% chance they could rise above that level.

Japanese earthquake insurance costs have been rising in recent years and Japanese catastrophe reinsurance renewals saw material hardening in 2023.

In addition, there has been increased reinsurance buying in Japan over the last year or two, as cedents dealt with growing exposure and price inflation, meaning that Japanese domestic non-life insurance companies have strengthened their protection, with support from reinsurance markets, including in some cases capacity from the capital markets and insurance-linked securities (ILS) funds.

Japan also sees a reasonable amount of parametric earthquake insurance traded as well, although these contracts are more typically focused on larger cities across the country.

Now, with a significant earthquake to begin 2024, should the eventual industry loss prove significant enough to attach any reinsurance layers, this could play into the renewal market dynamic at April 1st when most Japanese catastrophe reinsurance programs are renewed.