It’s the New Model Year: What is the New “Standard Equipment” for L&AH Insurers?

Published on

September 28, 2023

In August and September, auto manufacturers traditionally begin selling the next year’s models. The practice started in 1936 when Franklin Delano Roosevelt asked auto manufacturers to adjust their annual factory retooling schedule to keep auto workers working during the holiday seasons. It was meant as an economic stimulus.

In most model years, you don’t see many changes. We see the automotive tweaks with a few angles and a few new styles — big changes are few and far between. Interior touchscreens are getting larger. Smart device options are growing. Data gathering is also growing.

For cars, the big change in 2024 will be that many more models will be electric or hybrid, with some very famous nameplates beginning to offer electric versions. Volkswagen is soon to come out with a new electric Vanagon in the US. A Corvette hybrid is on the horizon, using electric power for faster acceleration. Cadillac is adding to its EV lineup with the Celestiq. While electric vehicles aren’t expected to take over the market very soon, it’s clear that many auto manufacturers are shifting gears.

It’s a new model year for insurance, too. Insurers are in the midst of a tremendous shift that will require not only retooling systems but mindsets as well. It is a necessary reconfiguring for insurers that wish to retain and grow market share.

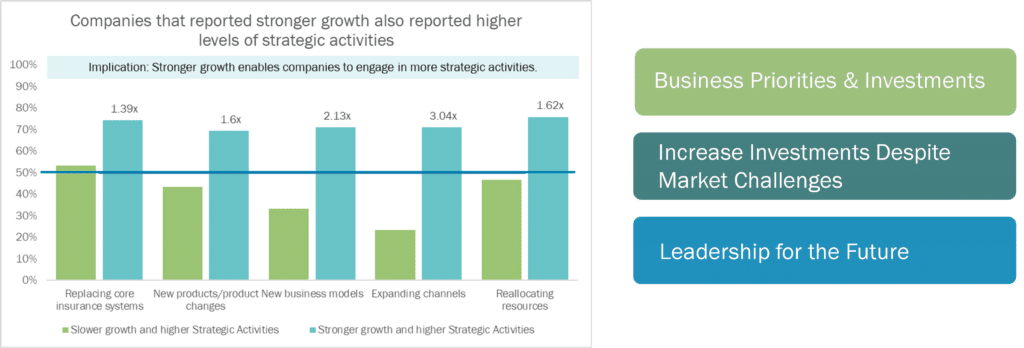

Majesco’s Strategic Priorities research found that as insurers considered and embarked on a business transformation and focused on key strategic areas such as core replacement, new product development, exploring innovative business models, reimagining business processes, and diversifying distribution channels, they experienced higher growth, as illustrated in Figure 1 below.

Figure 1: Alignment between growth and strategic activities

Equally important is the reallocation of resources, ensuring the continuation of current business operations while investing in the future. This approach underscores the significance of setting priorities, making strategic investments, and exhibiting strong leadership.

In a recent Majesco/Capgemini L&AH Roundtable discussion, L&AH business leaders shared their views on this transformation. They outlined the steps their companies are taking to create the operational and cultural environment needed to keep pace and lead the industry. You can read the full Majesco/Capgemini report by downloading, Don’t Pull Back…Put the Pedal to the Metal for L&AH Transformation. You’ll find some of these insurer insights in the quotes below.

Standard Equipment #1: An investment strategy for retooling and growth

Prioritizing operational and distribution investments as a strategy for growth may seem like a no-brainer. The reality is that it’s tough to do.Many insurers are grappling with the question of whether they can undertake the business transformation and investment alone. It entails significant capital investments in an already capital-intensive business. Thus, it prompts the consideration of potential opportunities that align with a commitment to investment and an opportunity to set a different trajectory. Fundamentally, insurers must achieve operational efficiency at scale, which can be accomplished through acquisitions, organic growth, and effective utilization of investments.

“When I envision our company ten years from now, I anticipate a significant transformation in our culture and operations. With a continuous influx of new associates, we are committed to change, evolution, and increased agility. Over the next five to ten years, many employees, who may have been more resistant to change, will retire. We have exerted extra effort to bring them along on this journey.”

Roundtable Participant

As companies embark on these substantial investments, it’s important to question whether they are defensive or offensive. Are they making these investments to survive or to achieve scalability? The success of these investments relies on attaining operational efficiency and achieving growth across all business lines. Therefore, growth becomes imperative.

Are insurers growing and subsequently making investments or are they making investments to facilitate growth? These aspects warrant careful consideration in setting business priorities – for both the current and future business.

Standard Equipment #2: Preparations that will allow for alliances, partnerships, mergers, and acquisitions.

A fast-changing insurance industry is also grappling with the challenges and opportunities that might be found through mergers and acquisitions. On the one hand, a merger might help a traditional insurer establish a route for change and modernization. On the other hand, an insurer might gain the upper hand in partnerships and mergers by establishing a technology framework that is so competitive as to be unassailable. The right preparations will position insurers to be discerning, swift, and attractive as they approach new relationships of any kind.

Roundtable participants discussed the possibility that the market will witness intriguing partnerships and M&A activities that go beyond private equity firms acquiring annuity companies solely for their capital. Instead, we may see firms seeking alliances with companies that are already making substantial investments, recognizing that joining forces can collectively foster growth and serve the best interests of policyholders. This will bring a fresh approach to strategy, priorities, and investment in the business that is critically needed.

These preparations will require real innovation because leading insurers need to prove that they:

Understand the link between using cutting-edge technologies, like generative AI and machine learning, and reaching new markets.

Grasp the timing imperative — that insurers are in the midst of a critical shift in how they do business that must be met with new business models.

Pursue solutions and partners that align with their focus on customers and stakeholders.

Standard Equipment #3: A renewed look at what creates differentiation in insurance.

Another crucial aspect that deserves attention is the role of people, culture, and leadership in this process. Managing these changes can be extremely challenging, and perhaps far more complex than its technical aspects. Many organizations are grappling with change when their long-standing mindset was to build products that last for decades without change. Shifting this mentality is crucial for success with today’s changing marketplace and customer needs.

“Indeed, I strongly believe that change management surrounding the implementation of new technical platforms requires more effort than the technology itself. It’s vital to bring people along on the journey, ensuring that they share a clear vision and understand the strategic objectives. It’s essential to recognize that individuals have varying levels of comfort with change and that not everyone will embrace it enthusiastically. Considering the generational diversity within our organization, we have employees with significant tenure who may not view change as a positive thing or readily embrace it. Millennials, on the other hand, might be relieved to leave behind the era of green screens. Getting Gen Xers or baby boomers on board could pose more challenges. Hence, we cannot overlook the human aspect of transformation. The people side is of utmost importance.”

Roundtable Participant

In the past, insurers believed that the secret sauce lay in how they handled policy issuance and service. They thought that customizing the software or building their systems, preserved their unique strengths. That kind of uniqueness is now a burden that is holding insurers back from progressing. The extensive customization made it costly and challenging to upgrade the software or move to the cloud. They cannot quickly take innovations from upgrades.

Does leadership understand the full scope of opportunity available to insurers right now? Does the business recognize it will have more “uniqueness” as it gains capabilities that aren’t custom-built?

The roundtable agreed that insurers must rethink their strategy and embrace the approach of taking as much as possible out of the box. Not only will this approach accelerate speed to implementation, but it will decrease overall total cost of ownership and enable quicker speed to market upgrades, new products, and more. The ability to easily upgrade when new releases are available is crucial to keep the company at the leading edge by taking advantage of the R&D in software and rapid shift in technologies – like Cloud, AI/ML, and now, generative AI.

“You made a great point about differentiation being attributed to our people and our products. I fully agree with that. The challenge we’ve set for ourselves is to rely on out-of-the-box solutions for 95% or more of our needs. Otherwise, we would just be drinking the same wine from a fancy new bottle. Change management is crucial here. We must be willing to change, leveraging technology without extensive customization. This allows us to avoid the costs associated with customization and focus on deploying our people to serve our customers, while letting our products shine on their own. It’s about cultivating a mindset within the organization that embraces change and is willing to let go of past practices. Our main focus should be on serving our customers and delivering value. Everything can change, and that’s okay.”

Roundtable Participant

Standard Equipment #4: Next-gen technology, from point-of-purchase to intelligent core.

Insurers must accelerate their digital business transformation because technology and new operating models provide a foundation to adapt, innovate, and deliver at speed as markets shift. This insurance model year is inaugurating ground-breaking possibilities to insurers that are open to swapping out their “engines” with more economical, fast, and AI-powered alternatives.

The rising importance and adoption of platform technologies, Cloud, APIs, new/non-traditional data sources, and advanced analytics capabilities are now crucial to growth, profitability, customer engagement, new products, channel reach, and workforce changes.

Right now, decisions are being made that will determine which companies will emerge as winners in the next three to five years. These winners will be sought after as partners and employers due to their ability to achieve scalability, agility, and their pivotal role in leveraging technology. These leaders will be prepared for the next major disruption, leaping forward from the competition.

L&AH companies are now able to make strides that weren’t possible even twelve months ago, due to the launch of Majesco’s L&AH Intelligent Core, Majesco Global IQX Sales & Underwriting Workbench, Digital Enroll360 for L&AH, and ClaimVantage Connect360 for L&AH. Majesco solutions form the benchmark for how Individual, Group, and Voluntary business will be done now and into the future.

Today’s leaders are nimble, creative — and bold. As they tackle the tough issues of legacy debt and an increased need for organized data and analytics, forward-looking L&AH insurers will be fixing supplemental issues that were silently driving down profitability while they steadily climb the ladder of growth.

Bold moves that embrace the future are defining the next generation of leaders in the insurance industry. Each company needs to rethink how it prioritizes and allocates resources – people and capital. Will you keep things relatively the same, allocate the same amount to each business unit to keep it operational, and focus on some enhancements for business processes and products? Or will you reallocate some of those resources to make bold changes for the future?

Today’s blog is co-authored by Denise Garth, Chief Strategy Officer at Majesco, and Samantha Chow, Global Head, Insurance, Annuities, and Benefits Leader, Capgemini Financial Services