It’s Not All Doom and Gloom Say Majority of Canadian Small Business Owners

Despite the ongoing pandemic, high inflation, soaring gas prices, and recession fears, most small business owners and self-employed professionals are upbeat about their prospects in the second half of 2022

60 per cent of small business owners confident for the future, but 46 per cent say revenue was either down or about the same in the first half of 2022 compared to 2021

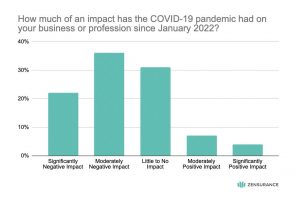

57 per cent say the pandemic has had a significantly or moderately negative impact on their businesses since January 2022

40 per cent say they don’t have a business insurance policy

Toronto, ON (Aug. 5, 2022) – The results of a new survey from Zensurance, Canada’s leading source for small business insurance, find that 60 per cent of small business owners and self-employed professionals are confident their businesses will be successful in the second half of 2022. That confidence eclipses the pandemic’s negative impact on their revenues in the first six months of the year and Canada’s record-high inflation.

Moreover, that confidence stands in contrast to the 46 per cent of respondents in the inaugural Zensurance Small Business Confidence Index who admit their revenue was either down or about the same in the first half of this year compared to the first half of 2021.

“It’s encouraging and a little surprising to see a majority of small business owners, entrepreneurs, and self-employed professionals as confident as they are when looking ahead. However, record-high inflation, the cost of gasoline, and supply chain reliability remain top-of-mind for many. Also, there are worries about a recession, and the pandemic is not over yet,” notes Danish Yusuf, Founder and CEO of Zensurance. “Nevertheless, these results speak to Canadian business owners’ resiliency. Their confidence that consumer demand will remain strong and they’ll be successful despite economic headwinds is inspiring.”

When asked how much of an impact the pandemic has had on their businesses or professions since the start of 2022, 36 per cent say it had a moderately negative effect. Another 21 per cent say it significantly impacted them, and 31 per cent claim it had little or no impact. However, for a few, the pandemic has given their businesses a boost. Almost 7 per cent say it had a moderately positive impact, and nearly 4 per cent say it had a significantly positive effect.

Although most respondents to the Zensurance survey are upbeat about their prospects, slightly more than 52 per cent admit their businesses cannot afford to take on more debt to fund necessary projects or initiatives. Meanwhile, 29 per cent say they can afford to take on more debt in 2022, and nearly 18% say they’re not sure.

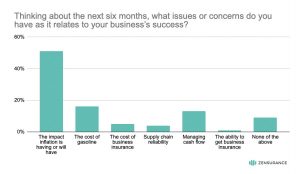

However, when looking ahead to the balance of 2022, Canadian business owners and independent professionals do have concerns.

Not surprisingly, the effect of inflation is the greatest concern for most (51 per cent). The spiking cost of gasoline also ranks high (16 per cent), as does managing cash flow (13 per cent). Almost 6 per cent cite the cost of business insurance, 5 per cent worry about supply chain reliability, and 2 per cent say the ability to get insurance is a factor. Another 9 per cent say they are not concerned about any of these factors.

(Source: Zensurance)

Additional Findings: What Business Owners Think About Insurance

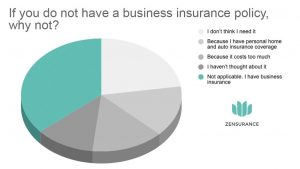

The survey also asked respondents if they have a business insurance policy and how often they compare rates. Interestingly, almost 40 per cent say they shop around for insurance annually, 13 per cent do so once every few years, and 7 per cent say they never do. Another 40 per cent say they don’t have a business insurance policy.

For those small business owners who do not have business insurance, most (25 per cent) say they don’t think they need it. Others say they don’t because it costs too much (16 per cent) or because they have personal home and auto insurance (16 per cent). Another 13 per cent admit they haven’t thought about it.

Among those who have a business insurance policy and what influenced them to get one to protect themselves from the cost of accidents and third-party liability risks, most (15 per cent) say it is a legal or regulatory requirement for their profession or industry. Another 13 per cent cite an insurance broker’s influence, 13 per cent say they were encouraged by family, friends, or colleagues, and 8 per cent did so because of advice from a mentor. Advertisements influenced 3 per cent, and stories in the media motivated 2 per cent to get a policy.

“Some of the views small businesses have on business insurance are troubling. They may not be aware of the risks they are taking that could prove to be financially catastrophic without an insurance policy,” Yusuf says. “No small business or independent professional is immune to the threat of a lawsuit or an accident. The cost of a lawsuit – even a frivolous one – or an unexpected event like a fire damaging or destroying a business property and all your inventory far exceeds the price of a commercial insurance policy.

“Small business owners, contractors, and other self-employed professionals need to protect their assets, finances, and reputations. A business insurance policy is the backbone of every organization’s or independent professional’s risk management strategy.”

About the Survey

The Zensurance Small Business Confidence Index is an online survey of 222 Canadian small business owners and self-employed professionals conducted by a third-party provider throughout June 2022.

Among the survey’s respondents, 11 per cent say they work in construction and professional trades, 10 per cent in retail and e-commerce, and 9 per cent in health and wellness. Another 9 per cent are in the technology industry, 6 per cent in hospitality and tourism, 6 per cent in finance, 5 per cent in manufacturing, 3 per cent in engineering, and 1 per cent in sports and fitness. Additionally, almost 40 per cent listed their industry or profession as “other”.

By region, most respondents are in Ontario (49 per cent), 18 per cent in Alberta, and 16 per cent in B.C. Five per cent call Saskatchewan home, followed by Nova Scotia (4 per cent), Manitoba (3 per cent), New Brunswick (2 per cent), and P.E.I. and Newfoundland and Labrador (1 per cent respectively).

About Zensurance

Zensurance is an online commercial insurance brokerage obsessed with making the process of purchasing small business insurance simple and fast. With a strong focus on technology, and a national footprint, Zensurance has enjoyed phenomenal growth since its founding in 2016. For more information, please visit www.zensurance.com.

Source: Zensurance Inc.

Tags: coronavirus, epidemic, InsurTech, InsurTech Spotlight, outlook / predictions, small business, survey, Zensurance

Read the original article at Insurance-Canada.ca

Like this:

Loading…