Is your client a good fit for a Take Command ICHRA?

An Individual Coverage Health Reimbursement Arrangement (ICHRA) is the newest standalone HRA that enables employers of all sizes to reimburse employees, tax-free, for individual health insurance premiums and potentially other qualifying medical expenses. Here’s a handy guide to see if ICHRA is a good fit for your client.

ICHRAs are quickly becoming one of the fastest-growing forms of employee benefits in the U.S., so many employers want to know if ICHRA is a good fit for their company. It’s time to start discussing ICHRAs with your clients; we can help!

Take Command helps your clients and their employees find, purchase, and manage affordable alternatives to small group insurance on the individual health insurance marketplace.

Our end-to-end platform simplifies and streamlines the entire process. Your client is supported by world-class industry experts every step of the way.

Is your client a good fit for a Take Command ICHRA?

ICHRA is a great fit for the modern, mixed workforce because it allows your client to provide health coverage for various employee types (classes), such as part-time and seasonal workers and remote workers. If your client has a mixed workforce or is in one of the following industries, they could be a good fit for ICHRA.

ICHRA Classes

If your client has the following workers, they could be a great fit for ICHRA.

Full-time employees

Part-time employees

Seasonal employees

Employees covered under a collective bargaining agreement

Employees in a waiting period

Foreign employees who work abroad

Employees working in the same geographic location (same insurance rating area, state, or multi-state region)

Salaried workers

Non-Salaried workers (such as hourly workers)

Temporary employees of staffing firms

A combination of two or more of the above

NOTE: Each class can be divided further by age and the number of dependents.

ICHRA Industries

Industries with high turnover, short employee tenure, populations of lower-paid workers, or a mix of hourly and salary employees tend to be a good fit for an ICHRA plan.

Hospitality

Retail

Restaurants

Manufacturing

Non-profits

Delivery

Construction

Landscaping

Health care

Professional services

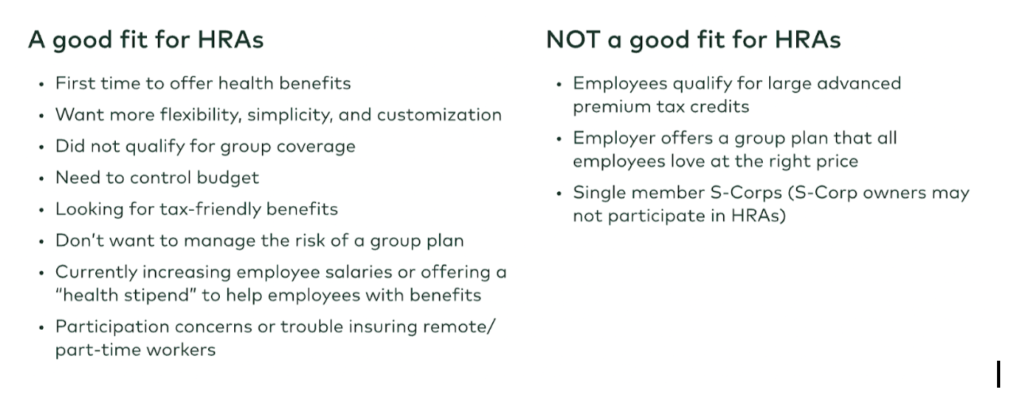

ICHRA Compatibility Chart

Explaining ICHRA Benefits To Your Client

When you want to transition your client to a new benefits model, it’s important to highlight the benefits for them and their employees. Here are some key talking points you can use.

Your client can get out of the health insurance risk management game.

HRAs are competitive employee benefits offerings.

There are no participation requirements.

There are no annual premium raises with an HRA.

HRAs reduce small business health insurance costs.

Employees can choose the health insurance plan that works best for them.

Employees get tax-free reimbursements for health insurance premiums and other medical expenses.

Health insurance is portable since the employee has their own individual plan.

Need more help?

Connect with us!

![]()