Is there long-term care insurance in Australia?

Is there long-term care insurance in Australia? | Insurance Business Australia

Guides

Is there long-term care insurance in Australia?

You cannot access long-term care insurance in Australia, but the government offers subsidies.

Long-term care insurance is currently unavailable in the country, with the government mostly shouldering the responsibility of financing aged care. A recent report published by the Royal Commission, however, has revealed that this funding is not enough to provide quality care, highlighting the need for private long-term care insurance in Australia.

In this article, Insurance Business takes a deeper look at the country’s aged care system and the role long-term care insurance may play in helping the nation’s senior population access the care they require. We will also discuss how much long-term care costs and how the current system is funded.

If you’re planning for your own care or helping an older family member, this piece can give you a rundown of the different options available. Meanwhile, if you’re among the insurance professionals who frequent our website, you can use this article to educate your clients about the benefits of having long-term care insurance in Australia.

The Royal Commission’s recent report on the state of aged care in the country emphasises the need for long-term care insurance in Australia. This type of policy can help families cover the different services given to older people who lost the ability to care for themselves due to age-related impairments.

While aged care services are subsidised by the government, the Royal Commission’s report has found that the funding is not sufficient to provide the country’s older population with quality care. And with the exorbitant cost of long-term care services, these can easily drain one’s retirement savings, which makes having long-term care insurance in Australia vital in helping seniors access the best care possible.

In countries such as the US and Canada, long-term care insurance can be accessed by individuals who can no longer perform two out of the six activities for daily living or ADLs. These are:

Bathing: Getting in and out of the bathroom to clean oneself

Continence: Controlling urinary and bowel movements

Dressing: Putting on or taking off clothes

Eating: Feeding oneself

Toileting: Getting on and off the toilet

Transferring: Getting in and out of a bed or a chair

Long-term care insurance often requires policyholders to pay for care services for a certain timeframe, called an elimination or waiting period. This usually spans between 30 and 90 days, after which the insurer starts the reimbursements. Plans also pay out a capped amount each day until the lifetime maximum is reached.

In place of long-term care insurance in Australia, the aged care system is designed to support members of the country’s older population who can no longer live in their own homes without assistance. The table below lists some of aged care services that older Aussies can access.

The government acts as the primary funder and regulator of the aged care system as set by the Aged Care Act of 1997. Figures from the Department of Health and Aged Care (DHAC) show that the government spent $24.8 billion for aged care in the last financial year, which if broken down consisted of:

$14.6 billion for residential aged care

$4.4 billion for home care

$3.7 billion for basic home support

$700 million for flexible and short-term care

$1.2 billion for other aged care services

Overall, an estimated 1.5 million Australians benefitted from some form of aged care coverage, with an overwhelming majority receiving home care, which comprises:

818,288 through the Commonwealth Home Support Programme

261,314 through Home Care Packages

Only a fraction, or 245,719, of the beneficiaries were in permanent residential aged care or assisted living care.

Aged care services are provided by the government, non-profit organisations, and private companies. The level of care given varies depending on the person’s needs. These come in four main types, namely:

1. Home support

Older Aussies are given entry-level support services, while carers are provided with respite services through the Commonwealth Home Support Programme (CHSP). This scheme is designed to allow people to have some form of independence while living in their own homes through various care services, including:

Personal care

Help with domestic chores

Home maintenance and modification

Nursing care

Social support

Transport

Allied health services such as physiotherapy

To be eligible, a person must be:

65 years or older

50 years or older for Aborigines and Torres Strait Islanders

50 years or older for those on a low income who are homeless or at risk of being homeless

45 years or older for Aborigines and Torres Strait Islanders on a low income who are homeless or at risk of being homeless

But because the CHSP caters to a large number of individuals, the programme can only provide a limited amount for each, which on average was at $2,949 worth of services based on the latest DHAC figures. As a result, clients may have to pay a contribution towards the cost of services, with the amount varying between providers.

2. Home care

For older Aussies who need a higher level of support to continue living at home, they can access the Home Care Packages (HCP) Programme. Compared to the CHSP, the HCP provides more comprehensive care and support services for those wanting to maintain their independence and remain safely in their homes. Each package of services is also tailored to cater to a person’s unique needs.

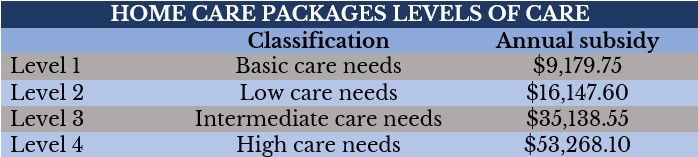

There are four levels of care, with a corresponding government subsidy. These are detailed in the table below:

HCP clients work with their chosen providers to identify their care needs and determine the best way to spend the funding. The service provider can likewise coordinate and manage the services on their behalf. Clients are also expected to contribute to the cost of care if they can afford to do so. The amount consists of three types of fees:

Basic daily fee of up to $12.14

Income-tested care fee of up to $34.84

Additional fees, which include any amount the client has agreed to pay for additional care and other services not covered under HCP

3. Residential care

Residential aged care services are designed for people who require care that cannot be adequately provided in their own homes. This type of care is given to individuals in aged care homes in a permanent or short-term, also called respite care, basis.

Funding for residential aged care services comes from government subsidies and contributions from the residents, who may be asked to pay a basic daily fee worth 85% of the single basic-age pension. Some residents may also need to cover a means-tested care fee based on their income and assets. Accommodation costs, meanwhile, may be fully or partially subsidised by the government, with those with greater means required to pay an “accommodation price” – previously called a bond – agreed upon with the aged care home.

4. Flexible care

Flexible care is designed for those whose needs cannot be adequately met by mainstream home and residential services. Older Aussies can access four main types of flexible care, namely:

Transition Care Programme (TCP): Offers up to 12 weeks of care and recovery services upon discharge from the hospital. These can be provided in aged care facilities or in a person’s home. TCP is jointly funded by the federal and state and territory governments.

Short-Term Restorative Care (STRC) Programme: Designed to reverse or slow down a decline in function in older people, allowing them to remain at home or delay entry to higher levels of care. The scheme provides up to eight weeks of services subsidised by the federal government.

Multi-Purpose Services (MPS) Programme: Provides integrated health and aged care services in small rural and remote communities that are unable to support standalone hospitals or aged care homes. MPS is jointly funded by the federal and state and territory governments.

Innovative Care Programme: This consists of government-funded projects focused on younger people with disabilities. The initiative supports flexible ways of providing care that cannot be met by mainstream services.

For Indigenous Australians, culturally appropriate home care and residential aged care services are provided through the National Aboriginal and Torres Strait Islander Flexible Aged Care Program.

While the government subsidises aged care services to help citizens access affordable care, those who can afford to are expected to shoulder a portion of the cost. How much older people pay depends on a range of factors, including:

Their financial situation

The types of services

The number of services

Where care is being provided

Fees from aged care services provider

These are some of the fees that Australians may need to pay when accessing aged care services:

Basic daily fee: Covers day-to-day services, including meals, cleaning, laundry, and facilities management. Everyone accessing care needs to pay this amount pegged at 85% of the single-person rate of the basic-age pension. The maximum basic daily fee currently is $58.98 or $21,527.70 annually.

Means-tested care fee: This is an additional contribution determined through a means assessment. Not everyone pays this amount, which can reach up to $358.41 per day. The amount a person pays, however, changes over time, depending on several factors.

Accommodation costs: Older Aussies entering an aged care facility need to agree on a room price with their provider. Whether or not the government will subsidise this amount will depend on the result of their means assessment. My Aged Care provides complete information on accommodation costs on its website.

Additional service fees: Most aged care homes offer “hotel-type” services – including paid TV services, preferred toiletries brand, or hairdressing – for a corresponding fee. These services are not government subsidised.

Extra service fees: These cover “higher standard hotel-type services” such as specialised menus, high-quality linen, or certain room furniture or furnishings.

You can find updated standard rates on these fees through the DHAC website. Another important thing to take note of is that before a person can access government-sponsored care, they need to undergo an assessment to determine eligibility.

While the level of protection long-term care insurance can provide cannot be replaced by other types of coverage, there are some types of policies that currently exist in the market that can offer some form of financial support under similar situations. These include:

Total and permanent disability (TPD) insurance: Pays out a lump sum to cover medical, rehabilitation, and living costs should the policyholder become permanently disabled.

Critical illness insurance: Covers treatment and recovery expenses incurred due to serious illnesses. Policies often pay out a lump sum that can be used to replace lost wages and pay for medical and non-medical costs and care expenses.

Trauma insurance: Pays out a lump sum to cover expenses incurred while recovering from a major illness.

Income protection insurance: Pays out a monthly benefit of up to 75% of the policyholder’s regular salary to cover living expenses if they are unable to work because of an illness or injury. These can include care costs.

If you want to understand how long-term care insurance works and learn why it is an important form of coverage, you can check out our comprehensive guide to this form of coverage.

Do you think it is beneficial to have long-term care insurance in Australia? Why or why not? Feel free to share your thoughts in the comments box below.

Keep up with the latest news and events

Join our mailing list, it’s free!