Is the gender wage gap widening in insurance?

Is the gender wage gap widening in insurance? | Insurance Business Canada

Insurance News

Is the gender wage gap widening in insurance?

Desjardins sheds light

Insurance News

By

Gia Snape

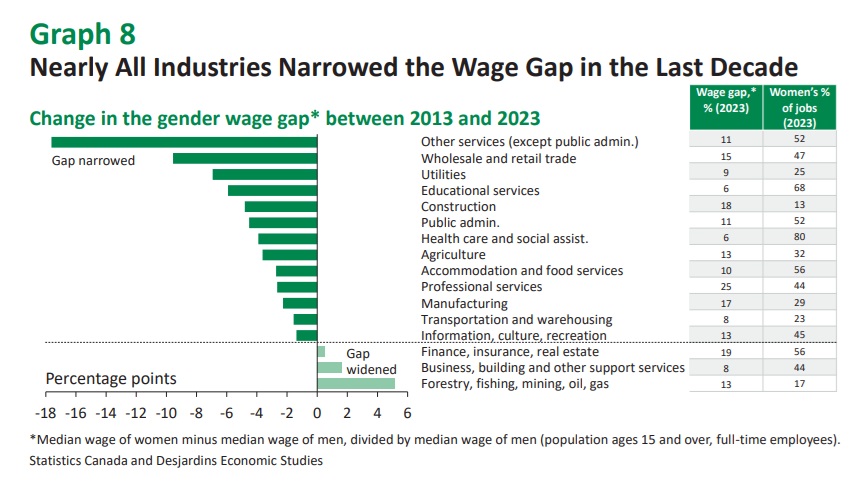

While many Canadian industries have made progress toward narrowing the gender wage gap over the past decade, insurance has gone the opposite way.

Data from Statistics Canada and Desjardins Economic Studies has shown that the gender wage gap widened in insurance between 2013 and 2023. That’s despite women holding 56% of roles in insurance.

The findings were shown in a recent Desjardins report highlighting persistent gender disparities in the Canadian workforce.

The research found that despite the narrowing of gaps, significant barriers remain to a more equitable environment for women professionals and entrepreneurs.

“Narrowing the earnings gap is not just a women’s issue, it’s an issue for all Canadians,” said Kari Norman (pictured), Desjardins economist and the study’s co-author.

Gender wage gap – how does Canada and its industries fare?

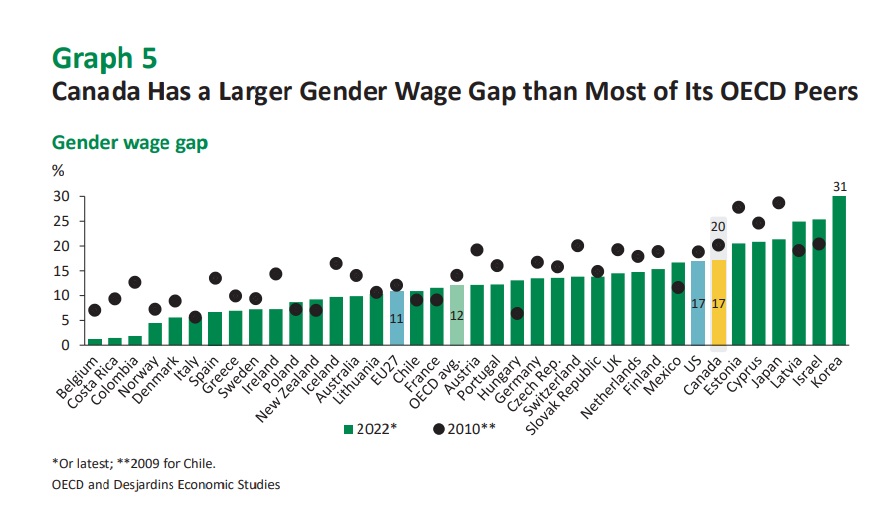

Despite being highly educated, Canadian women earn an average of 17% less than men, according to the Desjardins study.

This figure is significantly higher than other Organisation for Economic Co-operation and Development (OECD) peers, with the OECD average standing at 12%.

CREDIT: DESJARDINS ECONOMICS

CREDIT: DESJARDINS ECONOMICS

At the industry level, wholesale and retail trade, utilities, educational services, and construction were among the industries that improved the most in closing the gender wage gap.

Meanwhile, insurance joined finance, real estate, business, forestry, fishing, and mining as sectors lagging wage parity.

CREDIT: DESJARDIN ECONOMICS

CREDIT: DESJARDIN ECONOMICS

Entrepreneurship, often heralded as a realm of innovation and opportunity, presents an even more sobering picture for Canadian women. Despite comparable qualifications and business proposals, Desjardins’ analysis found that women entrepreneurs continue to grapple with systemic bias.

“The findings show that women are significantly less likely to get financing for their small businesses, and that is on studies where men and women go in and use the same presentation,” Norman said.

“It’s not that women are selling themselves less well than men. But even with all else being equal, they’re less likely to receive funding, and when they do receive funding, it’s likely to be for a smaller amount.”

What’s accounting for the persistent wage gap in insurance?

While some of Canada’s gender wage disparities can be attributed to occupational segregation, wherein women tend to gravitate towards lower-paying fields, a substantial gap persists within similar roles and industries.

Desjardins cited an OECD study that noted about three-quarters of the gender wage gap resulted from the same firm paying men more than women with similar skills, mainly due to differences in task and responsibility assignments.

Claudia Goldin, the 2023 Nobel laureate in economics, found that the disparity in earnings between genders varies notably across different occupations and that the gap is far wider in fields such as law and business administration.

This trend aligns with Canadian data, which shows that professional services, such as law, business consultancy, and insurance, exhibit the largest wage gap.

Additionally, factors such as the “mummy tax”, wherein women experience a significant earnings penalty upon becoming mothers, contributes to long-term disparities in income and wealth accumulation.

Women’s roles as caregivers, both for children and elderly relatives, often results in career interruptions and lower earnings potential, perpetuating the cycle of economic inequality.

Norman stressed that policies aimed at promoting workplace flexibility and supporting women’s participation in STEM fields are crucial steps toward closing the gender wage gap.

She also highlighted that the private sector must acknowledge the benefits of greater diversity in their workplace and take bigger steps towards making flexible work attainable.

“For businesses, greater diversity in management and boards of directors can lead to increased profitability. It makes Canada a more profitable and prosperous country with higher productivity and GDP growth, and it increases the Canadian standard of living overall,” Norman told Insurance Business.

“And it doesn’t come at the expense of men’s earnings. It’s not a zero-sum game. A rising tide lifts all boats.”

Do you have any thoughts about the gender wage gap in the insurance industry? Please share your comments below

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!