Is owning an insurance agency profitable?

Is owning an insurance agency profitable? | Insurance Business America

Guides

Is owning an insurance agency profitable?

What makes owning an insurance agency a profitable venture? Find out as we walk you through the different factors in this guide

The continued growth of the industry presents a massive opportunity for those wanting to venture into the insurance business. With people always in need of financial protection, starting your own insurance agency has the potential to reap high returns.

This begs the question, is owning an insurance agency profitable?

Insurance Business delves deeper into this matter in this guide. We will discuss what makes an insurance agency profitable, how long it takes to generate returns, and how you can maintain profitability.

If you’re wondering whether running your own insurance agency is a lucrative venture, you’ve come to the right place. Read on and find out if you have what it takes to operate a profitable insurance business.

People will always need financial protection. Be it when driving their cars, purchasing homes, running businesses, or seeking medical attention, people are always searching for the right coverage. This is why insurance products and services will always be in demand.

For aspiring insurance entrepreneurs, owning an insurance agency can be a profitable venture – but you must be willing to put in the hard work and dedication.

“With hard work and strategic planning, owning an independent insurance agency can be financially rewarding,” said Jessica Weaver, owner and commercial risk advisor at Weaver Insurance Agency. “The income potential is largely tied to my effort and ability to grow the business.”

Unlike captive agencies, which cater to a single insurance provider, independent agencies can offer products from multiple insurance carriers. “This allows for a diverse portfolio that can appeal to a broad customer base and provide multiple revenue streams.”

Starting an independent insurance agency and keeping it profitable depend on a range of factors. These include your education and professional background, skills, financial resources, and the market demand in your jurisdiction. Weaver also provided a short check list, so you can assess if you’re up to the task:

☐ You have a solid understanding of the insurance industry and a passion for helping people protect their assets.

☐ You have the necessary business acumen and are prepared to handle the challenges of starting and running a business.

☐ There’s a market opportunity in your area or niche that you can capitalize on.

Before we get into whether owning an insurance agency is profitable, we first need to bust the jargon behind the term “profit.”

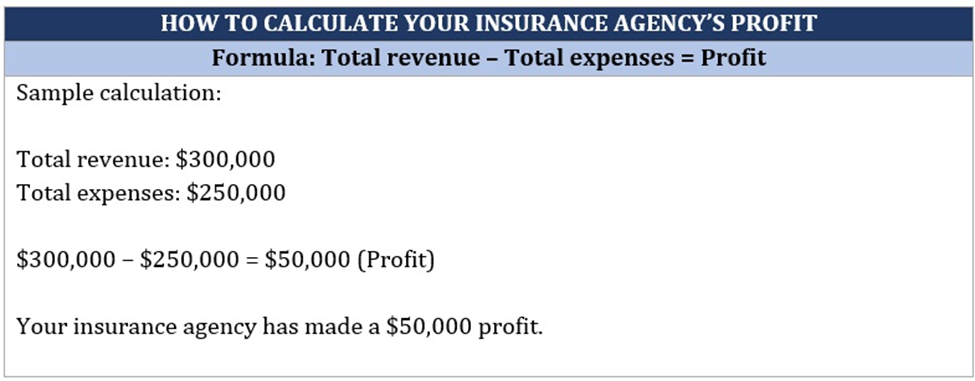

In business parlance, profit is the amount of revenue left for your business after the total expenses have been deducted. It is expressed in dollars and cents and shows how much money your business has earned for a given period.

Here’s a sample calculation:

To measure profitability, businesses use another metric called “profit margin.” Unlike profit, which is shown as a monetary unit, profit margin is expressed as a percentage. It is calculated by dividing your business’ net income by the total sales. Profit margin shows how much profit your company makes for every dollar of revenue it earns.

Profit margins come in several forms, but there are two that are commonly used to measure profitability:

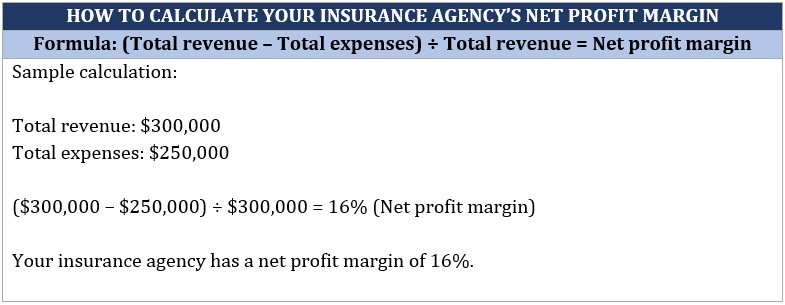

1. Net profit margin

Also called net margin, this measures profit as a percentage of revenue. Net profit margin is calculated by first subtracting your total business’ revenue from the overall sales then dividing the difference by your total revenue. Net margins let you know how well your business strategies are doing by measuring your company’s overall profitability.

Here’s a sample calculation:

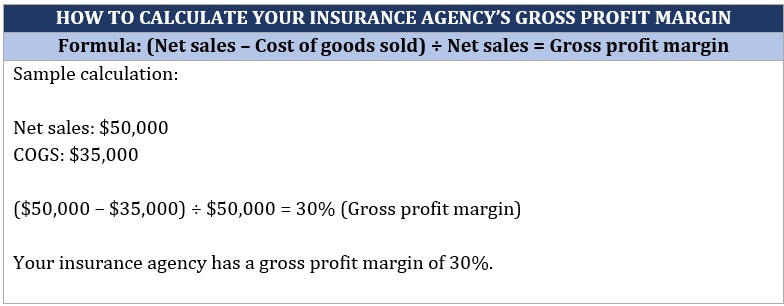

2. Gross profit margin

Also called gross margin, this is calculated by subtracting the “cost of goods sold” (COGS) from your business’ net sales then dividing the difference by net sales. Like net margins, gross profit margin is expressed as a percentage.

You can use gross margins to get a picture of your company’s financial health. Major changes in your gross margins may tell you that you might need to change how your insurance agency is being managed.

You can also use gross margins to measure the profitability of a product. This means that significant shifts may show that certain products or services need to be reviewed.

Here’s a sample calculation:

There are several factors that can affect your insurance agency’s profitability. Some are easily identifiable, quantifiable metrics, including earned premiums, operational costs, and taxes. Others are qualitative such as market share, consumer preferences, and leadership changes.

Here are the three biggest factors that can impact your agency’s profit margins.

1. Earned premiums

An insurance premium is the amount the policyholder agrees to pay in exchange for coverage. The premiums your insurance agency collects ensure that you have enough liquid assets to provide policyholders with financial compensation in the event of a claim.

If the amount your insurance agency collects exceeds what you pay in claims costs and operational expenses, the difference is considered profit. This is what is also called earned premiums.

You can also use premiums as an investment tool to generate higher returns. This strategy allows you to offset some of the costs associated with providing coverage and keep your insurance prices competitive.

2. Operational costs

Once you get your insurance agency up and running, you will need funding for your daily operational expenses. These include:

3. Quality leads

Finding good leads is often the most essential aspect of an insurance agency owner’s job, but it is also the most difficult. It doesn’t matter if you and your agents have thorough knowledge of an insurance product and can explain its benefits and features in the clearest way possible. Without good leads, your business can’t survive in the industry.

Finding good leads is the lifeline of an insurance sales business. In a highly saturated market, however, it is also the biggest challenge. Insurance agencies often compete for a few qualified prospects. To establish a profitable business, catching the attention of potential buyers before your competitors do is important.

Insurance agencies make profit in two ways:

the type of insurance agency (captive or independent)

the type of policies offered

number of insurance policies sold

whether the policies are new or renewals

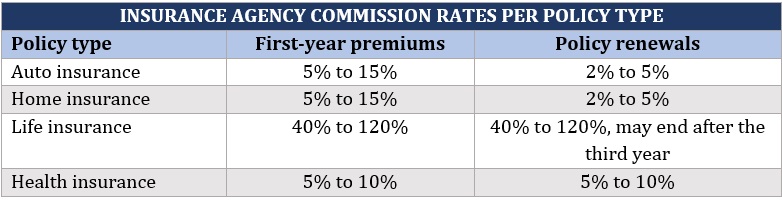

Here’s a summary of the commission rates insurance agencies receive for the four major insurance lines:

The rates above are for base commissions. Some insurance companies also offer partner agencies supplemental and contingent commissions. These are designed as incentives for insurance agencies that help them achieve certain business targets.

Here’s a summary of how the different types of commissions work:

base commission: earned as a percentage of premiums and varies depending on the type of policy

supplemental commission: a specific amount or percentage of premiums is set at the beginning of the year and given depending on the agency’s performance in the financial year

contingent commission: paid depending on the profitability of the business that the agency placed with an insurance company

2. Profit sharing

Insurance carriers often implement profit-sharing programs for the insurance agencies they work with. This is one of the reasons why owning an insurance agency may be profitable. Once insurance agencies reach certain revenue targets, insurance companies reward them with a percentage of either written or earned premiums as a bonus.

Insurance agencies may also invest a portion of the premiums they collect in various assets to boost profitability.

Because each insurance agency operates differently, it’s difficult to come up with a one-size-fits-all timeline for one to achieve profitability. Some industry experts advise new agency owners to curb their expectations during the first year of operation. They add that it can take between 18 and 24 months before insurance sales lead to profit.

This is if they survive the first few years of their business. Data from the US Bureau of Labor Statistics (BLS) reveals that about 20% of new businesses fail during the first two years. After five years, 45% of businesses shut down. The mortality rate rises to 65% after a decade. After 15 years, only 25% of businesses remain up and running.

The ideal profit margin for your insurance agency depends on a range of factors, including:

your business model

your operating expenses

the type of policies you offer

how hard you want to push for sales

According to industry experts, most insurance agency owners operate with an average profit margin of 2% to 10%.

While starting an insurance business can be difficult enough, keeping your insurance agency profitable is another challenge. Having a clear vision of how to keep clients coming and cash flow running is key to sustaining revenue growth. Here are some ways to maintain your agency’s profitability.

Set clear goals

The goals you set for your insurance agency can steer it in the right direction. Be sure to provide a clear picture of how you intend to reach these targets. If set correctly, your business goals can help you measure how profitable your insurance agency is.

Be proactive in getting leads

Success in the industry means having to continuously drive leads. There are several strategies that can help your agency tap new leads. These can include targeted marketing and multi-channel lead generation. Find out more in this guide to the top networking strategies to boost your insurance business.

Identify your niche

Clients’ needs evolve, paving the way for new and innovative insurance products. This presents an opportunity for your insurance agency to find a niche market that will help it become more profitable. While this can take a lot of time and effort, it can also help you reap dividends in the long run.

Take advantage of the latest technology

The insurance industry is increasingly embracing technological innovation. This is evident in AI, telematics, and cloud computing to manage risks, decrease operating expenses, and boost customer experience.

Another effective way of maintaining your insurance agency’s profitability is for you to keep abreast of the latest industry trends. Pad your industry knowledge by visiting our Insurance News Section regularly. Be sure to bookmark this page so you can access breaking news and the latest industry developments.

How much do you think an insurance agency should earn to make it profitable? Tell us in the comments.

Keep up with the latest news and events

Join our mailing list, it’s free!