Is Old Whole Life Insurance Better than New Whole Life Insurance?

Podcast: Play in new window | Download

There’s no secret that continuously low interest rates cause a struggle for life insurers and this can have a negative impact on insurance products that accumulate cash value. However, lower market interest rates negatively impact all financial tools that use fixed interest rates as a savings mechanism–think certificates of deposit, bonds, and money market accounts. We’ve known for some time that whole life insurance doesn’t operate in a vacuum and its relative standing against these other fixed-interest options is strong.

Despite this strong relative standing, we’ve observed whole life products change over the past decade in ways that we always assumed produced products that were less great than their predecessors. We never thoroughly tested this theory from a quantified money-in money-out perspective. But we did note that several covetable features of older whole life products faded over the years.

Then we had the big legislative victory accomplish by the life insurance industry at the end of 2020. A lower guaranteed rate on all insurance products, which led to much-desired breathing room with respect offering contractual guarantees that all insurers could reasonably accomplish given current market conditions. The net result, however, was new contracts with lower guarantees and often greater restrictions on design flexibility.

Whole Life Insurance: A Dated Product with a Fading Flame?

So with newer iterations of whole life insurance products rolled out that assume current market conditions, do we now suffer the consequences of a once-great safety play rendered near useless by every tighter restriction and lower guarantees? That is what we set out to evaluate.

Thankfully, I’ve been selling life insurance for a while and that means I have old whole life insurance proposals stored that I can reference. Having this means I can compare whole life insurance proposals from nears long now gone by to see how different things are in today’s marketplace of available products.

Comparing Old Whole Life to New Whole Life, Which One is Better?

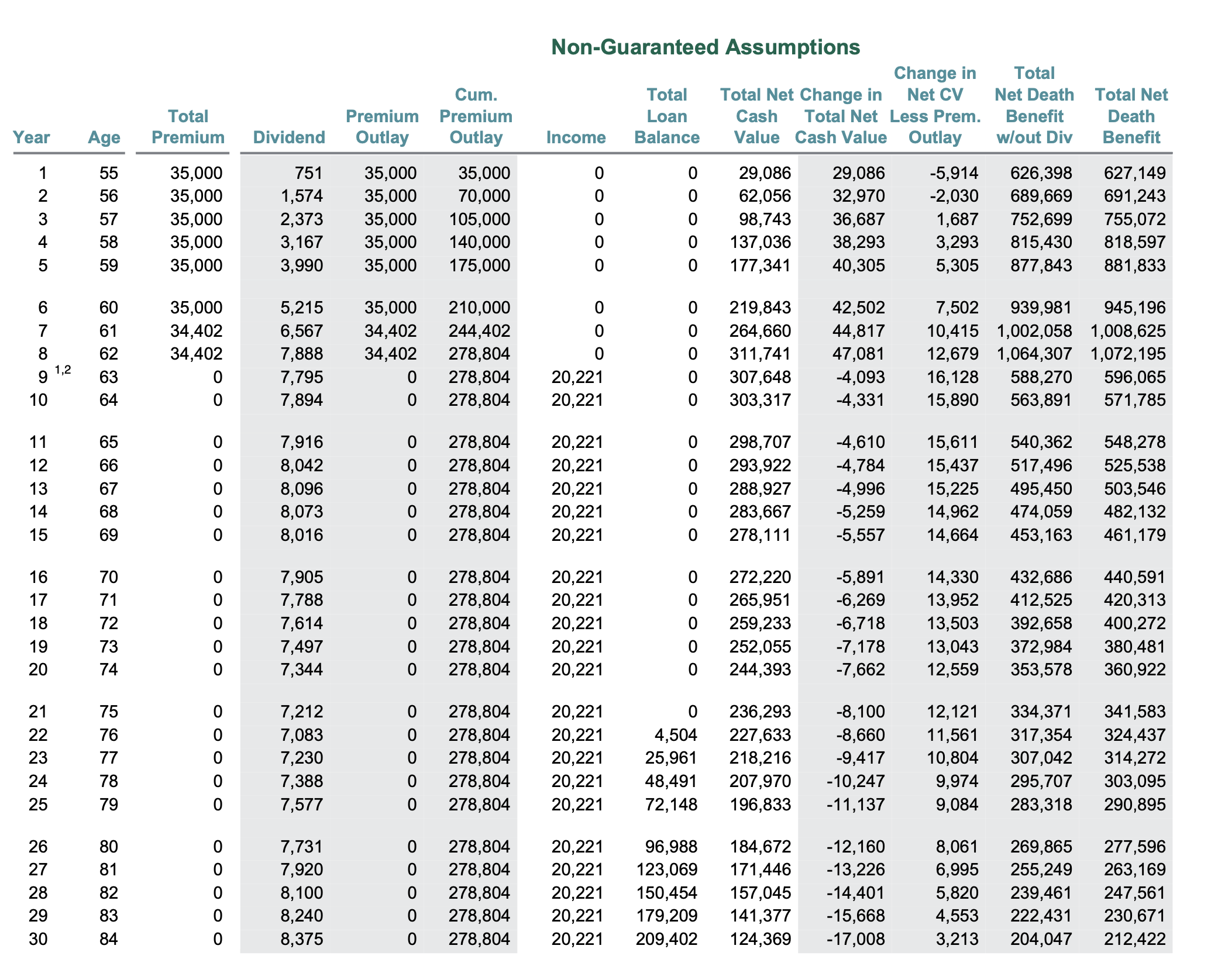

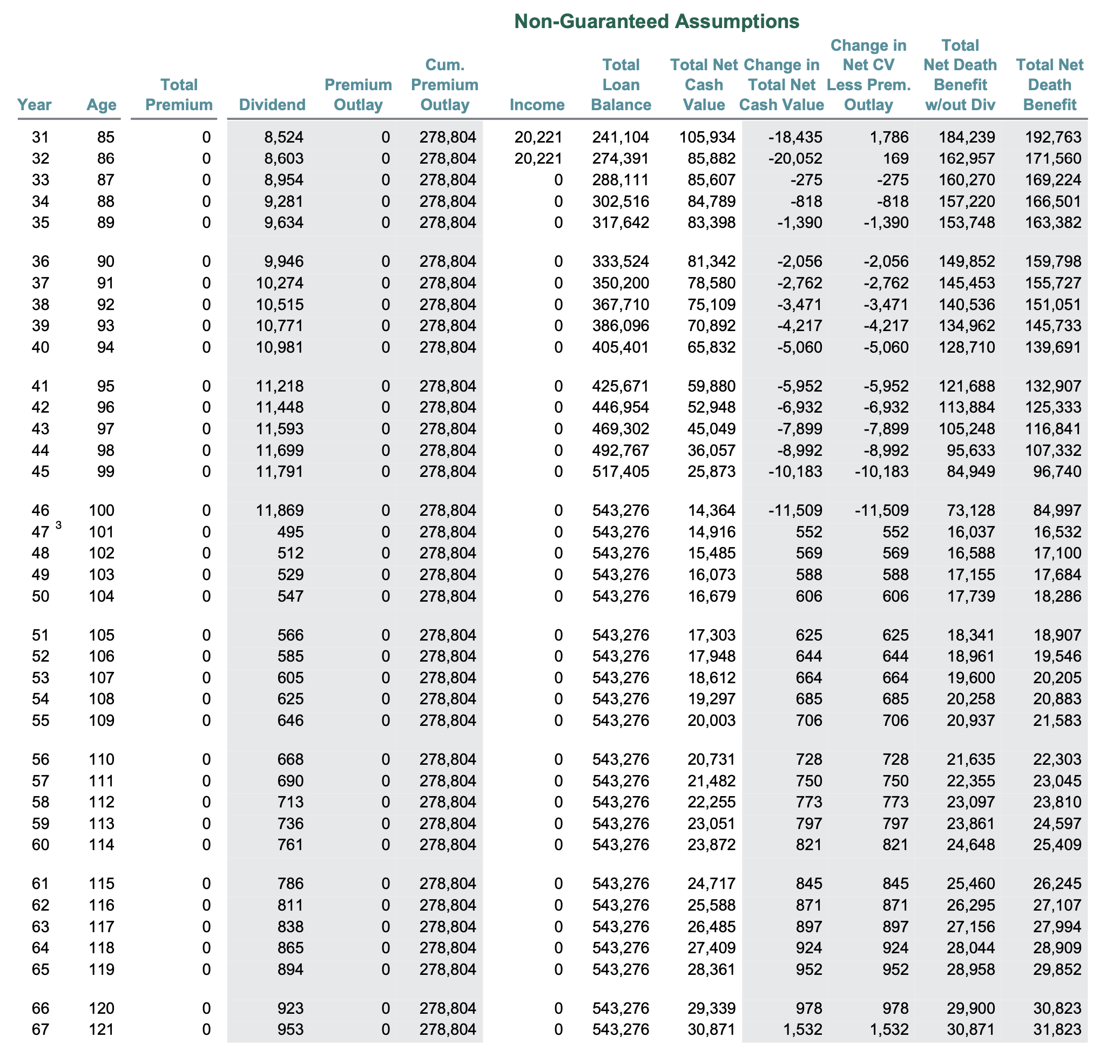

I’m using a whole life ledger from 2013 on a 54-year-old male assumed preferred. This whole life policy was designed to optimize cash value for the purpose of using it to supplement retirement income needs. One additional rider it included was the waiver-of-premium rider. This ledger assumes the dividend interest rate from 2013. Here are the results:

Old Whole Life

The proposed design was for the policyholder to pay premiums for eight years. Then the policyholder would exercise the reduce paid-up feature of the whole life policy to contractual guarantee no future premiums and begin taking income from the policy. Back in 2013, the projected income stream from this policy was $20,221 annually for 23 years.

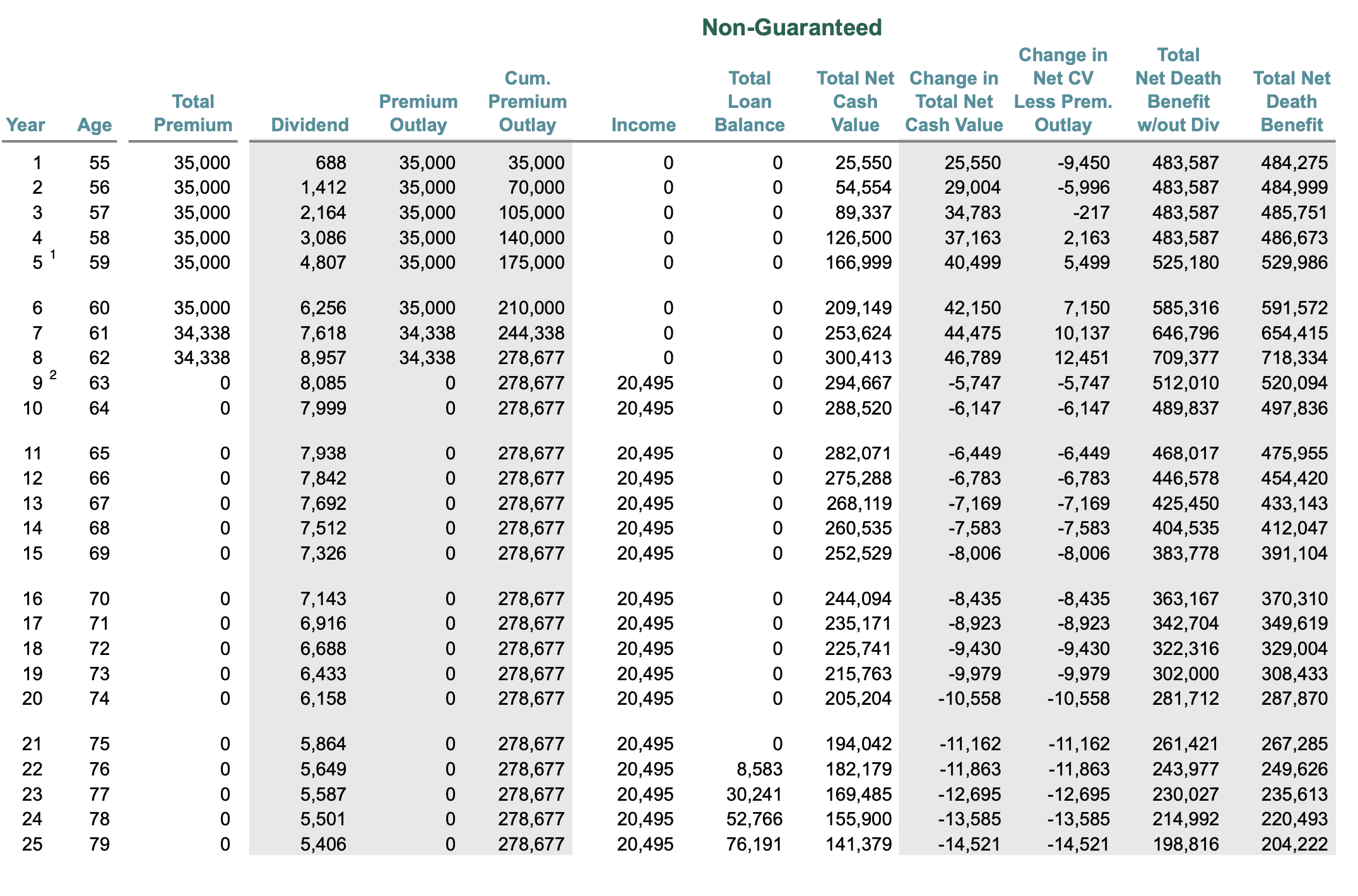

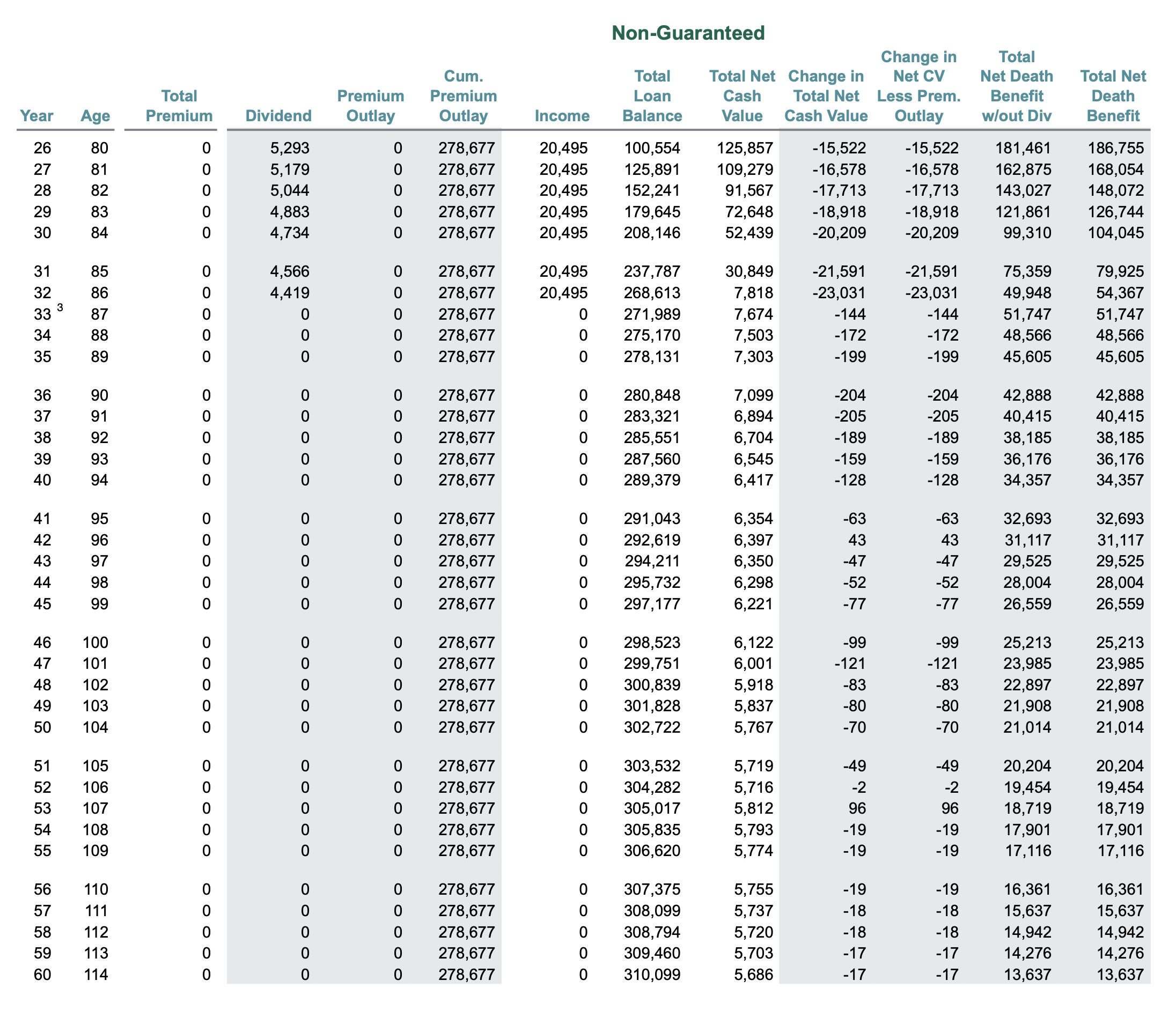

The whole life product available today from the same life insurance company is quite a bit different. It does not permit the same flexibility of design that we once had. It has a much lower guaranteed accumulation rate. It also exists in a world where the insurance company has lowered the dividend by a considerable amount since 2013. It’s therefore understandable that the new product wouldn’t compare as favorably as the product from 2013 if we attempted to sell the same strategy to the same-aged insured with the same health classification. We’d rightfully anticipate lower cash value and lower income.

But here’s how this new product compares:

New Whole Life

I’m stunned by these results. I expected the new whole life policy to produce less income than the old whole life product, but that’s clearly not the case. The new product outperforms the projection on the old products by a few hundred dollars per year. What’s even more interesting about this result is remembering that the new product assumes a considerably lower dividend interest rate versus the old product.

I’m stunned by these results. I expected the new whole life policy to produce less income than the old whole life product, but that’s clearly not the case. The new product outperforms the projection on the old products by a few hundred dollars per year. What’s even more interesting about this result is remembering that the new product assumes a considerably lower dividend interest rate versus the old product.

There are areas where the new product does come in lower than the old product. The death benefit on the new product is about 30% lower at the outset on the new product. This makes sense as the new lower guarantee permits a lower non-Modified Endowment Contract (MEC) death benefit per the planned premium. The old product’s death benefit is also more than 3 times larger at the end of the income scenario timeline versus the new product–again the guaranteed accumulation rate permits a lower death benefit, which helps to cut expense and extract more income from the policy.

Still, I’m shocked at how similar these results come out when comparing products with an eight-year gap between them. I’m especially shocked knowing what transpired during the eight years that separate these two products–chief among those changes is a dividend interest rate that was 55 basis points higher in 2013 than it is today.

Life Insurers are Going to Innovate

As times change, life insurance companies are going to diligently seek new paths to remain competitive. They are not blind to the innovations that exist and the options everyone has when it comes to wealth accumulation and retirement preparedness. Life insurers understand that they must innovate and develop ever-changing strategies to keep their product offerings attractive. We see evidence of their efforts through their lobbying efforts to reduce statutory minimum guarantees, the development of insurance indexed products to open up new accumulation strategies, and developing new products that seek to fit the demands of today’s savers.

The above exercise shows us that whole life insurance is alive and well despite the many changes it endured during the past decade. It still works as a strong wealth builder and a solid retirement income strategy among other efforts.

Consumers have also noticed the value whole life insurance brings to the table. Despite the changes, we’ve been busier than ever. A new wave of eager buyers contacts us each week seeking to set up a plan that incorporates life insurance in their wealth accumulation or retirement planning.

We have to embrace change. We cannot assume that because the rules change or a specific method we used in the past is no longer viable that the end is near. Accepting new ideas and innovations in any market helps many people get ahead. Whole life insurance works a bit differently than it did over a decade ago when I first started selling life insurance, but that doesn’t mean I should abandon whole life insurance, nor sit around complaining about how it used to be. These changes may not work out for everyone, but they will continue to work for the primary strategies that we’ve highlighted here on this website for the past decade.