Is life insurance a good career path?

Is life insurance a good career path? | Insurance Business America

Guides

Is life insurance a good career path?

The answer to whether life insurance is a good career path for you depends on a range of factors. Find out if this professional route suits you in this guide

One of the biggest challenges of a career in life insurance is that it entails dealing with a subject that most people don’t want to talk about – their mortality. On the flipside, life insurance professionals are also given the opportunity to leave a positive impact on people’s lives following a tragic loss, which can make their jobs truly rewarding.

If you’re working out whether this is the right direction to go careerwise, then you’ve come to the right place. In this article, Insurance Business will answer the question, “Is life insurance a good career path for me?” We will discuss the benefits and drawbacks of a life insurance career, what roles you can pursue, and how you can succeed in the industry. Read on and find out if a life insurance career matches your skills and qualifications in this comprehensive guide.

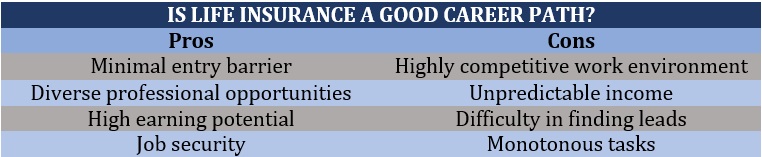

Just like in any profession, choosing a career in life insurance has its share of advantages and drawbacks. To find out if a role in the sector is a good fit for you, you must first weigh these pros and cons. Here are some of the benefits and disadvantages of pursuing a job in life insurance.

Benefits of a career in life insurance

1. Minimal entry barrier

While some life insurance companies prefer candidates with a college degree, several client-facing roles – including insurance agents and brokers – don’t necessarily require one. To help prepare these professionals for their jobs, most life insurers have mentorship and training programs in place.

Many back-office roles – including those in actuarial science, business analysis, and risk modelling – however, require specific college degrees. Some professionals also need to obtain licenses to practice.

2. Diverse professional opportunities

Apart from conventional roles in sales and underwriting, the life insurance sector offers a range of career opportunities that suit different skills and qualifications. You can choose roles that go beyond the purely insurance aspect, including those in the fields of:

Actuary

Communication

Customer service

Data analysis

Fraud investigation

Information technology

Human resources

Marketing and advertising

We will discuss the different occupations you can pursue within the life insurance sector in more detail in the succeeding section. If you’re looking for a life insurance position that fits your talent, our list of the best websites for insurance jobs can help you in your search.

3. High earning potential

Another factor that makes life insurance a good career path is the opportunity to earn a high salary with strong growth potential. Life insurance agents and brokers, in particular, generate commission-based incomes that are among the highest in the entire insurance industry.

4. Job security

Life insurance plays an essential role in providing families with a financial cushion after the death of a loved one. With the right policy, this type of coverage can help families pay off debts and meet daily living expenses. These are just a few of the several reasons why life insurance products are on demand. And with the high volume of people looking for coverage, this also means that plenty of opportunities to work in the industry are opening.

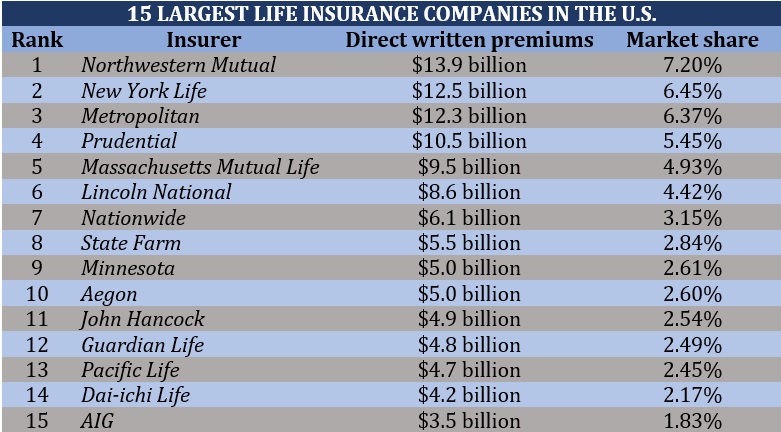

These include vacancies in some of the sector’s biggest names. The table below lists the 15 largest life insurance companies in the US, according to the latest market share report from the National Association of Insurance Commissioners (NAIC).

Disadvantages of a career in life insurance

1. High-pressure work environment

Depending on the role, many life insurance professionals work long hours and are under tremendous pressure to meet different targets and quotas. This highly competitive work environment often leads to stress and burnout, especially for new agents.

Data gathered by this website has revealed that 90% of new life insurance agents quit within the first year due to burnout. The figure rises to 95% if stretched to the first five years.

2. Unstable income

If you choose to pursue a commission-based role, predicting how much your next paycheck will be can prove challenging as your income will largely depend on the number of successful sales and claims you can assess. This means that for you to earn more, you also need to push yourself harder.

3. Difficulty in finding leads

Life insurance agents are often tasked with finding customer leads on their own. And although there are life insurance companies that provide staff with leads, in a highly competitive market, there is a strong likelihood that these leads may have already been contacted by several other insurance agents.

Agents can also pay to obtain exclusive leads, which can be extremely expensive. If you choose to go this route, you need to have a very high close rate – or the percentage of leads that results in a sale – to just break even.

4. Tasks can be monotonous

Some positions come with repetitive tasks, which can lead to boredom. There are also roles that offer limited upward mobility.

Here’s a summary of some of the pros and cons that you need to factor in if you want to find out whether life insurance is a good career path for you.

One of the benefits of pursuing a career in life insurance is that you can choose from a range of professional opportunities that fit your skills, experience, and qualifications. Some of these roles are:

Claims adjuster: Life insurance adjusters work with the policyholders’ beneficiaries by processing their claims and helping them receive the proper benefits. They must also ensure that the claims are not fraudulent. If you want to know how much income these professionals make, you can check out our insurance adjuster salary guide.

Customer service representative: These professionals provide frontline support for life insurance clients by answering their questions, addressing complaints, and giving them useful information about their coverage. They also ensure that customers are satisfied with a product or service.

Financial analyst: Often holding business or other related degrees, financial analysts evaluate a life insurance company’s projects and processes to ensure that they are making sound financial decisions.

Insurance actuary: Considered as math wizards, life insurance actuaries act as professional statisticians, helping life insurers assess risks and price policies. They also advise insurance companies on regulatory compliance and balancing capital.

Insurance investigator: Some people go great lengths to commit insurance fraud. This is what an insurance investigator is tasked to prevent. These professionals investigate claims and get to the bottom of suspicious ones.

Life insurance agent: Agents are licensed professionals tasked with selling the policies of their partner life insurance companies. They typically represent one or several insurers and give potential clients information about these companies and what products and services they offer.

Life insurance broker: Brokers are also licensed professionals who sell insurance products, but they represent the insurance buyers instead. Unlike insurance agents, brokers are not bound to sell policies of a particular insurer. They are instead responsible for finding the best coverage that suits the needs of their clients. You can check out how much insurance brokers make in this guide.

Life insurance underwriter: Underwriters help life insurance companies determine if they can offer coverage to a potential client by assessing the risks involved. These professionals are tasked with finding ways to create a balance between offering customers competitive premiums and maintaining the insurer’s profitability.

Risk manager: Risk managers help life insurers minimize their financial risks. Their tasks include implementing processes for insurance underwriters to follow and managing an insurance company’s investments.

For many client-facing roles, their success as a life insurance professional depends largely on the type of relationship they establish with customers. Here are some strategies that you can employ to help you build a strong professional relationship with your clients.

Practice good customer service: The key to building and maintaining trust with a client is excellent customer service. Successful life insurance professionals possess the ability to understand every potential client’s unique needs and consistently provide quality service.

Identify clients’ needs: The best life insurance professionals have the empathy to identify what kind of protection their clients need. When it comes to life insurance, people often already know that they need coverage, but may not necessarily comprehend what specific types of policies address their needs.

Play the long game: If the life insurance career you pick is involved in sales, you must understand that trying hard to sell policies right away is a sure-fire way of ruining clients’ trust. The best insurance agents and brokers focus on establishing relationships instead. They recognize that by being patient, they are more likely to secure a long-term customer who may be willing to refer them to other potential clients.

Leave a professional impression: If you want to be taken seriously in the industry, you must know how to dress and communicate in a professional manner. If you pick a role that entails working outside a professional setting, the choice of place to meet clients also plays an essential role in establishing professionalism.

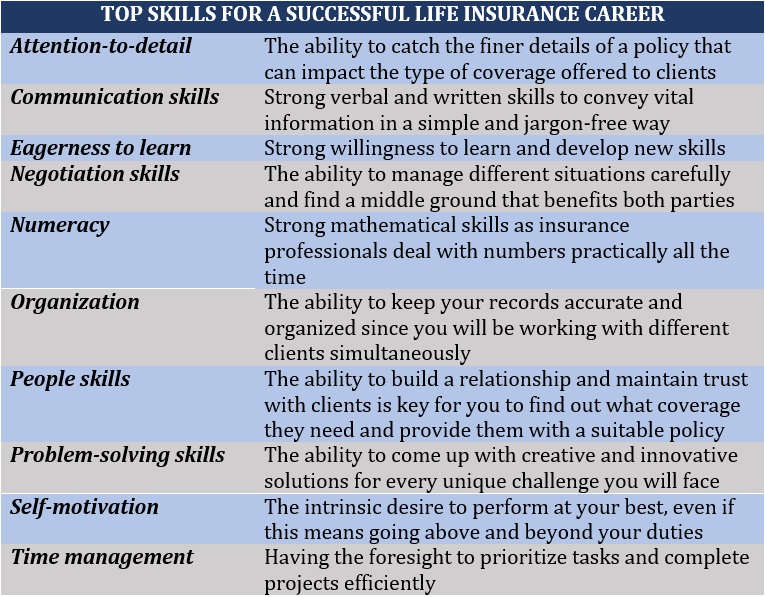

Having the right combination of hard and soft skills also plays a huge role in your success in the sector. The table below sums up the skills and attributes that will dictate if life insurance is a good career path for you.

Part of establishing a successful career in life insurance is keeping abreast of the latest developments in the sector. You can do this by bookmarking and regularly visiting our Life & Health Insurance News section, where you can access breaking news and the latest industry updates.

Is life insurance a good career path to take? What skills and attributes do you think aspiring professionals need to possess to thrive in the sector? Feel free to share your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!