Is getting non-owner car insurance worth it?

Is getting non-owner car insurance worth it? | Insurance Business America

Guides

Is getting non-owner car insurance worth it?

Non-owner car insurance provides coverage if you regularly drive another person’s vehicle. Find out if this type of auto policy is for you

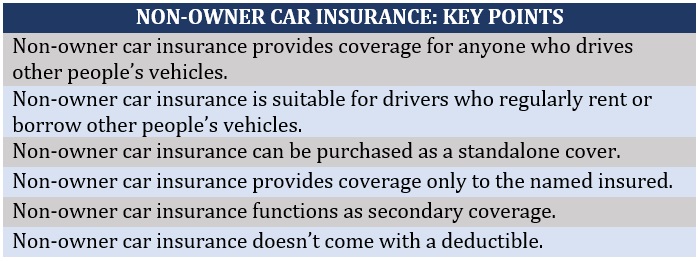

At first glance, non-owner car insurance seems like a pretty straightforward form of coverage. It protects you financially if you get into an accident while driving another person’s vehicle. But just like other types of auto insurance, there are several layers to the kind of protection this policy provides.

In this article, Insurance Business explains how non-owner car insurance works. We will discuss what this policy covers and what it doesn’t, and how much coverage costs.

If you’re wondering whether this type of car insurance is a worthwhile investment, this guide can help.

Since auto insurance is mandatory in almost all states for everyone operating a vehicle, not having your own car doesn’t exempt you. This is where non-owner car insurance comes in handy.

This type of policy provides protection for anyone who frequently drives another person’s vehicle or those whose personal circumstances require them to provide proof of coverage. If you regularly rent or borrow a relative’s or friend’s vehicle for personal driving, then a non-owner policy can be a suitable form of protection.

Many auto insurers offer non-owner car insurance as a standalone policy, although some offer coverage only for existing policyholders.

Non-owner vehicle insurance serves as a secondary type of protection. This means that if you get into an accident, the owner’s car insurance provides coverage first up to the policy’s limits. Once the loss or damage exceeds these limits, your non-owner policy then picks up the tab.

Non-owner car insurance also functions as a named insured policy, meaning it only covers the policyholder.

There are some auto insurers that will let you add your spouse to your policy, but this is not standard practice. Often, if you and your spouse both need non-owner insurance, you will need to take out separate coverage.

Another key feature of non-owner policies is that you don’t need to pay a deductible for coverage to kick in.

Here’s a summary of the key points you need to remember when taking out non-owner car insurance.

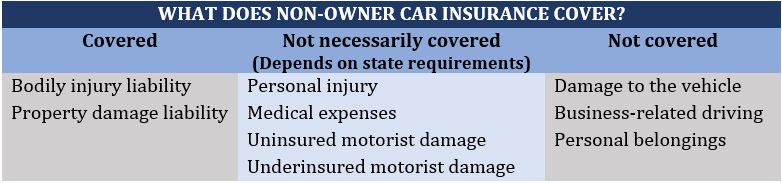

Non-owner car insurance policies are designed primarily to provide liability protection. Liability car insurance protects you financially if you have been found legally responsible for an accident that results in another person’s injury, death, or property damage.

This type of coverage is required in almost all states, that’s why it is often considered the foundation of any car insurance policy.

Liability car insurance provides two types of coverage:

Bodily injury liability: This pays for the medical costs of the person you injured in an accident and your legal expenses if you get sued. Some policies also cover a third party’s lost income and funeral expenses.

Property damage liability: This compensates another person for property damage and losses resulting from an accident you caused. It also covers legal expenses arising from a lawsuit, as well as settlement costs.

Get a deeper understanding of how liability car insurance works in this comprehensive guide.

Non-owner car insurance typically includes your state’s minimum coverage requirements, although you can purchase a policy with higher limits to give you extended protection. And because it’s designed to meet state-mandated coverages, your policy can also offer:

Personal injury protection (PIP): This covers you and your passenger’s medical and treatment expenses if you get injured in an accident. It also pays for lost wages and the cost of household services if your injury prevents you from performing such tasks. PIP coverage is required in no-fault states.

Medical payments (MedPay) coverage: This pays for you and your passenger’s medical and treatment costs, regardless of who caused an accident. MedPay, however, doesn’t cover lost income. This type of coverage is mandatory in Maine and Pennsylvania.

Uninsured/underinsured motorist (UM/UIM) coverage: UM policies compensate you and your passengers for injuries and damaged property if you’re hit by an uninsured driver. This may also cover hit-and-run accidents. UIM coverage, meanwhile, kicks in if the at-fault driver’s insurance is not enough to cover the entire cost of an accident. UM and UIM policies are often bundled together.

We’ve compiled a list of all the minimum coverage requirements for each state in one neat table in our complete guide on how car insurance works.

Non-owner car insurance doesn’t have some of the features present in standard auto policies. Here’s a list of some incidents not covered by your non-owner insurance and what policies can provide coverage instead.

Damages to the vehicle: Non-owner policies don’t cover damage or losses to the vehicle you’re driving. These are typically covered by the owner’s collision and comprehensive car insurance policies.

Business-related driving: If you’re driving a company-owned vehicle, it should be covered by your employer’s commercial auto insurance policy. If the business is renting or borrowing the vehicle you’re using for commercial purposes, then your company needs to take out hired and non-owned car insurance. Both instances are not covered by non-owner car insurance.

Belongings stolen from the vehicle: Personal possessions left inside the vehicles aren’t included in your non-owner coverage. So, it won’t pay out if these are damaged or stolen. Such incidents, however, may be covered by your homeowners’ or renters’ insurance policy.

Here’s a summary of what non-owner car insurance covers and what it doesn’t.

The average cost of a non-owner car insurance policy is around $795 per year based on the various price comparison and insurer websites that Insurance Business checked out. The amount is for a policy with 100/300/100 liability coverage.

The premiums you pay, however, may be considerably lower or higher depending on a range of factors. These include:

Your age: The younger and less driving experience you have, the higher the premiums you need to pay.

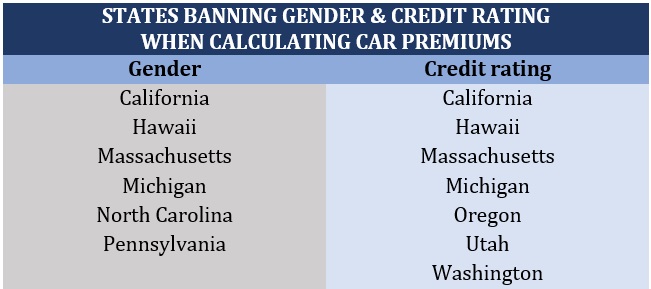

Your gender: Men typically pay more for coverage as they are statistically more prone to accidents than women. The disparity is more pronounced among younger drivers but typically levels off as drivers age.

Where you live: Each state imposes different requirements when it comes to car insurance, which can impact the price you pay for coverage.

Your driving history: Accidents and major violations can raise the cost of non-owner policies. Conversely, having a spotless driving record qualifies you for discounts.

Your credit rating: Insurers often view drivers with poor credit scores as more likely to file claims in the future. This raises their premiums.

The level of coverage: The minimum requirements states impose are often not enough to cover the entire cost of an accident. That’s why it’s advisable to purchase policies beyond these state minimums. You’ll pay more in premiums, but you’ll also get a higher level of protection.

Some states, however, prohibit auto insurance companies from using gender and credit rating in calculating premiums. These states are listed in the table below.

Car insurance is one of the biggest costs associated with owning and operating a vehicle, but there are ways to slash premiums. Get practical tips and strategies on how to access cheap car insurance.

Non-owner car insurance is designed for drivers who frequently use other people’s vehicles. But you need it more than others if:

You regularly borrow other people’s vehicles

While the owner’s car insurance provides liability coverage in case of an accident, you’ll be on the hook for the remaining expenses if these exceed the policy’s limits. Non-owner insurance helps cover the cost up to the policy’s limits.

You often rent vehicles from car rentals

If you’re renting a vehicle from car rental companies, you can also purchase rental car insurance in-house. However, this often costs more than a standard non-owner car insurance policy. If you want to save on premiums, getting non-owner auto coverage is the way to go.

You frequently rely on car-sharing services

Car-sharing services offer in-house coverage, but this is often the bare minimum. If you want a higher level of protection, it’s best to get non-owner insurance.

You don’t want a gap in your car coverage

Having a gap in car coverage results in higher premiums once you decide to purchase insurance again, even if you didn’t own a vehicle during that period. To avoid this, it pays to take out non-owner car insurance.

You’re required to provide an SR-22 certificate

If you’re in the process of getting your license reinstated after a major traffic violation or criminal conviction, you may need to provide proof of coverage in the form of an SR-22 certificate. Depending on the state, you may need to do so even if you don’t own a car. This is where non-owner car insurance comes in handy. Your insurer files the SR-22 (or FR-44 in Florida and Virginia) document on your behalf to prove that you have at least minimum coverage.

Non-owner car insurance, however, doesn’t suit everyone. You can skip this kind of coverage if:

Someone from your household owns the car you regularly borrow

You don’t need non-owner insurance if the car you often borrow belongs to someone you live with. This is because you can be named as an additional insured in their policy.

You often borrow the same vehicle from someone outside your home

Insurers typically require policyholders to name every driver who frequently uses their vehicle in their policy. This means that you can be covered under the owner’s car insurance.

You rarely drive

Non-owner vehicle insurance is not for you if you rarely drive. It may be better – and less costly – if you just purchase auto insurance from a rental company every time you rent or just rely on the owner’s car policy if an accident occurs.

You’re driving a vehicle that your company owns

If you’re using a company-owned vehicle for business-related tasks, you should be covered under your employer’s commercial auto insurance. Just make sure that you’re not using the vehicle to run personal errands or for recreation.

What does non-owned auto mean in car insurance?

In car insurance, a non-owned auto is any vehicle that is regularly driven by a non-owner. But since car insurance is legally required for anyone operating a vehicle, non-owners must also take out coverage, aptly called non-owner car insurance. This policy is designed to provide protection for those who frequently drive a vehicle that another person owns.

Can you get car insurance if you don’t own a car?

Even if you don’t own a vehicle, you can still access coverage in the form of non-owner car insurance. This type of policy protects you from the financial liability of paying for bodily injury and property damage from an accident you caused. Non-owner car insurance suits you if you frequently rent or borrow a vehicle for your personal activities.

What will happen to your non-owner car insurance after you’ve bought a car?

Once you’ve bought your own vehicle, you need to take out a standard car insurance policy. Some insurers may allow you to convert your non-owner insurance to a standard policy. But since regular auto insurance typically costs more, you may also need to pay higher premiums.

Car insurance can be a complicated form of coverage, especially if you don’t have sufficient industry knowledge and experience. If you want to gain a deeper understanding of the auto insurance space, you can visit our Motor & Fleet News Section. Bookmark this page to easily access breaking news and the latest industry developments.

Have you experienced taking out non-owner car insurance? How was it? We’d love to see your story in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!