IRC Releases StateAuto InsuranceAffordability Rankings

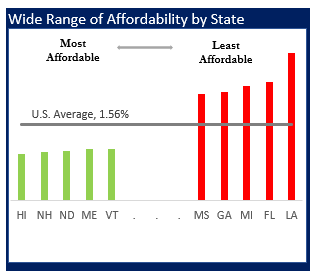

Louisiana, Florida, and Michigan are the three least affordable states for personal auto insurance, according to a new report by the Insurance Research Council (IRC). The three most affordable states, IRC finds, are Hawaii, New Hampshire, and North Dakota.

The state-by-state affordability rankings by IRC – like Triple-I, an affiliate of The Institutes – are based on insurance expenditures as a share of median household income. The report draws on data from the National Association of Insurance Commissioners (NAIC), which are only available up to 2019 and, therefore, don’t reflect more recent circumstances, such as the pandemic and the inflationary impact of supply-chain disruptions and the war in Ukraine.

Before these events, auto insurance nationwide had been becoming more affordable since the 1990s, when premiums as a percentage of median household income averaged 1.9 percent. By the 2010s, it had decreased to 1.6 percent, and, in 2019, that figure stood at 1.56 percent.

During this 30-year period, median household income grew 2.9 percent annually.

Affordability varies dramatically by state, with Hawaii coming in as the most affordable, with expenditures standing at 0.95 percent of income. The least affordable state is Louisiana, with the average expenditure-to-income ratio more than three times higher, at 3.01 percent.

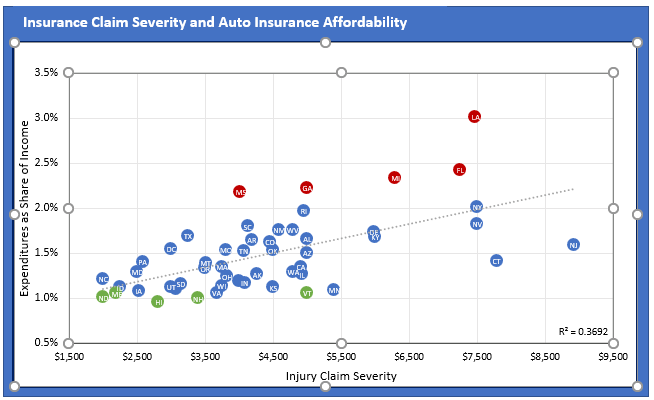

The report notes that attempts to reduce these costs must focus on key cost drivers, including accident frequency, repair costs, injury claim relative frequency, injury claim severity, medical utilization, attorney involvement, claim abuse, uninsured motorists, and litigation climate.

Looking ahead

Pandemic and post-pandemic riskiness of U.S. highways could also impact future affordability trends. After decades of decline, U.S. traffic deaths have increased in the past several years due to more speeding, driving under the influence, and not wearing seat belts during the pandemic. In 2021, U.S. traffic fatalities reached a 16-year high, with nearly 43,000 deaths.

“When everyday life came to a halt in March 2020, risky behaviors skyrocketed and traffic fatalities spiked,” said National Highway Traffic Safety Administration (NHTSA) administrator Steven Cliff. “We’d hoped these trends were limited to 2020, but, sadly, they aren’t.”

In 2022, NHTSA estimates, 9,560 people died in motor vehicle crashes between January and March, up 7 percent from the same period in 2021, making it the deadliest first quarter since 2002.

The IRC report highlights the role of attorney involvement in driving up insurer expenses – and, ultimately, policyholder premiums – in states where auto coverage is least affordable. As attorney involvement tends to be more prevalent in bodily injury claims cases, the NHTSA numbers are important for understanding anticipated upward pressure on premium rates.

All these factors contribute to increased frequency and severity of claims and, ultimately, higher premiums as insurers seek to maintain required levels of surplus to ensure their ability to keep their promises to policyholders.