IRC Outlines Florida’sAuto Insurance Affordability Problems

Florida is one of the least affordable states for personal auto insurance, according to a new study by the Insurance Research Council (IRC). Claims trends are pushing premium rates up nationwide, and Florida is being hit particularly hard.

In 2020, the average expenditure for auto insurance was $1,342 in Florida, more than 30 percent higher than the national average, the IRC report says, citing data from the National Association of Insurance Commissioners (NAIC). In terms of affordability, IRC says, auto insurance expenditures were 2.39 percent of the median household income for the state. Only Louisiana was less affordable.

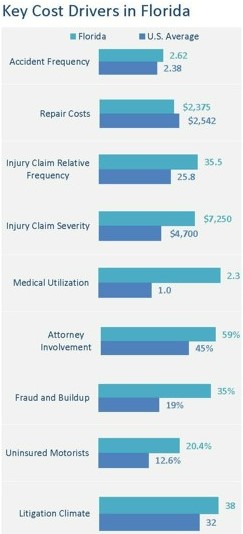

“Efforts to improve auto insurance affordability must begin with the underlying cost drivers,” the IRC report says. In nearly every of these categories, Florida costs are well above the national average:

Accident frequency: The number of property damage liability claims per 100 insured vehicles in Florida is 10 percent above the national average.

Repair costs: For years, the average cost of a property damage claim in Florida was below the national average. However, evidence suggests repair costs are increasing faster in Florida than elsewhere.

Injury claim relative frequency: Floridians show a greater propensity to file injury claims once an accident occurs, with a relative claim frequency 40 percent higher than the national average. Florida is the only no-fault state with an above-average ratio of bodily injury to property damage claim frequency.

Injury claim severity: The median amount paid per claim for auto injury insurance claims for all injury coverages combined is much higher in Florida.

Medical utilization: Florida auto claimants are more likely than those in other states to receive diagnostic procedures, such as magnetic resonance imaging (MRI).

Attorney involvement: Florida claimants are more likely to hire attorneys. Attorney involvement has been associated with higher claim costs and delays in settlement time.

Fraud and buildup: The percentage of all auto injury claims with the appearance of claim fraud and/or buildup is evidence of Florida’s culture of fraud.

Uninsured motorists: Florida has one of the highest rates of uninsured motorists, both a symptom and a cause of affordability challenges.

Litigation climate: According to a survey of business leaders, Florida’s legal environment ranks near the bottom of state liability systems in terms of fairness and reasonableness.

“Unique features in Florida’s insurance system and a long‐standing culture of claim and legal system abuse have allowed some medical and legal professionals to generate substantial income for themselves at a significant cost to Florida drivers,” said Dale Porfilio, IRC president and Triple-I chief insurance officer. Triple-I and IRC are both affiliated with The Institutes.

Policymakers in the Sunshine State enacted substantial property insurance reform in late 2022 to address the affordability and availability crisis in homeowners’ insurance and pledged to tackle similar issues in other lines of insurance to ease the financial burden that paying for auto insurance represents for Florida drivers.

Bills being addressed by the state’s Senate and House focus on significant tort reform to stop lawsuit abuse, including the elimination of one-way attorney fees for litigated auto claims and abolition of assignment of benefits for auto insurance claims — a generator of fraud and litigation. One-way attorney fees allow drivers who successfully sue their insurer to recoup attorney fees – but not the other way around.

Learn More:

Florida Insurance Crisis Reforms Gain Momentum With Latest Proposal

Florida Auto Legislation, on Heels of 2022 Reforms, Suggests State Is Serious About Insurance Crisis Fix

Florida and Legal System Abuse Highlighted at JIF 2022

Fraud, Litigation Push Florida Insurance Market to Brink of Collapse

Why Personal Auto Insurance Rates Are Likely to Keep Rising

Florida’s AOB Crisis: A Social-Inflation Microcosm

Triple-I Issues Briefs:

Florida’s Homeowners Insurance Crisis

Addressing Florida’s Property/Casualty Insurance Crisis

Personal Auto Insurance Rates

Risk-Based Pricing of Insurance