Investment management firm hit with record fine in greenwashing crackdown

Investment management firm hit with record fine in greenwashing crackdown | Insurance Business Australia

Environmental

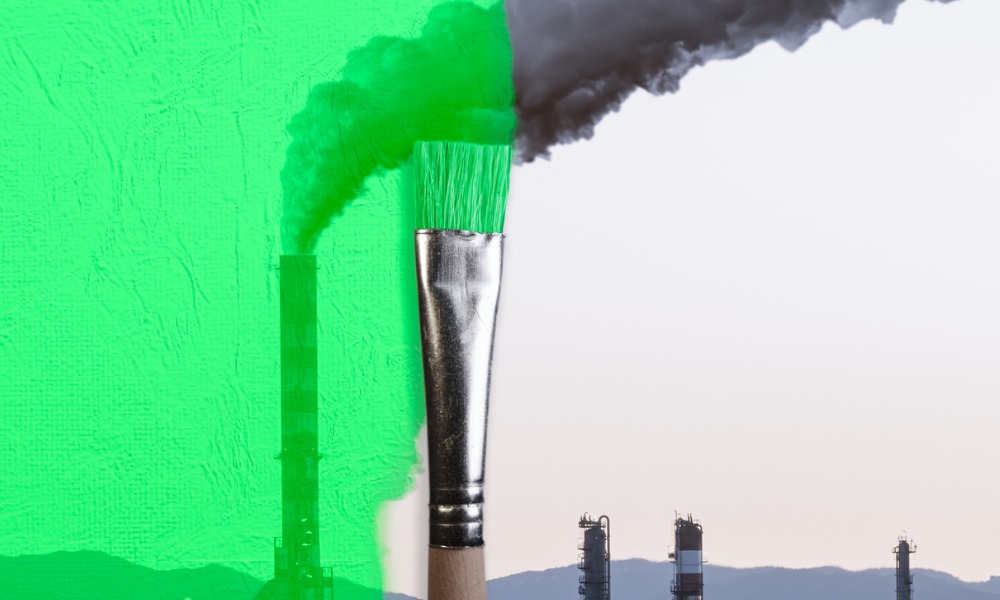

Investment management firm hit with record fine in greenwashing crackdown

Could this be a warning for insurers

Environmental

By

Roxanne Libatique

Vanguard Investments Australia (Vanguard) has been fined $12.9 million by the Federal Court for misleading claims regarding the environmental, social, and governance (ESG) screening of its Vanguard Ethically Conscious Global Aggregate Bond Index Fund.

The penalty, the largest of its kind in Australia for greenwashing, was the result of legal action initiated by the Australian Securities and Investments Commission (ASIC).

ASIC deputy chair Sarah Court highlighted the significance of the ruling, emphasising that greenwashing threatens the integrity of financial markets.

“Greenwashing is a serious threat to the integrity of the Australian financial system and remains an enforcement priority for ASIC,” she said.

Vanguard’s misleading ESG statements

Vanguard’s claims were made through various channels, including product disclosure statements, website content, and public presentations.

The company stated that the fund excluded businesses involved in industries such as fossil fuels, but the court found that approximately 74% of the fund’s securities had not been evaluated against these exclusions.

Justice O’Bryan noted the seriousness of the misconduct, explaining that Vanguard’s failure to apply the promised exclusions undermined the key ethical selling point of the fund.

“Vanguard’s misrepresentations concerned the principal distinguishing feature of the fund, being its ‘ethical’ characteristics. Vanguard developed and promoted the fund in response to market demand for investment funds having those characteristics,” O’Bryan said.

The court also found that the misrepresentations boosted Vanguard’s reputation as a provider of ethical investment products, benefiting the company financially while misleading its investors.

“The misrepresentations enhanced Vanguard’s ability to attract investors to the fund and enhanced Vanguard’s reputation as a provider of investment funds with ESG characteristics, as compared to what would have been the case if Vanguard had accurately disclosed the ESG screening limitations and the fund’s exposure to issuers engaged in the excluded industries,” O’Bryan said.

ASIC has issued guidance on avoiding greenwashing, including Information Sheet 271, which advises financial institutions on how to accurately promote ESG and ethical products. Additionally, ASIC’s Report 791 outlines regulatory actions taken from April 2023 to June 2024 related to misleading sustainability claims.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!