International (non-US) SCS losses increase in both frequency and severity: CRESTA

The CRESTA organisation, which tracks insurance industry losses outside the United States, says the data shows that severe convective storm (SCS) loss events of above $1 billion exhibit both increasing frequency and severity.

CRESTA’s latest update on international insured catastrophe loss events that it tracks, highlights the increase in severe convective storm (SCS) losses around the globe.

Already, SCS loss events have come into sharp focus in the United States, with record levels of insurance and reinsurance market impact in recent years, culminating in SCS losses hitting $50 billion in 2023 already.

But convective storms, or severe thunderstorms and the perils that come along with them, so hail, tornadoes, straight line winds etc, have also been causing increasing economic and insured losses around the world in recent years as well.

In the last quarter, Q3 2023, CRESTA highlights that the largest international insured loss event was the severe convective storms that affected Northern Italy in July 2023, bringing damaging hail and winds to the regions of Lombardy, Veneto, Friuli-Venezia-Giulia, Piemonte and Emilia-Romagna.

In an initial estimate, CRESTA pegs this as a US $2.2 billion insurance industry loss event.

Another significant event in the quarter was extreme rainfall in late July and early August across China, that led to flooding in Beijing and the surrounding regions, which CRESTA currently estimates as a US 1.4 billion industry loss.

Severe convective storms are playing an increasingly important role in insurance industry losses outside the United States, CRESTA explained.

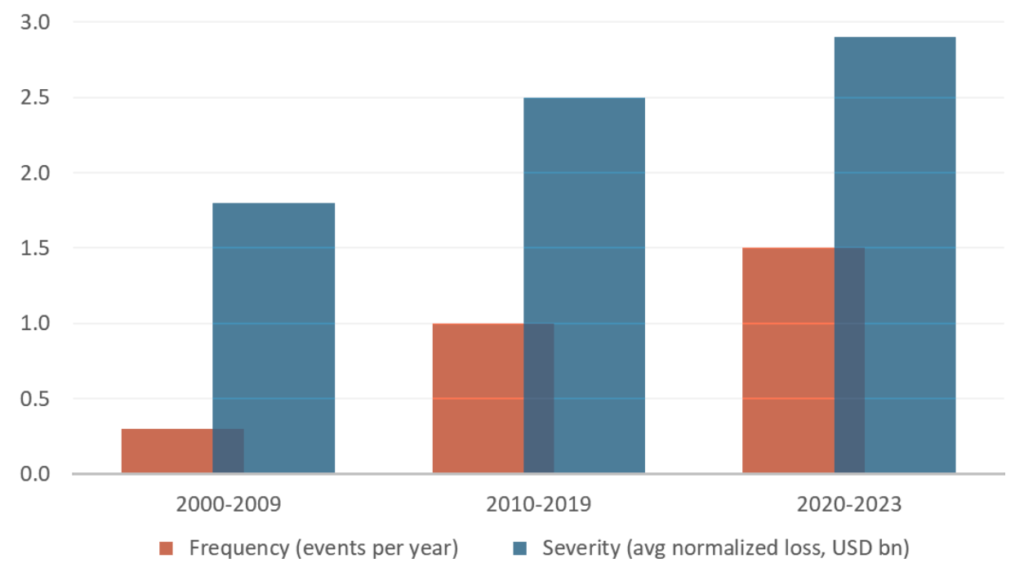

Commenting on the chart above, Matthias Saenger, Product Manager of CRESTA, explained, “The increase in the frequency and severity of severe convective storms is evident in our data which encompass 24 years of loss history. With loss figures indexed to reflect 2023 values, the decade from 2000 to 2009 saw three events which generated industry losses exceeding USD 1bn, while from 2010 to 2019 there were ten such events. Since 2020, we have already experienced six events which have exceeded our industry loss threshold.

“In terms of severity, the average event loss figures for the time periods are USD 1.8bn (2000- 2009), USD 2.5bn (2010-2019), and USD 2.9bn (2020-2013). The CLIX data therefore clearly illustrate that there has been a marked increase in the frequency and severity of severe convective storms since 2000.”

Showing that international severe convective storm (SCS) loss trends appear to be following the same path as the United States, where SCS activity has often become the biggest contributor to insurance market losses, in years where hurricane events are less pronounced.

CRESTA said that it added six new catastrophe events to its database from Q3 2023, while 23 loss events from the past three years were reviewed, 11 resulting in updates due to new information.

In 2023 so far, CRESTA is now tracking some 11 catastrophe events (ex-US) that it estimates have caused $1 billion or more in insurance market losses, including the Auckland floods and Cyclone Gabrielle in New Zealand, the Kahramanmaras Earthquake in Turkey, a number of outbreaks of severe convective storms in Europe, and flood events in Europe and China.