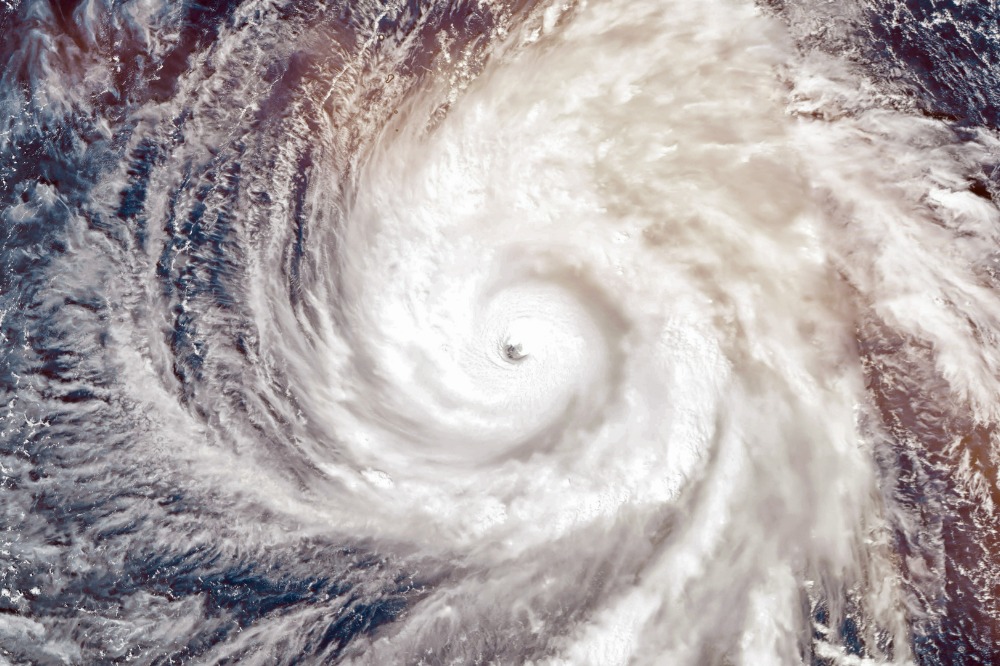

Insurers prepared for Cyclone Gabrielle claims, says ICNZ CEO

The Insurance Council of New Zealand (ICNZ) is fully prepared for claimants and their many claims as Cyclone Gabrielle continues its rampage, says chief executive Tim Grafton. An estimated 40,000 claims are already being handled by NZ insurers, with dates ranging from January 27 to February 2.

“While Gabrielle is yet to pass, insurers are already prepared with all available staff on hand to get on with accepting claims, prioritizing those displaced from their homes or otherwise needing extra care,” said Gratfton, CEO of Insurance Council of New Zealand – Te Kāhui Inihua o Aotearoa.

The climate event, which is the largest to date in the history of New Zealand, has already spurred the mobilization of insurers’ staff from across Aotearoa, Australia and further afield. ICNZ noted that these measures are already in place, and teams are poised to systematically work through the claims that are still expected to climb as Gabrielle rages on.

To be settled in a matter of months

While the number of claims is still expected to rise, most of these are expected to be settled in a matter of months. ICNZ noted that for claimants hit by significant property damage and those requiring demolition and full rebuilds, the process may take longer. Another subset which requires NZ insurers to look at the land first before assessing everything else may take longer still.

“People should put their own safety, and that of their whanau, first,” said Grafton. “House and contents policies typically include temporary accommodation benefits, including those held by renters. If it’s not possible to stay in your home, call your insurer as soon as possible. If you are able to stay in your home, it is best to lodge your insurance claim on-line.”

Top NZ insurer AA Insurance has already assured customers that they are on standby to assist with additional claims as Gabrielle hit the North Island earlier this Sunday. The local states of emergency are also expected to last another week.

“Aotearoa’s insurers have the strength and experience to see this through. As a sector, we will stand with all affected New Zealanders until the job is done,” Grafton concluded.