Insurers Investing in AI-Based P/C Claims Fraud Detection Solutions to Fight the Increasing Sophistication of Fraud

Demand for insurance claims fraud detection solutions is growing; new Aite-Novarica Group report profiles six vendors

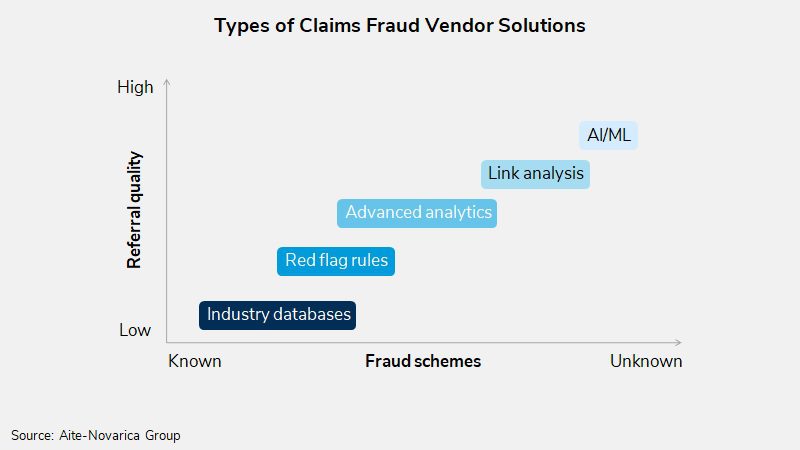

Boston, MA (Mar. 22, 2022) – To assist claims professionals and special investigation unit (SIU) teams in identifying suspicious claims activities, insurance companies are investing heavily in AI and advanced technology to analyze both structured and unstructured data to prevent claims fraud. In a new Impact Report, AI-Based P/C Claims Fraud Detection Solutions: A Market Overview, research and advisory firm Aite-Novarica Group evaluates the AI-based P/C claims fraud detection solution market, lists key market trends affecting fraud detection specific to P/C claims, and provides vendor profiles for BAE Systems Digital Intelligence, Daisy Intelligence, FRISS, Quantexa, SAS, and Shift Technology.

“Claims professionals, SIU teams, and IT executives should look beyond traditional fraud detection methods toward next-generation features and functionality,” said Stuart Rose, Strategic Advisor at Aite-Novarica Group. “Features such as real-time scoring, unstructured data analysis, and self-learning models will be highly differentiated and provide insurers with competitive positions in identifying claims fraud.”

“Insurers need to demand more advanced detection functionality, especially associated with digitalization and unstructured data,” adds Deb Zawisza, Senior Principal at Aite-Novarica Group and co-author of the new report. “Insurers want to partner with a vendor that has a deep understanding not only of fraud detection but also of the unique requirements, challenges, and priorities of SIU teams and P/C claims executives.”

Click here to access the report.

Report Preview

AI-Based P/C Claims Fraud Detection Solutions: A Market Overview

Insurers are turning to cloud-based solutions to ease deployment and to analyze the growing data volume

The demand for insurance claims fraud detection solutions is growing as insurers implement real-time fraud detection techniques to detect and prevent opportunistic and organized fraud across multiple lines of business and jurisdictions.

This Aite-Novarica Group vendor analysis report evaluates the AI-based P/C claims fraud detection solution market, lists key market trends affecting fraud detection specific to P/C claims, and provides vendor profiles based on factual responses to a universal request for information (RFI), product demonstrations, and vendor client feedback. This report profiles the following vendors: BAE Systems Digital Intelligence, Daisy Intelligence, FRISS, Quantexa, SAS, and Shift Technology.

This 46-page Impact Report contains three figures and six tables. Clients of Aite-Novarica Group’s Property & Casualty service can download this report and the corresponding charts.

Click here to access the report.

This report mentions CRIF Decisions, DataWalk, DXC Technology, EvolutionIQ, IBM, INFORM, LexisNexis Risk Solutions, Metromile, Owl.co, Palantir, Skopenow, Synectics Solutions, and Verisk.

About Aite-Novarica Group

Aite-Novarica Group is an advisory firm providing mission-critical insights on technology, regulations, strategy, and operations to hundreds of banks, insurers, payments providers, and investment firms—as well as the technology and service providers that support them. Comprising former senior technology, strategy, and operations executives as well as experienced researchers and consultants, our experts provide actionable advice to our client base, leveraging deep insights developed via our extensive network of clients and other industry contacts. For more information, visit aite-novarica.com.

Source: Aite-Novarica Group

Tags: Aite-Novarica Group, Artificial Intelligence (AI), dxc, fraud, FRISS, IBM, InsurTech, InsurTech Spotlight, LexisNexis Risk Solutions, Property/Casualty (P&C) insurance, SAS, Shift Technology, Skopenow, technology investment, Verisk