Insurers in Europe need to focus on aging population

In this series on sustainability, we have discussed the various definitions on what sustainability means, from environmental concerns to integrating the needs of vulnerable, underserved communities. At its heart, sustainability is concerned with making the resources last from one generation to the other and making sure that resources are accessible to every demographic. As life expectations increase, a key demographic that Europeans need to consider in their commitment to sustainability is the aging population.

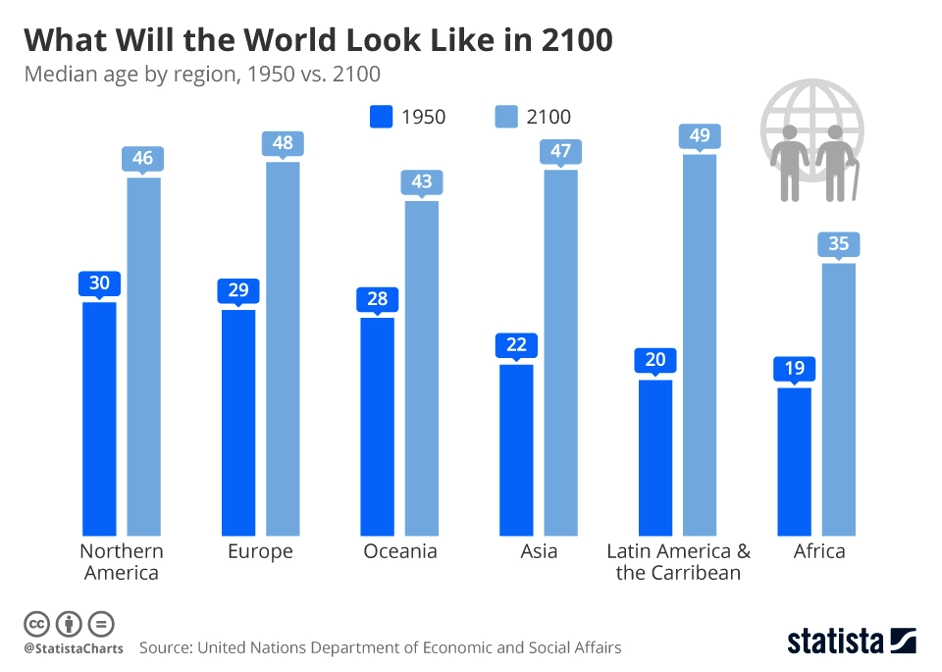

Click/tap to view a larger image.

Statistica estimates that by 2100, the median age in Europe is estimated to reach 48. Even closer than that, by 2050, one in six people in the world will be over age 65 and the number of people living with dementia will be 2.5 times higher than it is today. It is projected that there will be close to half a million centenarians in the EU-27 by 2050. The aging population in the EU is set to have profound implications for citizens on a personal level in terms of livelihood, career and caregiving. This spills into government, business and civil society, impacting health and social care systems, labour markets, public finances and pension entitlements. As customer needs change in response to this, insurers need to create strategies to insure and provide solutions for an older population.

The technology we have at our disposal is the insurance industry is well-positioned to make meaningful interventions in the lives of aging consumers. As we refine what our insurance ecosystems can do, there are multiple points of value to be explored. For example, in a recent blog post – Innovation rises to meet disability and long-term care risk – by Accenture, Global Insurance Sector Lead, Kenneth Saldanha, he mentions that at CES 2022 in Las Vegas, there were launches of home robot products to assist with housekeeping, for example. The guiding principle of these ecosystems is to prevent, mitigate, and manage the risks of illness and disability, including later in life.

As Europeans are living longer than ever before and the age profile of society is rapidly developing, insurers are finding ways to reimagine for long-term care. Also, even though the gap is narrowing, women outnumber men at older ages and society and insurers need to take this fact into account when designing products and services for seniors

Examples of finding new ways to reimagine insurance for seniors include Dutch insurance group Achmea who has stated an intention to create long-term care policies that enable older people to stay independent for as long as possible. And MAPFRE in Spain is launching new long-term care policies that allow speedy access to benefits as part of their wider “senior generation” initiative.

Older people in Europe are more likely than younger generations to live in rural areas, and these areas often suffer from a low provision of services. The answer to tackling problems of access to essential services in rural areas mostly relies on solidarity, thus the model of healthcare mutuals, based on solidarity and limited profitability could be key to a sustainable and inclusive recovery.

It’s not just about aging in place. Insurers such as Staysure travel insurance provides products tailored to travellers over 50 years of age in the UK. Travelling in retirement is a dream for many but in the current global economic climate, saving can be a challenge. Insurance Europe reports that the challenge of having an adequate income in retirement is particularly acute for certain groups, primarily those whose ability to save has been most hit by the effects of the pandemic. Multi-pillar pension systems, which complement state provision with occupational and personal pensions, are widely seen as the most sustainable and effective systems. And life insurers are major providers of those occupational and personal pensions.

As with any shift in the market, insurers can benefit from being led by the needs of their customers. In this case, it’s about catering to the full needs of an important market segment that will enhance the sustainable impact European insurers will have for years to come.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.