Insurers face climate risk challenges: Satellites could offer solutions

With each passing month between June 2023 and May 2024 setting new global temperature records. The specter of more frequent and severe extreme weather events looms larger. This isn’t just a temporary worry, but an urgent wake up call for action to insurers as volatile climate risks hinder the industry’s prosperity.

The insurance industry relies on solid data, but traditional information sources and modeling tools are playing catch up with the pace of climate change. In the search for new tools for more accurate and up-to-date data and risk modeling, satellite technologies are leading the way in mitigating the mounting threats posed by climate change.

While the technology itself is not new, its high costs have historically deterred the industry from fully embracing its potential. However, this is no longer the case. The rapid advancements in satellite-based risk monitoring and assessments now offer underwriters and risk engineers a cost-effective way to analyze risk in advance, leading to more accurate pricing, improved loss ratios and better financial performance.

Property

Consider the case of property, a cornerstone of global wealth, accounting for an estimated two-thirds of it. The effects of climate change, in the form of extreme weather events, are already causing damage that exceeds the norm.

The Economist recently projected that property owners worldwide will face a $25 trillion bill over the next 25 years to deal with the consequences of climate change. Alongside hurricanes, wildfires, and floods, the publication emphasized the significant and growing peril of subsidence-related property damage.

As droughts deepen and precipitation periods become increasingly intense, soils under buildings move and can cause structural damage, from cracks in the walls to broken utility connections. The phenomenon is well documented globally, with densely built-up cities suffering, from London and Amsterdam in Europe to Houston and New Orleans in the US.

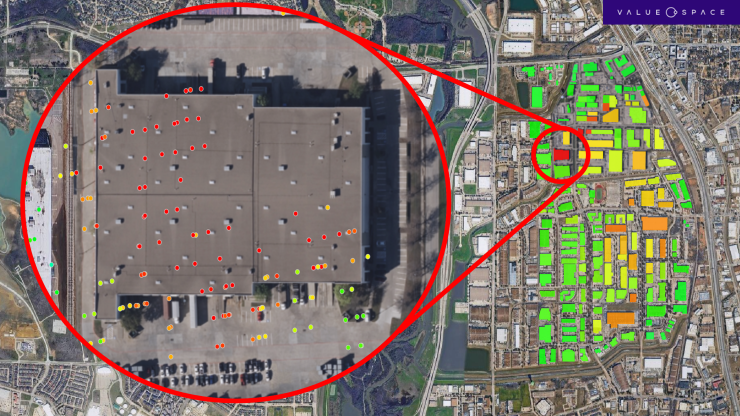

Detailed satellite survey of subsidence in New Orleans with easily identifiable hotspots encircled.

Addressing subsidence risks

There is a clear awareness that better tools than the existing ones used for calculating subsidence risks to property—such as static exposure maps updated in 2 to 3-year intervals —are needed to understand where the risks are. Satellite-based monitoring offers insurers a way to get ahead in identifying and quantifying subsidence risks because surveys are taken every two weeks, creating an almost real time exposure view.

You don’t have to look that far to understand the significance of this issue. In the UK, PwC modeling shows that the expected cost of subsidence for insurers could increase to £1.9bn by 2030. In France, these climate-related claims are expected to triple to €43 billion between 2020 and 2050, compared to the previous 30-year period.

Radars that are attached to satellites have been scanning the movement of the entire Earth’s surface for more than ten years, measuring millimeter-scale deformations in any location every two weeks as they fly past. Analysis of this data delivers an almost real-time view of subsidence and provides insurers with a 2 in 1 view from large-scale exposure mapping to understand and detect risks on the city down to even an individual property level risk analysis.

Satellite-measured movement timelines combined with other climate data – precipitation, temperature, and soil moisture – allow users to detect, monitor, and quantify existing and developing subsidence risks with previously impossible accuracy.

Satellite-survey of commercial property in Dallas. Full zoom-in on a building with different subsidence measurements indicating possible structural stresses.

Improving infrastructure resilience

Climate change is also affecting the world’s critical infrastructure, creating pressure on railways, highways, and dams that are getting older and were not designed with today’s climate patterns in mind.

For instance, the railway industry has seen increased climate-related service disruptions and is recognizing the need to invest billions to become more resilient. Given that they often have hundreds, if not thousands, of miles of track under maintenance, it is difficult to monitor and detect risks over their networks with traditional on-site methods.

Satellites on the other hand can scan movements continuously over hundreds of miles of track and surroundings, detecting small existing or developing deformations that can be warning signs for more prominent movements – such as landslides, shifts in the track bed, or the deterioration of supporting infrastructure like bridges, retaining walls, and tunnels, which could lead to significant losses from service disruptions. Using satellite-based movement surveys can help to detect existing and developing signs of structural weaknesses and target investment to increase the network’s climate resilience to where it matters the most.

Recent significant disruptions on the U.S.’s second busiest passenger rail corridor, running on the coast of California – the LOSSAN corridor – provide an example of what satellite data can bring to the table. Several ground movement incidents in San Clemente created months-long stoppages and required tens of millions of dollars worth of repairs. Assessing satellite data for movements on this track section showed that a damaging landslide could have been detected up to six months before the actual incident. Similarly, satellite data showed that initial works to stabilize a track shift in the area were ineffective in preventing further movement and recurring damage to the railway.

Certain asset classes are even riskier as their failure can cause large-scale economic losses, human suffering, and environmental catastrophes. For example, in the US, there are more than 90,000 dams nationwide, with an average age of 63 years. This means that the majority have now entered an “alert age” when these structures surpass their designed lifespan of 50 years. Since the 1980s, there have been, on average, 24 dam failures a year, more than was the case for preceding decades. The US Association of State Dam Safety Officials estimated in 2023 that the total cost to rehabilitate only the non-federal dams in the US stands at $157.5bn.

An example of a recent failure was in Michigan, where the Edenville dam breached in 2020, resulting in flooding that caused more than $200 million in property damage and forced the evacuation of more than 10,000 people. Assessing the satellite data for the Edenville dam showed that satellite-based monitoring would have pinpointed developing deformation on the failed section of the dam up to 14 months before its failure, which would have given on-site risk engineers valuable time to take remedial action.

Future outlook

With an eye to the future, satellite-based risk assessments offer an almost real-time view of existing or developing structural risks for property, dams, railways, highways, and more. With access to up-to-date deformation surveys, insurers can reduce financial losses and protect the infrastructure that supports daily life.

Integrating satellite-based monitoring and assessments not only delivers a more accurate premium setting and improves loss ratios but also significantly reduces costs. This reassurance should relieve insurance professionals, knowing they can enhance their resilience to climate-related risks without substantial financial burdens.