Insured catastrophe losses have now surpassed $100bn in 2023: Bowen

Global insurance and reinsurance market losses from natural catastrophe events have already surpassed $100 billion in 2023, making this the sixth year since 2017 that this level of nat cat insured losses has been reached, according to Gallagher Re’s Chief Science Officer Steve Bowen.

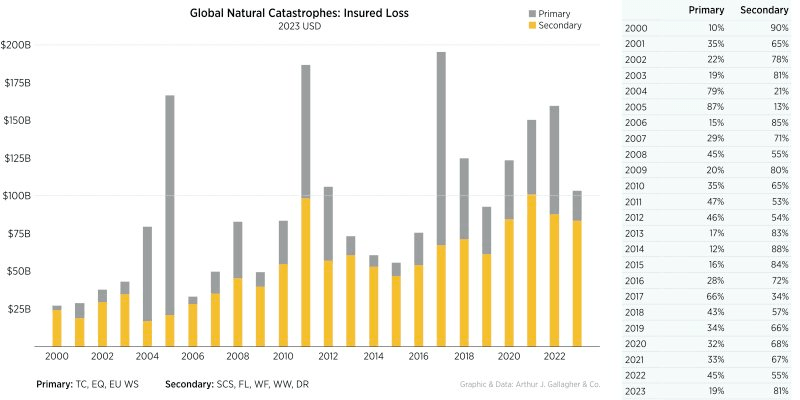

Secondary peril events have had a significant impact in insurance markets again this year, with Bowen’s data estimating that 81% of the now over $100 billion of insured catastrophe losses came from these perils.

Posting on Linkedin, Bowen said, “We continue to believe that $100 billion insured loss years is becoming the benchmark moving forward.”

“Perhaps the most interesting part of 2023, thus far, is that we’ve gotten to $100+ billion almost solely driven by high frequency / lower dollar ‘secondary’ events versus low frequency / higher dollar ‘primary’ events,” Bowen added. “In fact, this is one of the few years where we’ve hit $100+ billion without a major ‘primary’ event driving loss costs.”

Severe convective storms (SCS) losses in the United States continue to be the biggest contributor to the global bill, with $56 billion through the start of November, Bowen explained.

He said that it’s actually not that surprising that secondary perils have driven the bulk of losses, as since the year 2000 only three years, 2004, 2005, and 2017, have seen primary perils drive the majority of insured catastrophe losses.

Other years have all seen secondary perils as the main contributor to insurance and reinsurance market losses, as the data below shows, shared by Bowen.

Bowen highlighted that, “This is an important point as we head into upcoming reinsurance renewal cycles. As insurance carriers continue to see growing losses from non-peak perils, it’s going to lead to more creative means to gain access to greater reinsurance protection.”

The insurance industry needs frequency and aggregate reinsurance solutions, to assist in covering more of the risks that they now have to bear due to higher attachments and more stringent coverage terms.

But the industry will also need to be prepared to pay the price for that coverage, as reinsurers and ILS funds remain focused on sustaining acceptable returns for their investors.

Bowen also said, “We can look to reasons such as more damaging events influenced by climate change, annual extreme weather / natural catastrophe volatility, greater volume of exposed assets, higher replacement costs, inflation, and growing insurance penetration as to why losses will likely keep increasing. This should no longer by a surprising narrative. We need to switch to a proactive stance versus our natural reactive mindset to guarantee better protection and mitigation against loss potential before it is realized.”