Insurance for contractors: 10 essential policies for construction projects

Insurance for contractors: 10 essential policies for construction projects | Insurance Business Canada

Guides

Insurance for contractors: 10 essential policies for construction projects

Insurance for contractors is needed for construction projects. But with plenty of options available, finding the right policies can be hard. This guide can help

As a contractor, you face various risks when managing and completing construction projects. Having the right coverage is crucial in ensuring that you and your business are protected.

Insurance for contractors comes in many forms. The key to finding the policies that match your needs is understanding what options are available.

In this article, Insurance Business will walk you through the different policies contractors and skilled tradespeople should consider to keep themselves financially protected. Insurance professionals can also share this piece with their clients to help them make informed choices.

Find out which insurance policies are essential for contractors handling construction projects in this guide.

Contractors insurance is the general term given to a range of policies designed to protect contractors and skilled tradespeople financially against claims involving their work. These include third-party injuries, property damage, monetary losses, and faulty workmanship.

Some policies may be legally required, depending on the project you’re working on. Others are set as requirements for your business contract.

While contractors are typically associated with construction projects, insurance for contractors extends to professionals operating in other industries. These include agriculture, advertising, media, mining, oil and gas, and technology.

Contractors can access a range of policies, with each providing different levels of protection. Here are some of the most essential types of insurance that contractors working on various construction projects need to consider.

1. Commercial general liability insurance

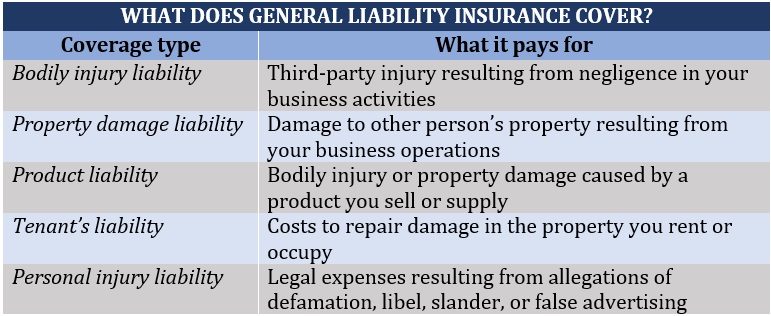

Commercial general liability insurance, also called CGL insurance, protects you financially against claims of bodily injury and property damage due to negligence in your business activities. It also covers claims resulting from defective work or a faulty product. A standalone product liability insurance policy may also pay for the latter.

General liability insurance for contractors is designed to protect you against lawsuits. It can also cover claims relating to defamation, libel, or slander. CGL insurance pays for legal expenses, damages, and out-of-court settlements up to the limits of your policy.

Here’s a summary of the different levels of protection a comprehensive commercial general liability insurance policy provides:

2. Builder’s risk insurance

A builder’s risk insurance policy provides protection against any losses or liability arising from a construction project. It covers the building, materials on-site, and contractor’s liability throughout the project’s duration.

Also called course of construction insurance or construction liability insurance, this form of coverage is often needed for:

construction of new homes and commercial buildings

building expansions

major renovations

Depending on your agreement, builder’s risk insurance can be taken out by the property owner or the contractor. It’s important to confirm who will be responsible for purchasing coverage when finalizing the details of your contract.

3. Tools and equipment insurance

This type of insurance for contractors covers the cost of replacing or repairing the tools and equipment essential to your business. These include items and machinery that you rent or are in your care. Policy limits on the value and age of the items apply.

Some policies also have provisions that pay for lost income and the costs incurred for additional supplies or services necessary to keep the project on schedule. Tools and equipment insurance can be purchased as a standalone policy or as a rider for your commercial property coverage.

4. Equipment breakdown insurance

Equipment breakdown insurance works essentially the same way as tools and equipment coverage. Both pay for items that are lost or damaged due to an insured event. The difference, however, is what these policies cover.

Unlike tool and equipment insurance which covers movable items that can be transported to different job sites, equipment breakdown insurance provides protection for stationary equipment. This includes boilers, computer systems, generators, HVAC systems, and other infrastructure-related machinery.

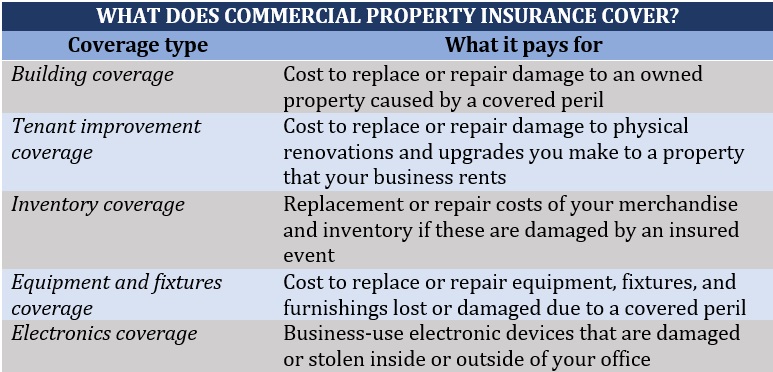

5. Commercial property insurance

Commercial property insurance is important if you own or rent office space. This policy covers physical loss or damage to your property and its contents due to an external event, including fire, theft, and vandalism.

Here’s a summary of what commercial property insurance, also called commercial building or business property insurance, covers:

6. Commercial vehicle insurance

If your contracting business uses vehicles to transport staff or perform business-related activities, then you need commercial vehicle insurance. Also known as commercial auto or business auto insurance, this policy covers:

company cars

trailers

trucks

vans

Every vehicle you use to transport equipment, materials, tools, and staff should carry a commercial auto insurance policy.

Commercial vehicle insurance for contractors works the same way as personal auto policies. Provinces and territories have their own rules and regulations when it comes to mandatory coverage. However, there are certain similarities, including:

Third-party liability coverage

This covers the cost of lawsuits if someone from your business is responsible for an accident that causes bodily injury, death, or property damage.

Direct compensation property damage (DCPD)

This covers damage to the vehicle and its contents if it’s caused by a collision with another insured vehicle as long as the driver is not at fault. This policy applies only in Ontario, Québec, Nova Scotia, New Brunswick, and Prince Edward Island.

Accident benefits (AB)

This pays for medical treatment and lost income if someone from your staff is injured in an accident, regardless of who is at fault. It also covers funeral expenses.

Uninsured automobile/motorist (UM)

This type of coverage kicks in if your employee is injured or killed by an uninsured driver. Policies also cover hit-and-run accidents. UM insurance also pays for the damage your commercial vehicle sustains.

7. Pollution liability insurance

Contractors’ pollution liability (CPL) insurance pay for clean-up costs, injuries and illnesses, and property damage caused by harmful substances resulting from a construction project. Most policies cover expenses arising from a lawsuit, as well as civil fines, penalties, and assessments.

8. Contractors’ errors and omission insurance

E&O insurance for contractors protects your business from claims of financial losses resulting from a service you provided. These include lawsuits alleging negligence, misconduct, faulty workmanship, and missed deadlines. E&O insurance is also called malpractice or professional liability insurance in other industries.

9. Mobile property insurance

Mobile property insurance covers materials, tools, and equipment while these are being transported from one job site to another. It pays for the cost to repair or replace anything your business owns that isn’t stored in a fixed location and is routinely taken offsite. This type of coverage functions like inland marine insurance.

10. Surety bonds

A surety bond pays the property owner if you’re financially unable to finish the project or your business goes bankrupt. This covers the cost of getting the services of another contractor so the project can proceed as planned.

Unlike other types of insurance for contractors, a surety bond doesn’t protect your business. Instead, it offers the owner peace of mind knowing that the project can continue on schedule even without your services. Surety bonds are often mandatory for large construction or publicly funded projects.

The cost of insurance for contractors varies depending on the type of policy. Here’s a summary of how much the different contractors insurance policies cost per year. This is based on different insurer and price comparison websites that Insurance Business checked out.

Insurance for contractors price guide

Type of policy

Average annual premiums

Commercial general liability insurance

$450 to $500 for small and midsize contractors

Builder’s risk insurance

1% to 4% of the total cost of the construction project

Tools and equipment insurance

Starts at $400

Equipment breakdown insurance

Starts at $230

Commercial property insurance

$500 to $1,000 for small contractors

Commercial vehicle insurance

$300 to $3,000 depending on the number of vehicles

Pollution liability insurance

$3,500 for $2 million coverage limit

Contractors’ E&O insurance

$250 to $500 depending on the coverage limit

Mobile property insurance

$160 to $200

Surety bond

1% to 15% of the bond cost

Just like other types of business insurance, premiums for contractors insurance are influenced by several factors, including:

the industry the business is in

years of experience in the industry

annual and projected gross revenue

number of employees

the business’ claims history

You can learn more about how business insurance works in Canada in this guide.

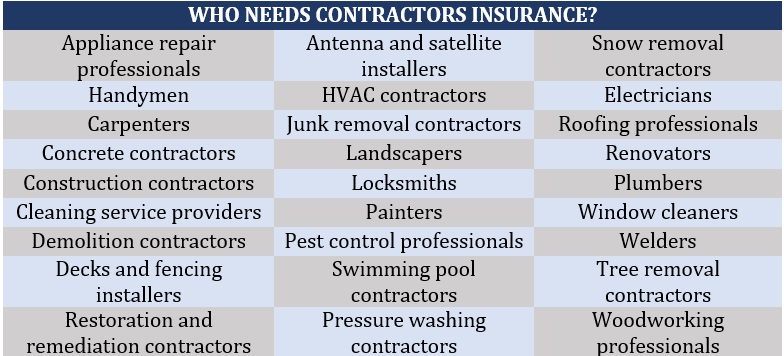

Who needs contractors insurance?

All types of tradespeople involved in construction projects need insurance for contractors to protect them financially. These include:

Contractors insurance is not always legally required but there are several benefits for taking out coverage. Here are some of them, according to one of the five-star awardees for this year’s Best Insurance Companies for Construction in Canada.

1. Contractors insurance protects your business against the unique risks it faces.

Each construction project comes with a different set of risks. That’s why taking out the right combination of policies is crucial. This ensures that your business is protected from the unique hazards it faces.

“Every business is unique, and we can’t take a one-size-fits-all approach,” explains Adam Collier, underwriting director at commercial insurance specialist Northbridge Insurance. “That’s why we rely heavily on our brokers to give us insight and understanding of the customer’s needs. Then, we complement that with our specialized construction expertise to develop the solutions.”

2. Insurance for contractors allows you to meet contractual requirements.

Although it isn’t mandatory, most project owners require commercial general liability insurance as a condition before working with a contractor. This helps them avoid taking on more risks than they need to. Contractors are often required to present proof of insurance and if they have sufficient coverage before signing on the dotted line. Northbridge can help with this.

“We can leverage all that expertise to create the custom recommendations and solutions that help us keep our customers safe and our projects on track,” Collier notes. “On the claims side, we help them get back on their feet as quickly as possible after a loss.”

3. Having contractors insurance helps boost your credibility.

Getting the proper coverage shows project owners that you’re taking responsibility for your risks. This also indicates that you’re taking the project seriously. Overall, contractor insurance helps build your reputation within the industry.

“We work with our broker partners, and we want them and our customers to be the safest in the country,” Collier says. “So, providing the expertise and insight solutions, anything we can do to help make sure that they’re getting everything they need, that’s our focus.”

Do you think insurance for contractors is essential for those involved in construction projects? What types of coverage do you think are necessary? Share your thoughts in the comment box below.

Keep up with the latest news and events

Join our mailing list, it’s free!