Insurance executives rake in millions as premiums continue to rise – CFA

Insurance executives rake in millions as premiums continue to rise – CFA | Insurance Business America

Insurance News

Insurance executives rake in millions as premiums continue to rise – CFA

Six major CEOs received eight-digit compensation

Insurance News

By

Kenneth Araullo

A recent review conducted by the Consumer Federation of America (CFA) has shed light on the substantial compensation received by CEOs in the nation’s top 10 personal lines insurance companies.

At a time when rising insurance rates are causing financial strain for policyholders across the United States, the CEOs of major insurance firms have been earning substantial salaries, bonuses, and additional payments.

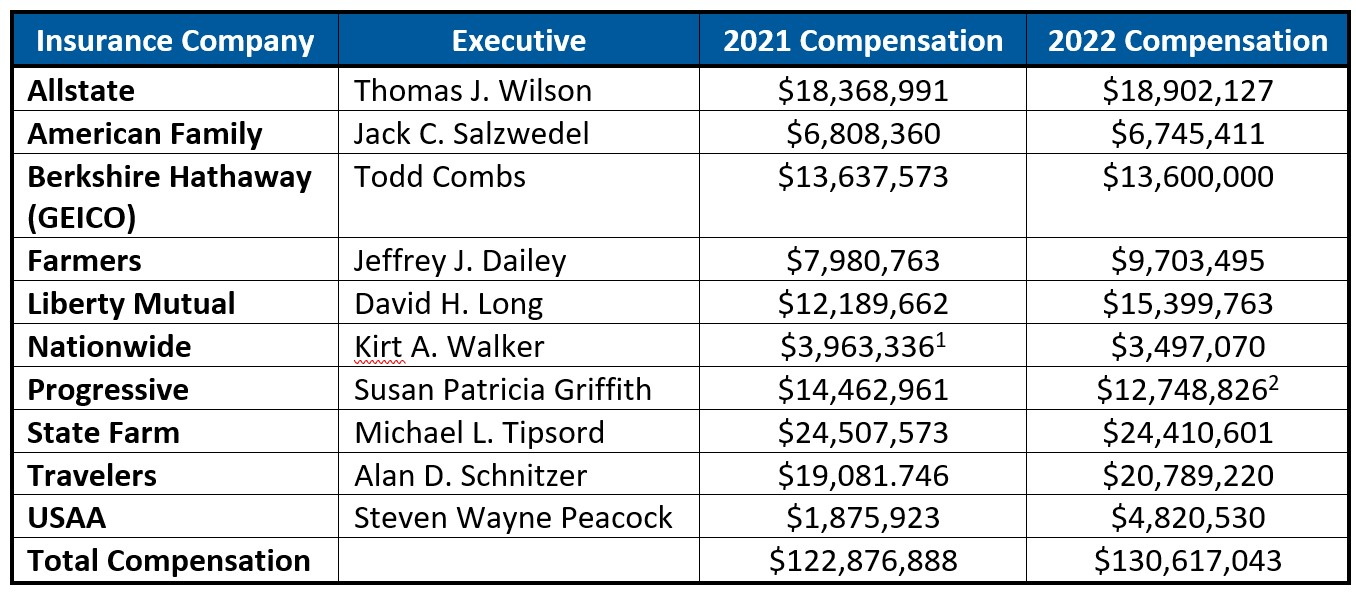

According to a news release, the Consumer Price Index for August highlights a 19% increase in auto insurance costs compared to 2022. Meanwhile, the CEOs of six major insurance companies received compensation exceeding $12 million each in 2022. In total, these top 10 insurance executives were paid over $130 million in the same year, with combined earnings over the span of two years amounting to $253,493,931.

The compensation figures for insurance executives in 2021 and 2022 were obtained from Nebraska’s Department of Insurance, which mandates insurance companies to disclose information regarding salaries, bonuses, and other compensation for their top officials. However, CFA also noted that these reported figures may underestimate the actual earnings of executives, as they might exclude compensation from affiliated companies.

CFA also observed that these excessive compensation for insurance executives coincided with the burden faced by customers and employees due to stringent charges imposed by these companies. The federation cited these examples:

Farmers’ executive Jeff Dailey received a nearly $2 million raise in 2022, while the company increased homeowners insurance premiums by over $575 million across 42 states, limited availability in California, halted renewals for almost a third of its homeowners insurance policies in Florida, and laid off 11% of its workforce

Liberty Mutual paid its CEO, David Long, over $15 million in 2022 and recently raised homeowners insurance rates by $729.8 million

State Farm compensated its CEO, Michael Tipsord, with over $24 million while raising auto insurance rates four times in a year in its home state of Illinois, increasing auto rates by 17% in Louisiana, and raising homeowners insurance rates by 28.1% in California, alongside halting new applications for homeowners insurance in California

“CEOs are living high on the hog while increasing insurance premiums for people living paycheck to paycheck,” said Michael DeLong, research and advocacy associate at CFA. “Insurers are telling regulators that ordinary consumers have to pay much more for auto and home insurance because the companies are struggling with inflation and climate change, but they are quietly handing CEOs gigantic bonuses. Drivers are required to buy auto insurance and homeowners have to buy coverage to satisfy their loan requirements, so there needs to be more scrutiny of the rate hikes companies are demanding and the huge CEO paydays that are funded with customer premiums,.”

What are your thoughts on this story? Please feel free to share your comments below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!