Insurance brokers cut out the cyber and D&O middle man

Insurance brokers cut out the cyber and D&O middle man | Insurance Business America

Professional Risks

Insurance brokers cut out the cyber and D&O middle man

But are they doing so at their own peril?

Professional Risks

By

Jen Frost

A soft professional liability and cyber environment is driving retail insurance brokers towards direct carriers and away from wholesale brokers when it comes to new submissions and clients.

But amid an abundance of available coverage, a professional lines specialist has cautioned that brokers that take the ‘easy route’ may find themselves in their clients’ bad books later.

“Our retail brokers are very good and transparent, and we do retain a lot of our renewals,” Anthony Manna (pictured), Jencap specialty insurance division SVP, told IBA. “But on the flip side, if a retail broker is seeking a new submission… or servicing a new client, the fact that the market is softer drives them to use their direct market and their own access [before] they come to us.”

In the current environment, retail insurance brokers may run the risk of thinking that bagging a quote means their client’s insurance needs are met, as per Manna. It might not be until an issue is flagged or they face competition that they again reach out to a wholesaler.

“They’re working on million-dollar premiums to properly insure the client but the D&O coverage might only be $50,000, so they don’t think twice about it,” Manna said. “They get it… present it, and don’t even say ‘there’s an anti-trust exclusion on here or they don’t have any additional side A, or they don’t have this’ – they’re not reviewing it [to the extent they] should be.”

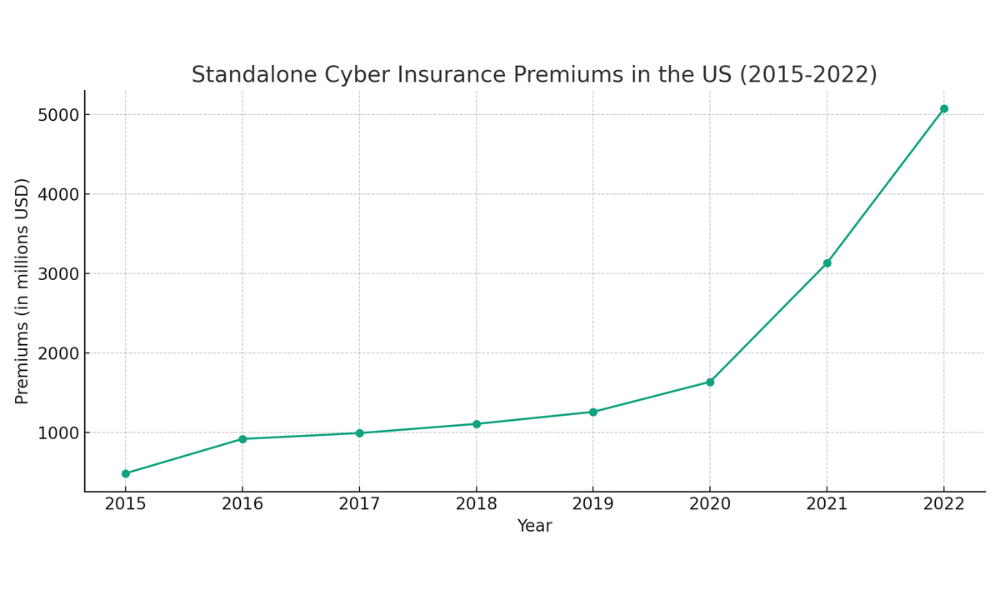

While D&O has seen a softening and capacity surge, cyber liability has proved the standout.

“On any given risk, you could go to 30 markets and get 20 quotes,” Manna said on the state of play today. “That doesn’t mean they’re all the right coverage, that doesn’t mean they’re all competitive, but two to three years ago you could go to 30 markets on a tough risk and get one call, or you could be begging someone to quote – it’s definitely a different marketplace.”

Hot cyber and professional liability competition could taper off

The culprit behind falling rates? The now hotly competitive cyber and professional liability insurance marketplaces have experienced an influx of fresh capacity.

“Everyone wants to get a piece of the insurance pie,” Manna said, highlighting private equity (PE) investment and moves from existing players. “They’re bringing in new MGAs, which means that there’s more capacity being written and more outlets wanting to write business.”

But some newer entrants and insurers that have upped their appetite could be in for a rude awakening when the claims come pouring in.

“As they [new entrants] start to see claims activity, it’ll drive them out of the space or at least [see them] reduce their capacity,” Manna predicted.

IBA top specialist wholesale broker Manna predicted that the softening “overcorrection” will start to burn itself out within the next six to 12 months as claims catch up, placing marginal upwards pressure on rates. Lines are though unlikely to return to the level of hardening seen in 2020, he said.

“We just become a valuable asset to our retailers in any way that we can,” Manna said. “Having market access is an asset, even in a soft market – but being able to understand the different coverages, being able to understand the forms, being able to help our broker and their client understand what they’re purchasing, what’s being covered, and what’s not.”

Efforts could include joining retail brokers in presentations, providing policy comparisons and claims examples, and getting the “best” rather than cheapest quote for the client.

“We’re going to get a handful of quotes, we’re going to survey the market, we’re going to push them to beef up coverage or to revise it where needed,” Manna, who has been with Jencap since its 2016 acquisition of NIF, said. “Retail brokers can lean on us for that.”

Got a view on professional lines and cyber softening? Leave a comment below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!