Inspiring Female Leaders in Insurance in Asia | Elite Women 2023

Jump to winners | Jump to methodology

Leading from the front

The Asia-Pacific region has reached the tipping point of 30% of senior roles held by female leaders, according to Grant Thornton’s Women in Business research.

Insurance Business Asia’s Elite Women of 2023 are at the forefront at the forefront of this. They possess grit and determination and have seized the opportunity to make a difference.

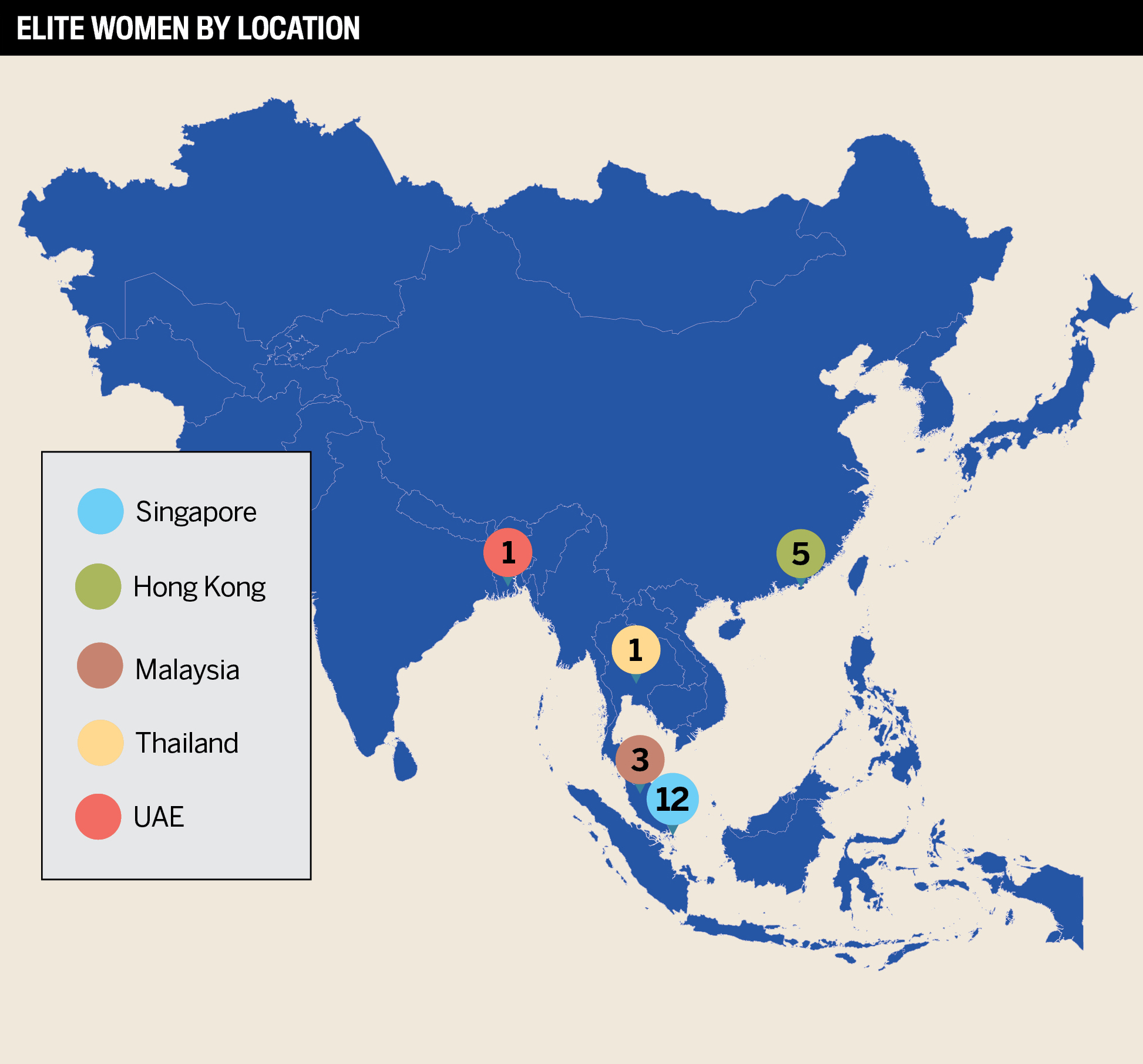

This year’s cohort of 22 outstanding female leaders in insurance have triumphed over stubborn stereotypes, achieving significant success within their organisations and inspiring others.

“These obstacles are not insurmountable, and progress is being made to overcome them,” says Tulsi Naidu, APAC chief executive at Zurich Insurance and a former Elite Woman of 2021. “Companies are recognising and acknowledging these obstacles, addressing biases, providing support systems, implementing inclusive policies, and creating equal opportunities for women to thrive.”

Fellow former 2022 Elite Woman Violet Chung agrees. The senior partner at McKinsey & Company offers the following observations on the common traits shared by female leaders in insurance:

inspirational leadership that motivates others to be better

pursuing a career path with boldness

serving as an outstanding role model

ensuring great impact is delivered

attracting the right talent

“I’d like to take financial advisory to the next level because in Asia, I’m probably among the first few to champion certain things and write about financial literacy from my personal perspective”

Jaslyn NgPrudential Assurance Company

A new era of female leaders breaking barriers

The need for female role models is becoming increasingly clear.

“Indeed, it can reinforce the unconscious bias of what leadership looks like,” asserts Naidu.

For Lei Yu, QBE Asia’s chief executive for North Asia and regional head of distribution, obstacles are an opportunity to grow and strengthen the team bonds she has built within her organisation. Since 2019, Yu has driven profitable growth and turned the company’s performance around. She has prioritised innovation and modernised traditional insurance practices in tandem with employee engagement. She counts among her successes a recent survey showing 85% of QBE Asia staff are highly engaged.

“I feel very fortunate and privileged to lead such a highly engaged workforce,” she notes. “We did a lot in the past few years to ensure our colleagues feel cared for, and we invested in their development.”

Among Yu’s notable accomplishments are:

leading successful digital transformation projects resulting in QBE Hong Kong clinching three industry awards

forming the QBE Hong Kong Circle, an employee network group promoting gender equality and fostering a supportive and inclusive environment

addressing regional economic challenges as a Pacific Basin Economic Council board member

The Elite Women have tackled obstacles relating to gender bias, lack of women in leadership positions in Asia, and work-life balance that can create the incorrect perception that women are less committed than men.

“It’s important to remember it’s not just one person, you have your whole team, and you can overcome obstacles together,” explains Yu. “Focus on taking baby steps to make changes.”

To motivate others to keep moving forward, Yu draws on her experience leading a team of women on a trek to Mount Everest base camp. As a collaborative leader, she has focused on promoting flexible work policies and parental leaves within her organisation. Over 50% of QBE Asia staff are women, including in technical roles such as underwriting.

“The next phase of my career is about how I can attract more women into the insurance industry and help more women break this glass ceiling,” she adds.

She highlights how the post-Covid acceptance of remote working has led to some benefits.

“Many women in insurance struggle to balance work and family responsibilities, and flexible working has helped women to manage their obligations.”

“We can only transform our industry to be more relevant if we attract more young people and women, and we can modernise with the use of digital technology”

Lei YuQBE Asia

What challenges have Asia’s female leaders in insurance risen above?

Singapore-based financial services director Jaslyn Ng has led her all-female team at Prudential Assurance Company adeptly. She credits her background in the HR sector with instilling an ability to connect in a genuine and ethical way.

In addition, her insights and financial knowledge in service of others has amassed her a following on social media and the conference circuit.

Despite only joining the financial services industry over five years ago, Ng is regarded as a “legendary” figure for achieving sales breakthroughs. Her resilience and ability are evidenced by adapting to challenging personal circumstances, including divorce and parenting two children.

“I’ve been through a lot in life, and any of the obstacles I faced could have defeated me,” she explains. “When I feel like I don’t have an ounce of energy left, I think about my kids, and I find the strength to move on because I want them to grow up in the best and healthiest ways possible.”

Ng’s top-performing achievements have been recognised by the insurance trade association The Million Dollar Round Table, from which she and her agency received the following awards:

Top of the Table 2023

Multi-Million Dollar Agency 2022

Court of the Table 2019–2022

Million Dollar Round Table 2018

Ng’s leadership skills fast-tracked her into management. She was promoted to financial services director within five years, was certified as a high-net-worth advisor and completed the ChFC designation within seven months.

Armed with the realisation that female role models are scarce and women lack representation in senior and decision-making insurance roles, Ng prioritised sharing her success story with other women. She is also a prolific contributor on LinkedIn and has written books to help guide financial consultants.

“My team are all working mothers, and I want to push that out to the wider community to help women succeed,” she explains. “I want to pay it forward and inspire more women leaders; that is my key motivator.”

Building networks is key for Asia’s leading women in insurance

As chief commercial officer at Aon Asia-Pacific, Jane Drummond consistently drives double-digit growth and exceptional employee engagement. Her ability to foster positive relationships while propelling the organisation forward is evidenced by employees rating her as the top manager that “connects with me as a person”.

She has distinguished herself as a leader in risk management and insurance solutions, and her unwavering passion for serving clients led to the creation of the Aon Insights Series, Asia, a platform to connect leaders who make enterprise-wide risk decisions.

That initiative regularly attracts registrants of more than 1,500 and is now hosted in the United States, Europe, Australia, and Singapore. Sub-events are also being created in person in Manila, Tokyo, and Hong Kong for the first time.

Drummond aims to continue blazing a path for colleagues to challenge, innovate, and deliver market-leading solutions. And she is resolutely focused on mentoring aspiring female leaders to reach the next level of their development.

“I am always willing to step up, challenge, lead and support all colleagues in our day to day to service delivery in APAC and globally.”

She has earned a reputation among her peers, insurers, and clients for being efficient and effective over her 25-year career. Her biggest strength is unquestionably communication, closely followed by positivity and ‘woo’.

“Woo is the ability to win over others, and I thrive on meeting new people and winning them over, which aligns to my passion for sales,” explains Drummond. “My philosophy and approach to obstacles is that tomorrow is another day and therefore another opportunity; you must be resilient and be ready to pick yourself and your team back up.”

Drummond’s outstanding accomplishments include:

sponsoring Aon’s partnership with the Pan-Asia Risk Management Association, maintaining platinum sponsorship for a decade

delivering Aon United, a blueprint guiding employees to bring top-notch service to clients, credited with kick-starting a significant culture shift toward agnostic client leadership

championing DE&I initiatives such as Dive In and WIN

“I thrive on problem-solving and helping colleagues to achieve their goals, and I hope to continue this well into the future”

Jane DrummondAon

Cindy Kua

Co-Founder and CEO

Sunday

Cynthia Yeung

Senior Vice President, Construction Practice Leader

Marsh

Diana Gobeawan

Director of Travel Partnerships, APAC

Cover Genius

Goh Geok Cheng

Non-Executive Director

IPPFA

Jenny Lim

Chief Executive Officer

Howden Insurance Brokers

Jess Tan

Chief Distribution Officer

Etiqa Insurance Singapore

Karren Tan

Head of Recoveries and Subrogation Claims

Crawford & Company

Loh Guat Lan

Managing Director and CEO

Hong Leong Assurance Berhad

Monami Mukherjee

Director and Head of P&C Analytics, Asia Pacific

Swiss Re

Nikki Davies

Group Diversity and Inclusion Director

Prudential plc

Shirley Tan

Chief Marketing Officer

Etiqa Insurance Singapore

Stella Soh

TPA Services Manager

Broadspire by Crawford & Company

Tanja Magas

Chief Data and Analytics Officer

Democrance

Teresa Wong

Chief Risk Officer and Head of Sustainability Risk

Zurich General Insurance Malaysia

Veronica Grigg

CEO and President, Asia

Crawford & Company

Yen Yen Koh

General Manager, Singapore

bolttech

Insurance Business Asia invited insurance professionals from across the region to nominate exceptional female leaders for the annual Elite Women list. Nominators were asked to provide details of their nominee’s achievements and initiatives over the past 12 months, including specific examples of their professional accomplishments and contributions to the industry.

The Insurance Business team reviewed all nominations, examining how each individual had made a meaningful contribution to the industry, to whittle down the list to the final 22 Elite Women.

The Elite Women 2023 report is proudly supported by the Association of Professional Insurance Women (APIW).

Founded in 1976, the Association of Professional Insurance Women (APIW) is the premier organization committed to the career advancement of Women Insurance Professionals. As an inclusive national association, APIW’s goal is to provide women insurance professionals with unparalleled opportunities for professional development and networking. APIW’s regular programs address the latest developments and issues affecting our industry, helping members prepare for leadership roles within their organizations by providing a broad, comprehensive view of the insurance business.

Additionally, on an annual basis APIW celebrates the accomplishments of outstanding women in the insurance business through a variety of acknowledgments, including honoring the APIW Insurance Woman of the Year and providing scholarship aid to young women studying insurance.

APIW encourages all members to actively participate in the organization, assume leadership roles and work on collaborative projects. Whether women insurance professionals are looking to expand their network of professional contacts, hone their leadership skills, or advance their career, APIW is here to help members achieve their goals.

APIW originated in New York and over the years has continually expanded its reach to a number of cities including Chicago, Atlanta, Hartford, New Jersey, Philadelphia, Miami and San Francisco (Bay Area).