Industry loss warranty (ILW) rates-on-line soften from highs

The industry loss warranty (ILW) market has softened somewhat, seemingly in-line with the catastrophe bond market, with what were record high ILW rates-on-line now coming in on average roughly 12% lower for the second-quarter of 2022, according to our sources.

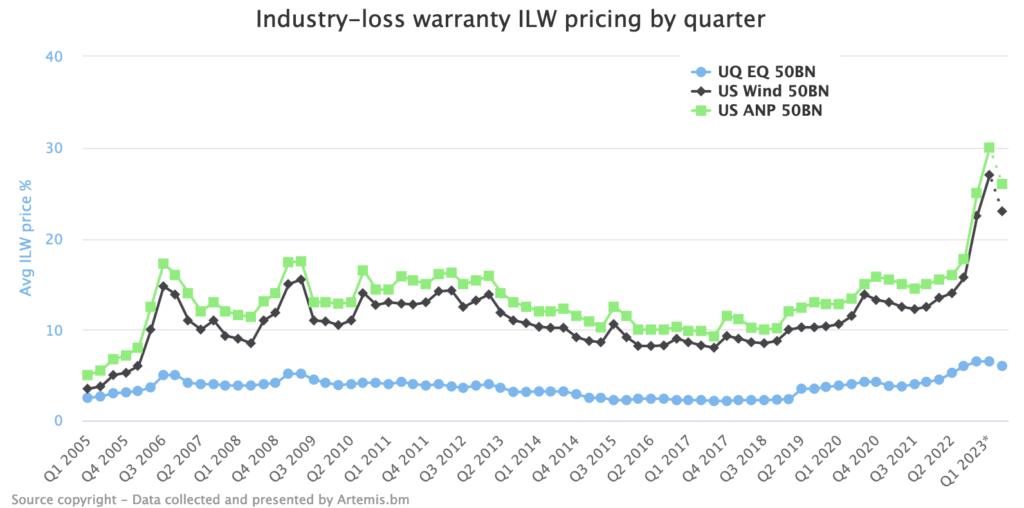

We’ve updated our industry-loss warranty (ILW) pricing data set using insights gathered from a range of our market sources.

As before, we’ve projected out into the second-quarter of 2023 what the potential rates-on-line (RoL’s) could be for certain fixed industry-loss attachment points for protection buyers over the coming weeks.

Of course, the reinsurance market is particularly dynamic right now and the catastrophe bond segment has provided clear evidence of the modicum of softening now being seen, as new cat bonds settle at upsized volumes and with lower pricing than guidance.

All three of the ILW data points we track have come in at reduced rates-on-line for the second-quarter, while in surveying our market sources again the points we had for the first-quarter have also been revised slightly lower, to reflect softening that began during that period.

On average, ILW rates-on-line seem to be softening around 12% for the second-quarter of 2023.

On the ILW pricing chart below (analyse an interactive version of here) the dotted-lines indicate projections for the forward-looking ILW rate environment for the new quarter.

This industry-loss warranty pricing data set has been validated with a number of our market sources.

We believe it provides a reasonable reflection of average rate-on-line, or pricing, that these property catastrophe ILW’s could have traded at throughout the historical period, as well as the approximate prices being quoted at this time.

Interestingly, our latest data on catastrophe bond spreads indicates an average decline in pricing of around 10% for the latter stages of the first-quarter and perhaps a further 10% to 15% for the second-quarter so far.

Of course, it’s early days for the cat bond market in Q2, with a large pipeline still to price and settle. So things could change.

But the cat bond market seems to be running ahead of price indications in other areas of reinsurance and retrocession, given it is not a market bound by renewal seasons, so this may turn into a trend that cascades to other areas of the marketplace, as ILW’s now indicate as well.

The softening seen in ILW rates-on-line implies while reinsurance and retrocession rates will continue to harden at mid-year, it may not be to the degree assumed a few months ago.

However, the reinsurance and retro market is likely to continue its practice of significant differentiation, for cedents and risks, based on loss experience, as well as perceived exposure to future catastrophe loss events.

We’ll next update this ILW pricing data set after the mid-year renewals, or perhaps if we get any fresh price indications sooner.

It’s important to remember that these are not risk-adjusted prices and many of our sources believe the risk of a $50bn industry loss event occurring has increased over the duration of this data set.

It’s also important to remember that coverage has changed across the reinsurance market, through the tightening of terms and conditions. So major industry loss events may no longer manifest in precisely the same way they did even a few years ago.

We hope you find our ILW pricing data set useful, as another indicator of reinsurance and retrocession market appetite and rates-on-line.

It can be helpful to compare this ILW pricing data with our other indices and to use the indications they provide to help inform your pricing and return expectations, such as our tracking in real-time of issued catastrophe bond coupons, spreads and cat bond multiples-at-market, the index of global property catastrophe reinsurance pricing from Guy Carpenter, as well as the catastrophe bond fund return indices from Plenum, and data on broader ILS fund strategy returns from ILS Advisers.