Indexed Universal Life Income Distributions in the Lost Decade

Podcast: Play in new window | Download

Last week, we discussed the results one could get from indexed universal life insurance from 2001 to 2010. We also looked at how this type of policy performed if the market returns from this time period were repeated over and over again every 10 years. We wanted to evaluate how IUL behaved during a sustained period of mediocre market returns. It turns out indexed universal life insurance does just fine. To check our results, we also looked at the results of a passive index investment during the same time period. Not surprisingly, the index investment performs way short of normalized expectations for stock market returns.

While recording the podcast for last week, we mentioned in passing that these results might look a little differently if we evaluated a similar scenario during an income phase versus an accumulation phase. That’s the very task we’re accomplishing this week.

IUL and Regular Investment Income Distributions During the Lost Decade

I’m using the accumulated values from last week’s analysis as our starting point for income. I’m taking 5.5% of the cash value generated by the indexed universal life policy that used a standard 1-year point-to-point S&P 500 index with an 8% cap as our income basis. This means we’ll be distributing $43,466 per year from each scenario and then calculating the rate of return–expressed by internal rate of return also known as the money-weighted rate of return. Loans for IUL scenarios are assumed indexed loans at a 6% accumulation rate in all years.

I’m going to evaluate this scenario using another 20 year test period, which will assume the same market return taking place in repeat. So just like last week, I’m simply taking the 2001-2010 results and repeating them every 10 years. I’m also going to add a 50/50 stock and bond scenario for the investment. I’ll keep the Vanguard 500 Fund to represent the passive stock market investment and I’ll use the Vanguard Total Bond Index (VBMFX) to represent the bond component.

Results of the Analysis

Standard S&P 1-year Point-to-Point with 8% Cap

Year

Age

Premium

Premium Charge

Policy fee

Per 1000

COI

TOTAL

S&P 500 Return

Cash Value

Loan Balance

Net Cash Surrender Value

21

61

0

0

60

0

1,558

1,618

1.00%

790,308

46,074

744,234

22

62

0

0

60

0

1,487

1,547

1.00%

798,211

94,912

703,298

23

63

0

0

60

0

1,367

1,427

8.00%

862,068

146,681

715,387

24

64

0

0

60

0

1,348

1,408

8.00%

931,033

201,556

729,477

25

65

0

0

60

0

1,451

1,511

4.69%

974,698

259,723

714,975

26

66

0

0

60

0

1,540

1,600

8.00%

1,052,674

321,381

731,294

27

67

0

0

60

0

1,732

1,792

3.65%

1,091,097

386,737

704,360

28

68

0

0

60

0

1,938

1,998

1.00%

1,102,008

456,016

645,992

29

69

0

0

60

0

2,161

2,221

8.00%

1,190,169

529,450

660,718

30

70

0

0

60

0

2,408

2,468

8.00%

1,285,382

607,291

678,091

30 Year IRR

4.34%

31

71

0

0

60

0

2,682

2,742

1.00%

1,298,236

689,803

608,433

32

72

0

0

60

0

2,745

2,805

1.00%

1,311,218

777,265

533,953

33

73

0

0

60

0

2,762

2,822

8.00%

1,416,116

869,975

546,141

34

74

0

0

60

0

2,693

2,753

8.00%

1,529,405

968,247

561,158

35

75

0

0

60

0

2,493

2,553

4.69%

1,601,134

1,072,416

528,718

36

76

0

0

60

0

2,063

2,123

8.00%

1,729,225

1,182,835

546,390

37

77

0

0

60

0

2,459

2,519

3.65%

1,792,341

1,299,879

492,462

38

78

0

0

60

0

2,922

2,982

1.00%

1,810,265

1,423,946

386,319

39

79

0

0

60

0

3,465

3,525

8.00%

1,955,086

1,555,457

399,629

40

80

0

0

60

0

4,115

4,175

8.00%

2,111,493

1,694,858

416,635

40 Year IRR

4.17%

Uncapped S&P Index

Year

Age

Premium

Premium Charge

Policy fee

Per 1000

COI

TOTAL

S&P 500 Return

Cash Value

Loan Balance

Net Cash Surrender Value

21

61

0

0

60

0

1,558

1,618

1.00%

763,011

46,074

716,937

22

62

0

0

60

0

1,487

1,547

1.00%

770,641

94,912

675,729

23

63

0

0

60

0

1,367

1,427

8.00%

832,293

146,681

685,612

24

64

0

0

60

0

1,348

1,408

8.00%

898,876

201,556

697,320

25

65

0

0

60

0

1,451

1,511

4.69%

941,034

259,723

681,310

26

66

0

0

60

0

1,540

1,600

8.00%

1,016,316

321,381

694,936

27

67

0

0

60

0

1,732

1,792

3.65%

1,053,412

386,737

666,674

28

68

0

0

60

0

1,938

1,998

1.00%

1,063,946

456,016

607,930

29

69

0

0

60

0

2,161

2,221

8.00%

1,149,062

529,450

619,611

30

70

0

0

60

0

2,408

2,468

8.00%

1,240,986

607,291

633,695

30 Year IRR

4.14%

31

71

0

0

60

0

2,682

2,742

1.00%

1,253,396

689,803

563,593

32

72

0

0

60

0

2,745

2,805

1.00%

1,265,930

777,265

488,665

33

73

0

0

60

0

2,762

2,822

8.00%

1,367,205

869,975

497,230

34

74

0

0

60

0

2,693

2,753

8.00%

1,476,581

968,247

508,334

35

75

0

0

60

0

2,493

2,553

4.69%

1,545,833

1,072,416

473,417

36

76

0

0

60

0

2,063

2,123

8.00%

1,669,499

1,182,835

486,664

37

77

0

0

60

0

2,459

2,519

3.65%

1,730,436

1,299,879

430,557

38

78

0

0

60

0

2,922

2,982

1.00%

1,747,740

1,423,946

323,795

39

79

0

0

60

0

3,465

3,525

8.00%

1,887,560

1,555,457

332,103

40

80

0

0

60

0

4,115

4,175

8.00%

2,038,564

1,694,858

343,707

40 Year IRR

3.98%

VFINX IRR end of first 10 years = 1.82%

VFINX IRR end of next 10 years = null

50/50 VFINX/VBMFX IRR first 10 years = 3.21%

50/50 VFINX/VBMFX IRR second 10 years = 3.29%

Commentary on the Results

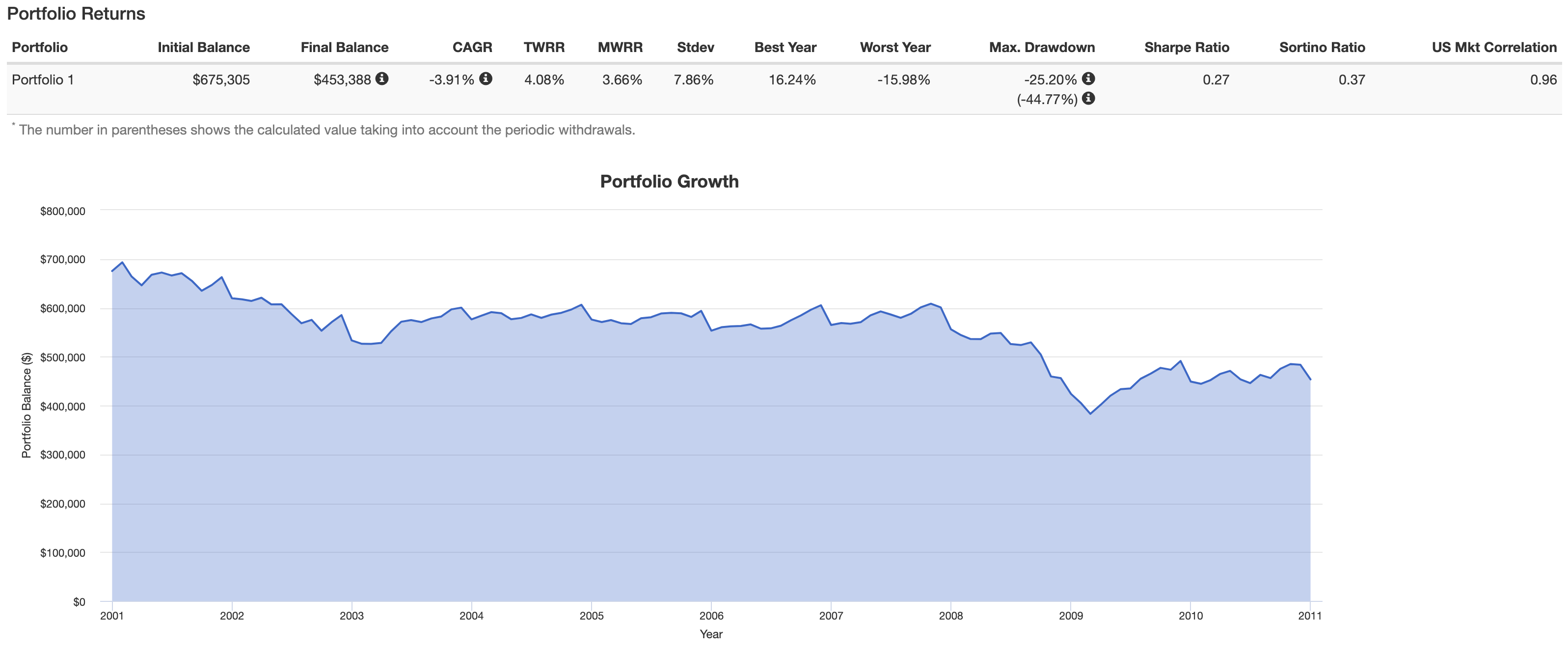

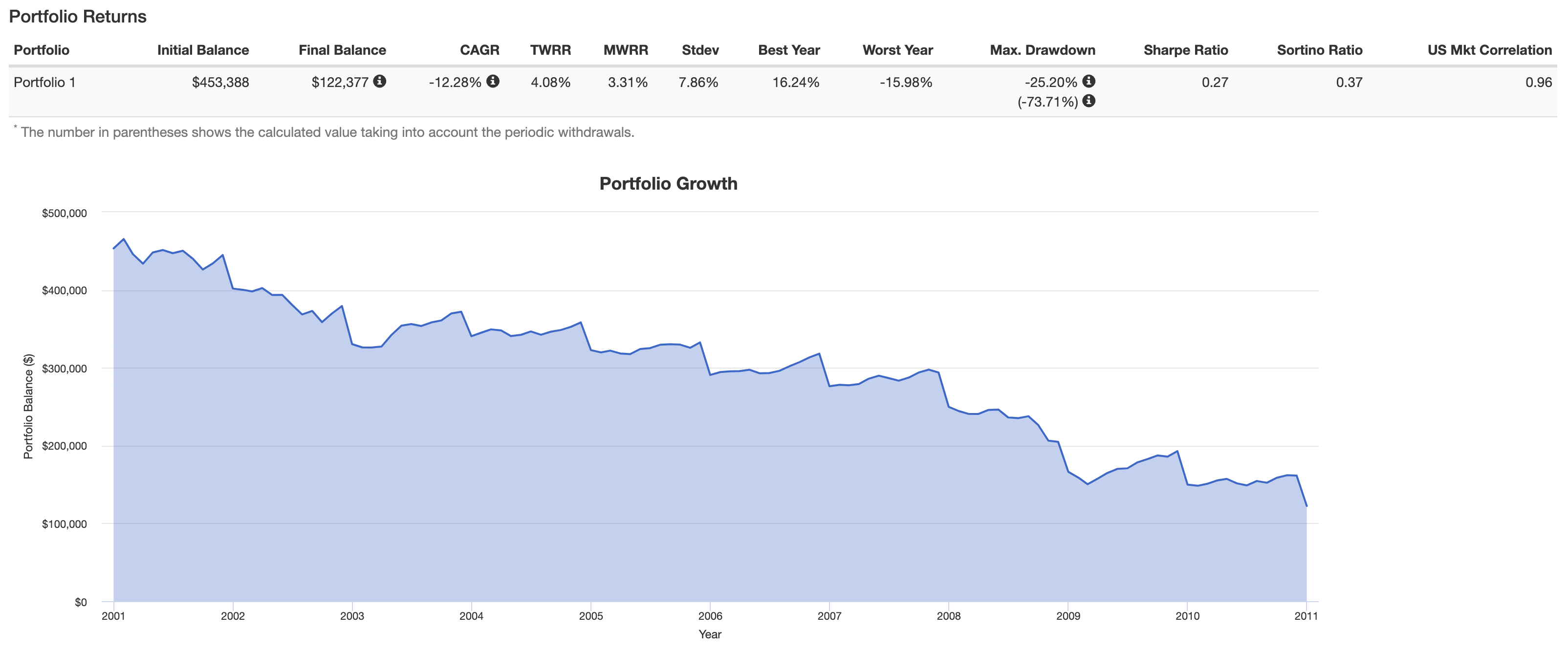

As a reminder, income for all scenarios in all years is $43,466 per year. This is 5.5% of the cash surrender value of the 8% cap IUL at the end of year 20 from last week’s example (i.e. the end of the accumulation period). One could argue that I should have taken some other number from the resulting end of accumulation period results for each individual option, and this would have resulted in different endpoints for the other scenarios that weren’t the 8% capped IUL. This is true, but ultimately, retirement planning is about creating the most amount of income for the dollar saved. Since making this adjustment for the other scenarios would have resulted in lower-income distribution, I find whatever results from this created to be un-remarkable.

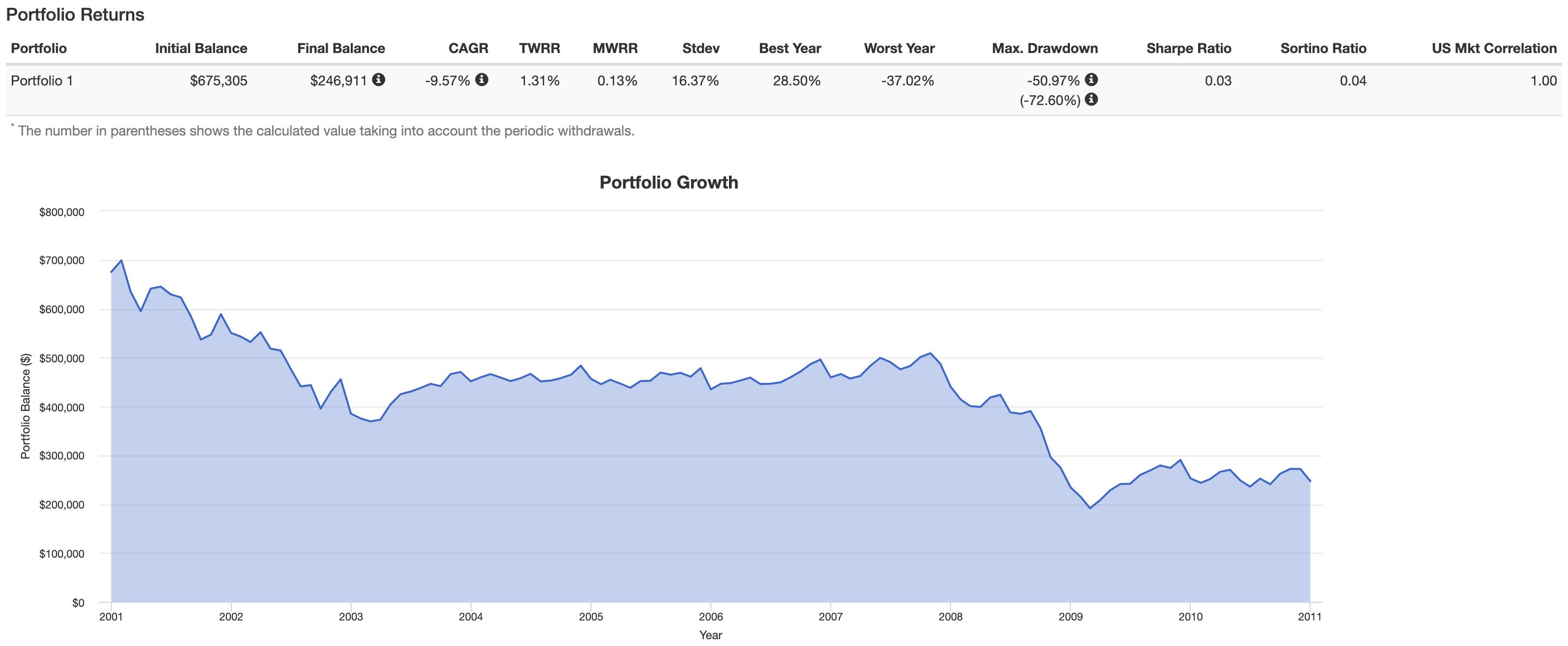

It’s interesting, though not really surprising, that the passive index investment entirely in the stock market wasn’t able to survive the entire 20 year period of the income distribution. Now I’m well aware that customary investment advice would never recommend someone keep 100% of their portfolio in the market and never recommend taking 5.5% of the balance as income in all years. There are two points, however, that I wish to make about this.

First, there are some internet and radio financial warriors out there who have espoused remaining 100% in the market forever or–ideally–as long as possible. Some of them are on recorded YouTube videos making such recommendations to ladies in their elder years. While traditional investment advising would disagree–and disagree correctly with this sentiment–there are people who will go rogue and their investment advice is horrible as it’s wildly susceptible to problems highlighted above.

Second, I want to reiterate the fact that I’m trying to suss out what benefit achieved per dollar in. If both IUL policies are capable of sustaining the same income figure despite different beginning account balances, where does that put the market investment?

IUL is Far More Resilient in this Scenario

It’s obvious under this scenario indexed universal life insurance shows more resiliency. It’s also extremely unlikely that this scenario will ever play out. This isn’t a thought exercise attempting to dissuade anyone from owning stocks and bonds and persuade them to load up on life insurance. Instead, I’m using it to highlight that cash value life insurance products have a tactical purpose for risk mitigation.

I strongly doubt we’ll see a sustained stock market period like the one in this example. However, I believe that market corrections will take place more than once over the next several decades. These corrections will dramatically alter the results achieved by ordinary investors who use said investment for retirement preparedness. Incorporating fixed universal or dividend-paying whole life insurance into your retirement portfolio will shield you to varying degrees from these potentially life-altering corrections.

What’s more, the cost of insurance (COI) reporting in the IUL results is likely overstated as I did not account for the change (reduction) in the net amount at risk in years when index earnings are higher than anticipated from the illustration.

Also, just like last week, the bonus that is a part of this IUL product is still not included. Additionally, income from the investment does not account for taxes due.